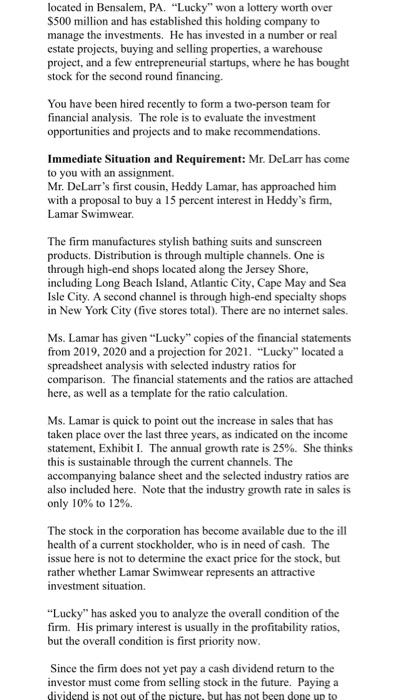

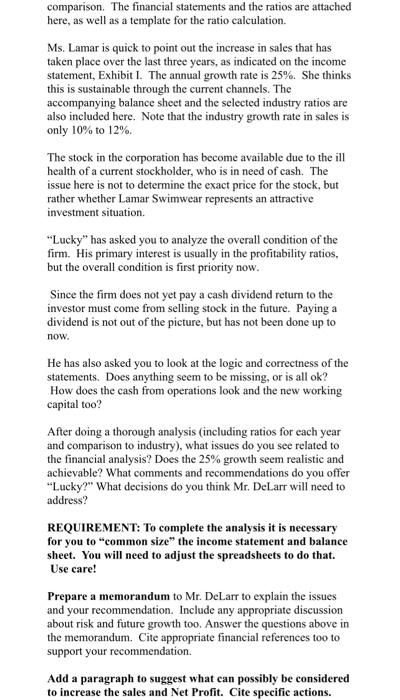

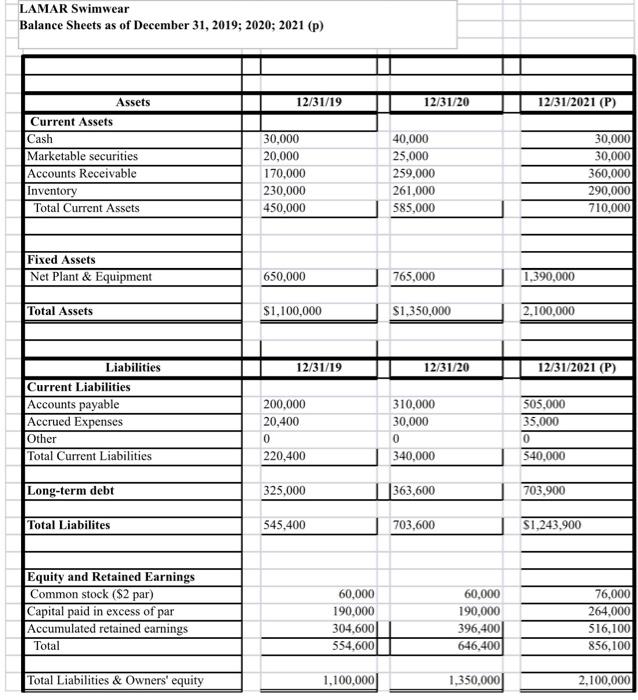

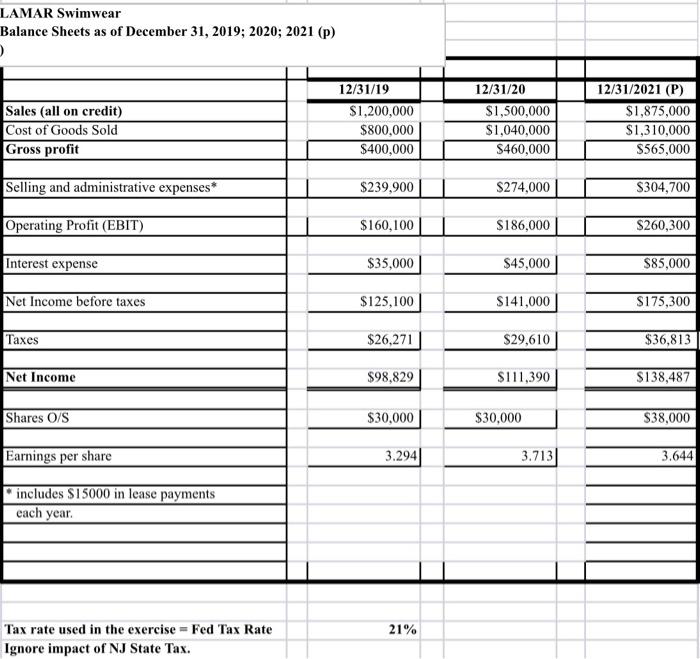

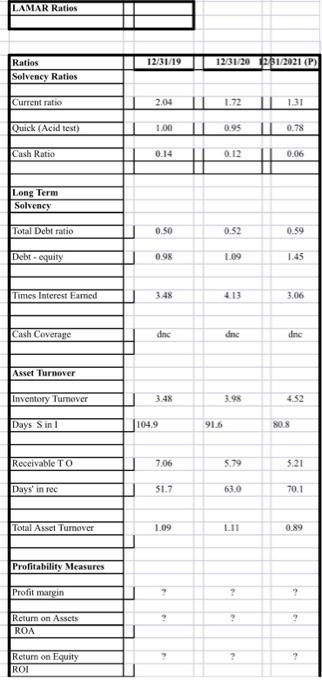

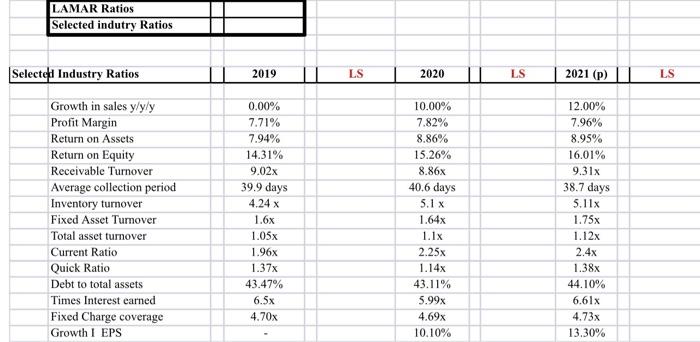

located in Bensalem, PA. "Lucky" won a lottery worth over $500 million and has established this holding company to manage the investments. He has invested in a number or real estate projects, buying and selling properties, a warehouse project, and a few entrepreneurial startups, where he has bought stock for the second round financing. You have been hired recently to form a two-person team for financial analysis. The role is to evaluate the investment opportunities and projects and to make recommendations. Immediate Situation and Requirement: Mr. DeLarr has come to you with an assignment. Mr. DeLarr's first cousin, Heddy Lamar, has approached him with a proposal to buy a 15 percent interest in Heddy's firm, Lamar Swimwear The firm manufactures stylish bathing suits and sunscreen products. Distribution is through multiple channels. One is through high-end shops located along the Jersey Shore, including Long Beach Island, Atlantic City, Cape May and Sea Isle City. A second channel is through high-end specialty shops in New York City (five stores total). There are no internet sales. Ms. Lamar has given "Lucky" copies of the financial statements from 2019, 2020 and a projection for 2021. "Lucky" located a spreadsheet analysis with selected industry ratios for comparison. The financial statements and the ratios are attached here, as well as a template for the ratio calculation. Ms. Lamar is quick to point out the increase in sales that has taken place over the last three years, as indicated on the income statement, Exhibit I. The annual growth rate is 25%. She thinks this is sustainable through the current channels. The accompanying balance sheet and the selected industry ratios are also included here. Note that the industry growth rate in sales is only 10% to 12%. The stock in the corporation has become available due to the ill health of a current stockholder, who is in need of cash. The issue here is not to determine the exact price for the stock, but rather whether Lamar Swimwear represents an attractive investment situation. "Lucky" has asked you to analyze the overall condition of the firm. His primary interest is usually in the profitability ratios, but the overall condition is first priority now. Since the firm does not yet pay a cash dividend return to the investor must come from selling stock in the future. Paying a dividend is not out of the picture, but has not been done up to comparison. The financial statements and the ratios are attached here, as well as a template for the ratio calculation. Ms. Lamar is quick to point out the increase in sales that has taken place over the last three years, as indicated on the income statement, Exhibit I. The annual growth rate is 25%. She thinks this is sustainable through the current channels. The accompanying balance sheet and the selected industry ratios are also included here. Note that the industry growth rate in sales is only 10% to 12% The stock in the corporation has become available due to the ill health of a current stockholder, who is in need of cash. The issue here is not to determine the exact price for the stock, but rather whether Lamar Swimwear represents an attractive investment situation. "Lucky" has asked you to analyze the overall condition of the firm. His primary interest is usually in the profitability ratios, but the overall condition is first priority now. Since the firm does not yet pay a cash dividend return to the investor must come from selling stock in the future. Paying a dividend is not out of the picture, but has not been done up to now. He has also asked you to look at the logic and correctness of the statements. Does anything seem to be missing, or is all ok? How does the cash from operations look and the new working capital too? After doing a thorough analysis (including ratios for each year and comparison to industry), what issues do you see related to the financial analysis? Does the 25% growth seem realistic and achievable? What comments and recommendations do you offer "Lucky?" What decisions do you think Mr. DeLarr will need to address? REQUIREMENT: To complete the analysis it is necessary for you to "common size the income statement and balance sheet. You will need to adjust the spreadsheets to do that. Use care! Prepare a memorandum to Mr. DeLarr to explain the issues and your recommendation. Include any appropriate discussion about risk and future growth too. Answer the questions above in the memorandum. Cite appropriate financial references too to support your recommendation Add a paragraph to suggest what can possibly be considered to increase the sales and Net Profit. Cite specific actions. LAMAR Swimwear Balance Sheets as of December 31, 2019; 2020; 2021 (p) 12/31/19 12/31/20 12/31/2021 (P) Assets Current Assets Cash Marketable securities Accounts Receivable Inventory Total Current Assets 30,000 20,000 170,000 230,000 450,000 40,000 25,000 259,000 261,000 585,000 30,000 30,000 360,000 290,000 710,000 Fixed Assets Net Plant & Equipment 650,000 765,000 1,390,000 Total Assets $1,100,000 $1,350,000 2,100,000 12/31/19 12/31/20 12/31/2021 (P) Liabilities Current Liabilities Accounts payable Accrued Expenses Other Total Current Liabilities 310,000 30,000 200,000 20,400 0 220,400 505,000 35,000 0 540,000 0 340,000 Long-term debt 325,000 363,600 703,900 Total Liabilites 545,400 703,600 $1,243.900 Equity and Retained Earnings Common stock ($2 par) Capital paid in excess of par Accumulated retained earnings Total 60,000 190,000 304,600] 554,600 60,000 190,000 396,400 646,400 76,000 264,000 516,100 856,100 Total Liabilities & Owners' equity 1,100,000) 1,350,000 2,100,000 LAMAR Swimwear Balance Sheets as of December 31, 2019; 2020; 2021 (p) Sales (all on credit) Cost of Goods Sold Gross profit 12/31/19 $1,200,000 $800,000 $400,000 12/31/20 $1,500,000 $1,040,000 S460,000 12/31/2021 (P) $1,875,000 $1,310,000 $565,000 Selling and administrative expenses* $239,900 $274,000 S304,700 Operating Profit (EBIT) $160,100 $186,000 S260,300 Interest expense $35,000 $45,000 $85,000 Net Income before taxes $125,100 $141,000 $175,300 Taxes $26,271 $29,610 $36,813 Net Income $98,829 $111,390 $138,487 Shares O/S $30,000 $30,000 $38,000 Earnings per share 3.294 3.7131 3.644 includes $15000 in lease payments each year. 21% Tax rate used in the exercise = Fed Tax Rate Ignore impact of NJ State Tax. LAMAR Ratios 12/31/19 12/31/20 121/2021 (P) Ratios Solvency Raties Current ratio 2.04 1.72 Quick (Acid test) 1.00 0.95 0.78 Cash Ratio 0.14 0.12 0.06 Long Term Solvency Total Debt ratio 0.50 0.52 0.59 Debt-equity 0.98 1.09 1.45 Times Interest Eamed 3.48 4.13 3.06 Cash Coverage dne dne dinc Asset Turnover Inventory Turever 3.48 39 4.52 Days Sin 1 104.9 91.6 80.8 Receivable TO 7.06 5.79 5.21 Days' in rec 51.7 63.0 70.1 Total Asset Turnover 1.09 1.11 0.89 Profitability Measures Profit margin : 2 ? Return on Assets ROA Return on Equity ROI : ? LAMAR Ratios Selected indutry Ratios Selecten Industry Ratios 2019 LS 2020 LS 2021 (p) 11 LS Growth in sales y/y/y Profit Margin Return on Assets Return on Equity Receivable Turnover Average collection period Inventory turnover Fixed Asset Turnover Total asset turnover Current Ratio Quick Ratio Debt to total assets Times Interest earned Fixed Charge coverage Growth I EPS 0.00% 7.71% 7.94% 14.31% 9.02x 39.9 days 4.24 x 1.6% 1.05x 1.96x 1.37x 43.47% 6.5x 4.70x 10.00% 7.82% 8.86% 15.26% 8.86x 40.6 days 5.1 x 1.64x 1. 1x 2.25x 1.14x 43.11% 5.99x 4.69x 10.10% 12.00% 7.96% 8.95% 16.01% 9.31x 38.7 days 5.11x 1.75x 1.12x 2.4x 1.38x 44.10% 6.61x 4.73x 13.30%