Locate the common-sized income statements for a company of your choice and assess the companys performance from the information presented in these statements. Include a copy of the common-sized income statements in your post.

Locate the common-sized income statements for a company of your choice and assess the companys performance from the information presented in these statements. Include a copy of the common-sized income statements in your post.

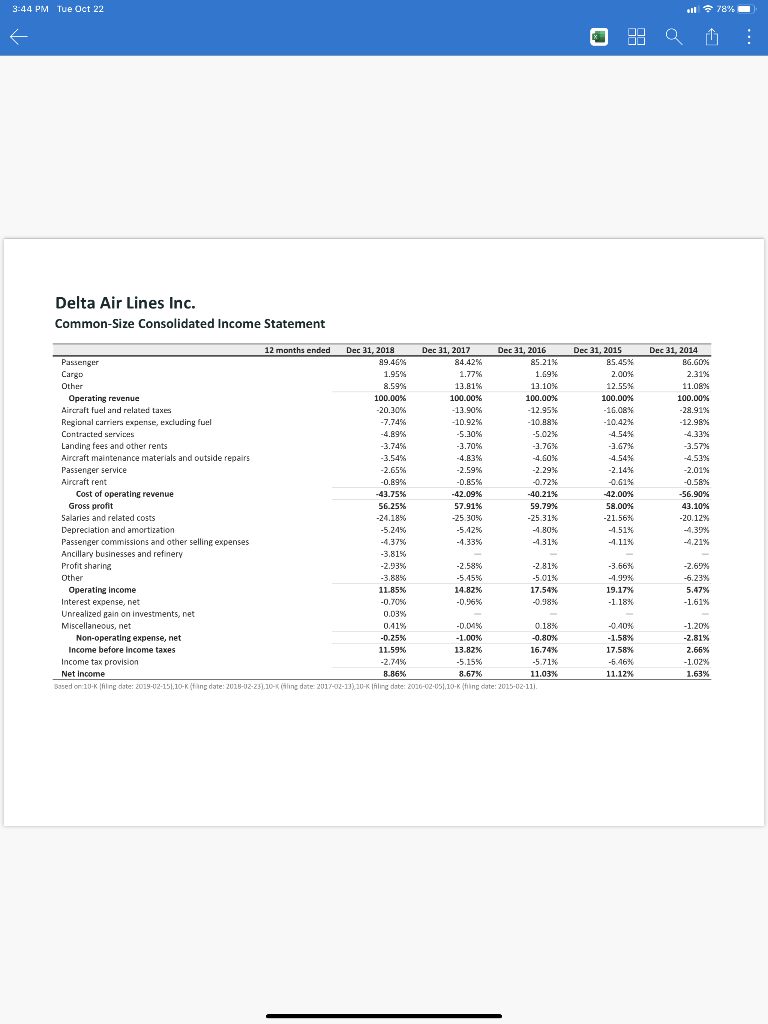

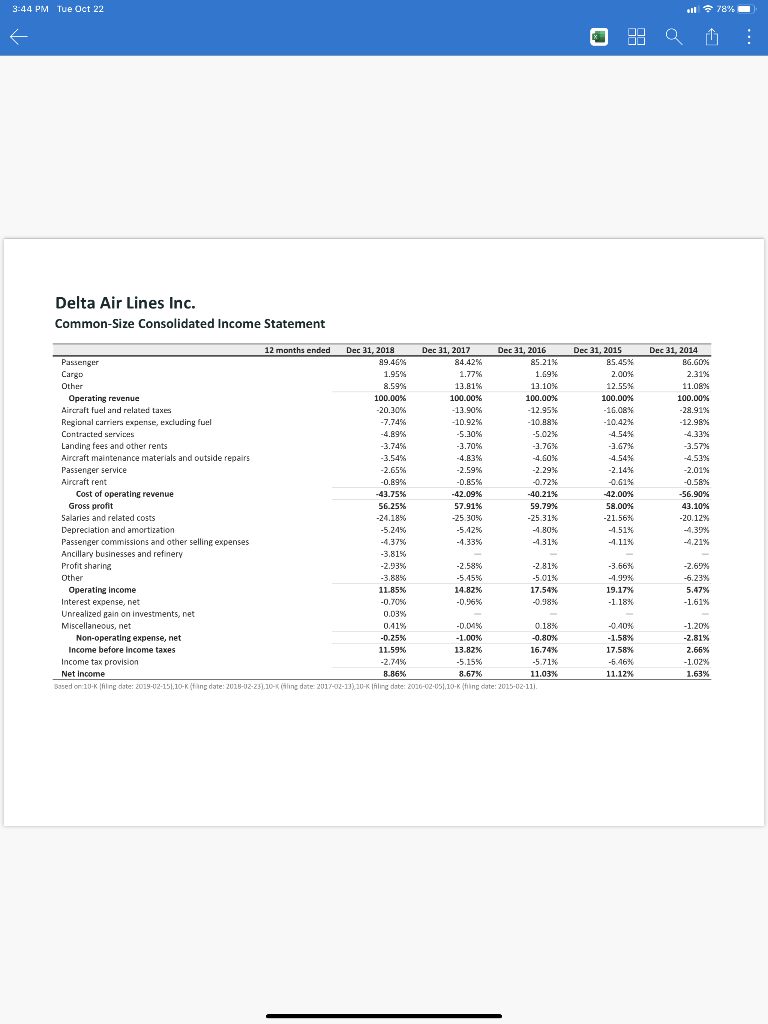

3:44 PM Tue Oct 22 ..! 78% Delta Air Lines Inc. Common-Size Consolidated Income Statement Dec 31, 2014 86.60% 2.31% 11.08% 100.00% -28.91% -12.9895 12 months ended Dec 31, 2018 Dec 31, 2017 Dec 31, 2016 Passenger 89.46% 84.42% 85.21% Cargo 1.95% 1.77% 1.69% Other 8.59% 13.81% 12 10% Operating revenue 100.00% 100.00% 100.00% Aircraft fuel and related taxes -20.30% -13 90% - 12.95% Regional carriers expense, excluding fuel -7.74% -10.92% -10 98% Contracted services -4.89% -5.30% -5.02% Landing fees and other rents -3.74% -3.70% -3.76% Aircraft maintenance materials and outside repairs -3.54% -4 60% Passenger service -2.59% -2.29% Aircraft rent -0.99% -0.65% -0.72% Cost of operating revenue -43.75% -42.09% -40.21% Gross profit 56.25% 57.91% 59.79% Salaries and related costs -24,18% -25.30% -25 31% Depreciation and amortization -5.24% -5.12% - 80% Passenger commissions and other selling expenses -4,37% -1.33% -1.31% Ancillary businesses and refinery -3.815 Profit sharing -2.9390 -2.58% -2.81% Other -3.8896 -5.45% -5.01% Operating income 11.85% 14.82% 17,54% Interest expense, net -0.70% -0.96% -0.98% Unrealized gain on investments, net 0.03% Miscellaneous, net 0.41% -0.02% 0.18% Non-operating expense, net -0.25% -1.00% -0.80% Income before income taxes 11.59% 13.82% 16.74% Income tax provision -2.74% -5.15% -5.71% Net Income 8.86% 8.67% 11.03% Based on:10-K hinc date: 2017-02-15.10-K fing date: 2015-02-23.10- (ling date: 2017-02-13) 10-K hling date: 2016-02-05.10- K ling date: 2015-02-111 Dec 31, 2015 85.45% 2.00% 12.55% 100.00% -16.08% -10.42% -4.54% -3.67% -4.54% -2.14% -0.61% 42.00% 58.00% -21.56% -1.51% 1.11% -4.53% -2.01% -0.58% -56.90% 43 10% -20 12% 4.39% -4.21% -3 56% 1.99% 19.17% -1 18% -2.69% -6.239 5.47% -1.61% -0.40% -1.58% 17.58% -5.46% 11.12% -1.20% -2.81% 2.66% -1.02% 1.63% 3:44 PM Tue Oct 22 ..! 78% Delta Air Lines Inc. Common-Size Consolidated Income Statement Dec 31, 2014 86.60% 2.31% 11.08% 100.00% -28.91% -12.9895 12 months ended Dec 31, 2018 Dec 31, 2017 Dec 31, 2016 Passenger 89.46% 84.42% 85.21% Cargo 1.95% 1.77% 1.69% Other 8.59% 13.81% 12 10% Operating revenue 100.00% 100.00% 100.00% Aircraft fuel and related taxes -20.30% -13 90% - 12.95% Regional carriers expense, excluding fuel -7.74% -10.92% -10 98% Contracted services -4.89% -5.30% -5.02% Landing fees and other rents -3.74% -3.70% -3.76% Aircraft maintenance materials and outside repairs -3.54% -4 60% Passenger service -2.59% -2.29% Aircraft rent -0.99% -0.65% -0.72% Cost of operating revenue -43.75% -42.09% -40.21% Gross profit 56.25% 57.91% 59.79% Salaries and related costs -24,18% -25.30% -25 31% Depreciation and amortization -5.24% -5.12% - 80% Passenger commissions and other selling expenses -4,37% -1.33% -1.31% Ancillary businesses and refinery -3.815 Profit sharing -2.9390 -2.58% -2.81% Other -3.8896 -5.45% -5.01% Operating income 11.85% 14.82% 17,54% Interest expense, net -0.70% -0.96% -0.98% Unrealized gain on investments, net 0.03% Miscellaneous, net 0.41% -0.02% 0.18% Non-operating expense, net -0.25% -1.00% -0.80% Income before income taxes 11.59% 13.82% 16.74% Income tax provision -2.74% -5.15% -5.71% Net Income 8.86% 8.67% 11.03% Based on:10-K hinc date: 2017-02-15.10-K fing date: 2015-02-23.10- (ling date: 2017-02-13) 10-K hling date: 2016-02-05.10- K ling date: 2015-02-111 Dec 31, 2015 85.45% 2.00% 12.55% 100.00% -16.08% -10.42% -4.54% -3.67% -4.54% -2.14% -0.61% 42.00% 58.00% -21.56% -1.51% 1.11% -4.53% -2.01% -0.58% -56.90% 43 10% -20 12% 4.39% -4.21% -3 56% 1.99% 19.17% -1 18% -2.69% -6.239 5.47% -1.61% -0.40% -1.58% 17.58% -5.46% 11.12% -1.20% -2.81% 2.66% -1.02% 1.63%

Locate the common-sized income statements for a company of your choice and assess the companys performance from the information presented in these statements. Include a copy of the common-sized income statements in your post.

Locate the common-sized income statements for a company of your choice and assess the companys performance from the information presented in these statements. Include a copy of the common-sized income statements in your post.