Answered step by step

Verified Expert Solution

Question

1 Approved Answer

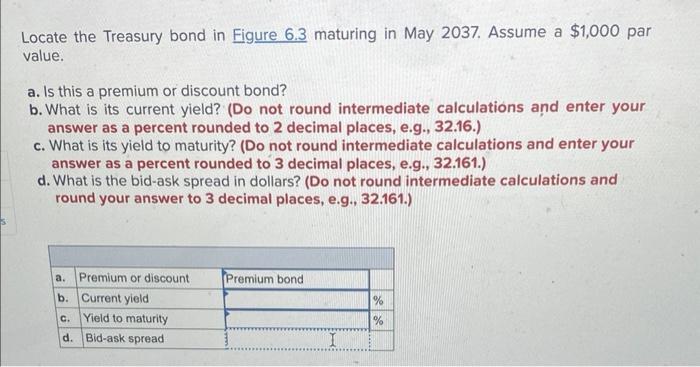

Locate the Treasury bond in Eigure 6.3 maturing in May 2037. Assume a $1,000 par value. a. Is this a premium or discount bond?

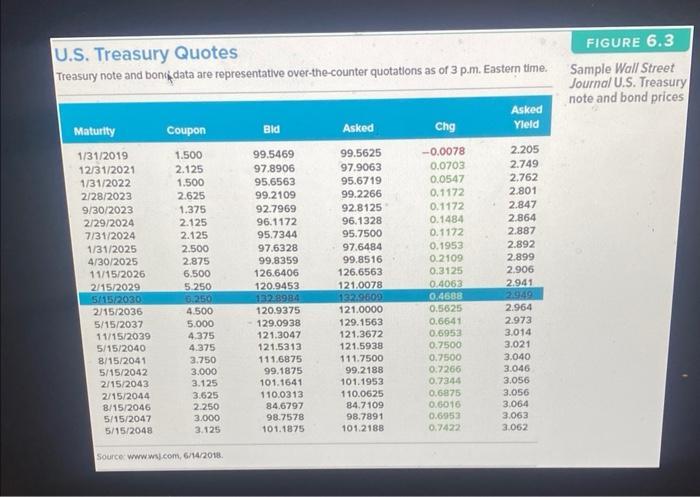

Locate the Treasury bond in Eigure 6.3 maturing in May 2037. Assume a $1,000 par value. a. Is this a premium or discount bond? b. What is its current yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is its yield to maturity? (Do not round intermediate calculations and enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) d. What is the bid-ask spread in dollars? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) a. Premium or discount b. Current yield c. Yield to maturity d. Bid-ask spread Premium bond I % % U.S. Treasury Quotes Treasury note and bond data are representative over-the-counter quotations as of 3 p.m. Eastern time. Maturity 1/31/2019 12/31/2021 1/31/2022 2/28/2023 9/30/2023 2/29/2024 7/31/2024 1/31/2025 4/30/2025 11/15/2026 2/15/2029 5/15/2030 2/15/2036 5/15/2037 11/15/2039 5/15/2040 8/15/2041 5/15/2042 2/15/2043 2/15/2044 8/15/2046 5/15/2047 5/15/2048 Coupon 1.500 2.125 1.500 2.625 1.375 2.125 2.125 2.500 2,875 6.500 5.250 6.250 4.500 5.000 4.375 4.375 3.750 3.000 3.125 3.625 2.250 3.000 3.125 Source: www.wsj.com, 6/14/2018. Bid 99.5469 97.8906 95.6563 99.2109 92.7969 96.1172 95.7344 97.6328 99.8359 126.6406 120.9453 132.8984 120.9375 129.0938 121.3047 121.5313 111.6875 99.1875 101.1641 110.0313 84.6797 98.7578 101.1875 Asked 99.5625 97.9063 95.6719 99.2266 92.8125 96.1328 95.7500 97.6484 99.8516 126.6563 121.0078 132.9609 121.0000 129.1563 121.3672 121.5938 111.7500 99.2188 101.1953 110.0625 84.7109 98.7891 101.2188 Chg -0.0078 0.0703 0.0547 0.1172 0.1172 0.1484 0.1172 0.1953 0.2109 0.3125 0.4063 0.4688 0.5625 0.6641 0.6953 0.7500 0.7500 0.7266 0.7344 0.6875 0.6016 0.6953 0.7422 Asked Yield 2.205 2.749 2,762 2.801 2.847 2.864 2.887 2.892 2.899 2.906 2.941 2.949 2.964 2.973 3.014 3.021 3.040 3.046 3.056 3.056 3.064 3.063 3.062 FIGURE 6.3 Sample Wall Street Journal U.S. Treasury note and bond prices

Step by Step Solution

★★★★★

3.37 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Okay here is the detailed work a Is this a premium or discount bond The bon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started