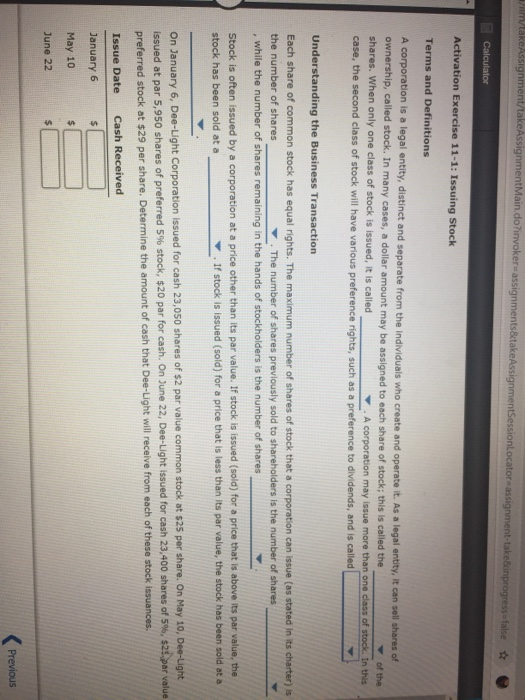

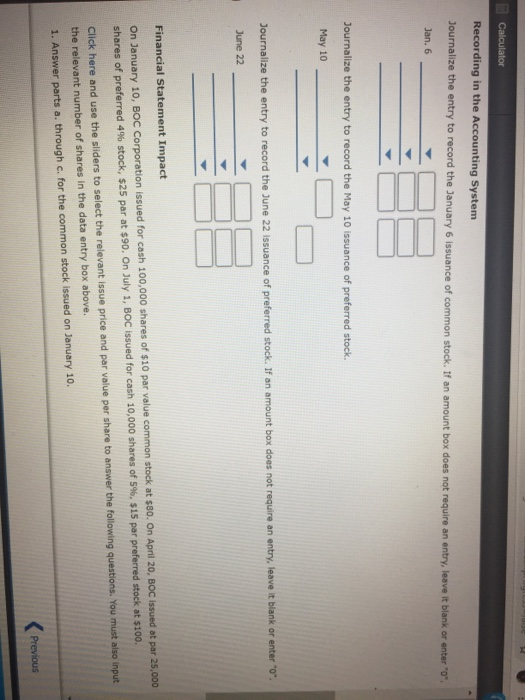

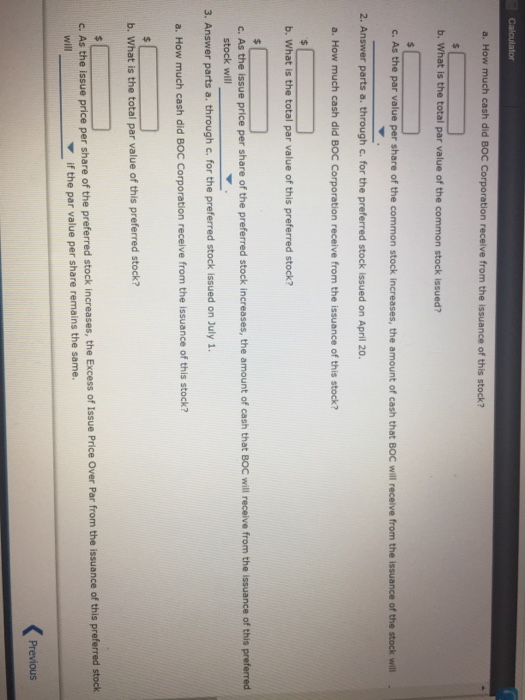

Locator ass s-false Terms and Definitions A corporation is a legal ownership, called stock. In many cases, a dollar amount may be assigned to each share of stock; this is called the shares. When only one class of stock is issued, it is called case, the second class of stock will have various preference I entity, distinct and separate from the individuals who create and operate it. As a legal entity, it can sell shares of Y of the .A corporation may issue more than one class of stock. In thits rights, such as a preference to dividends, and is called Understanding the Business Transaction Each share of common stock has equal rights. The maximum number of shares of stock that a corporation can issue (as stated in its charter) is the number of shares , while the number of shares remaining in the hands of stockholders is the number of shares The number of shares previously sold to shareholders is the number of shares Stock is often issued by a corporation at a price other than its par value. If stock is issued (sold) for a price that is above its par value, the stock has been sold at a Y . If stock is issued (sold) for a price that is less than its par value, the stock has been sold at a On January 6, Dee-Light Corporation issued for cash 23,050 shares of $2 par value common stock at $25 per share. On May 10, Dee-Light issued at par 5,950 shares of preferred 5% stock, $20 par for cash. On June 22, Dee-Light issued for cash 23,400 shares of 5%, sd par value preferred stock at $29 per share. Determine the amount of cash that Dee-Light will receive from each of these stock issuances. Issue Date Cash Received January 6 May 10 June 22 May 10 June 22 On January 10, BOC Corporation issued for cash 100,000 shares of $10 par value common stock at $80. On April 20, BOC issued at par 25,000 shares of preferred 4% stock, $25 par at $90. On July 1, BOC issued for cash 10,000 shares of 596, S15 par preferred stock at $100. 1. Answer parts a. through c. for the common stock issued on January 10 a. How much cash did BOC on receive from the issuance of this stock? b. What is the total par value of the common stock issued? c. As the par value per share of the common stock increases, the amount of cash that B0C will receive from the issuance of the stock wil 2. Answer parts a. through c. for the preferred stock issued on April 20. a. How much cash did BOC Corporation receive from the issuance of this stock? b. What is the total par value of this preferred stock? c. As the issue price per share of the preferred stock increases, the amount of cash that BOC will receive from the issuance of this preferred stock will 3. Answer parts a. through c. for the preferred stock issued on July 1. a. How much cash did BOc Corporation receive from the issuance of this stock? b. What is the total par value of this preferred stock? share of the preferred stock increases, the Excess of Issue Price Over Par from the issuance of this preferred if the par value per share remains the same. C. As the issue price per will Previous Locator ass s-false Terms and Definitions A corporation is a legal ownership, called stock. In many cases, a dollar amount may be assigned to each share of stock; this is called the shares. When only one class of stock is issued, it is called case, the second class of stock will have various preference I entity, distinct and separate from the individuals who create and operate it. As a legal entity, it can sell shares of Y of the .A corporation may issue more than one class of stock. In thits rights, such as a preference to dividends, and is called Understanding the Business Transaction Each share of common stock has equal rights. The maximum number of shares of stock that a corporation can issue (as stated in its charter) is the number of shares , while the number of shares remaining in the hands of stockholders is the number of shares The number of shares previously sold to shareholders is the number of shares Stock is often issued by a corporation at a price other than its par value. If stock is issued (sold) for a price that is above its par value, the stock has been sold at a Y . If stock is issued (sold) for a price that is less than its par value, the stock has been sold at a On January 6, Dee-Light Corporation issued for cash 23,050 shares of $2 par value common stock at $25 per share. On May 10, Dee-Light issued at par 5,950 shares of preferred 5% stock, $20 par for cash. On June 22, Dee-Light issued for cash 23,400 shares of 5%, sd par value preferred stock at $29 per share. Determine the amount of cash that Dee-Light will receive from each of these stock issuances. Issue Date Cash Received January 6 May 10 June 22 May 10 June 22 On January 10, BOC Corporation issued for cash 100,000 shares of $10 par value common stock at $80. On April 20, BOC issued at par 25,000 shares of preferred 4% stock, $25 par at $90. On July 1, BOC issued for cash 10,000 shares of 596, S15 par preferred stock at $100. 1. Answer parts a. through c. for the common stock issued on January 10 a. How much cash did BOC on receive from the issuance of this stock? b. What is the total par value of the common stock issued? c. As the par value per share of the common stock increases, the amount of cash that B0C will receive from the issuance of the stock wil 2. Answer parts a. through c. for the preferred stock issued on April 20. a. How much cash did BOC Corporation receive from the issuance of this stock? b. What is the total par value of this preferred stock? c. As the issue price per share of the preferred stock increases, the amount of cash that BOC will receive from the issuance of this preferred stock will 3. Answer parts a. through c. for the preferred stock issued on July 1. a. How much cash did BOc Corporation receive from the issuance of this stock? b. What is the total par value of this preferred stock? share of the preferred stock increases, the Excess of Issue Price Over Par from the issuance of this preferred if the par value per share remains the same. C. As the issue price per will Previous