Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lockheed Tristar is the world's leading Aerospace company. It is (3. considering building a new plant to manufacture its latest F35- Lightning III aircraft

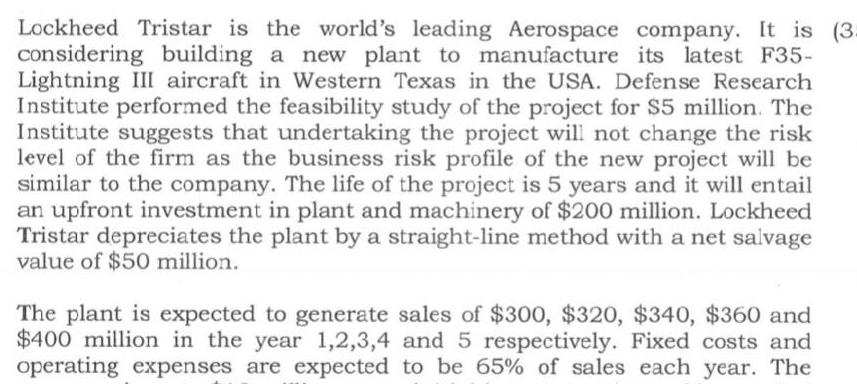

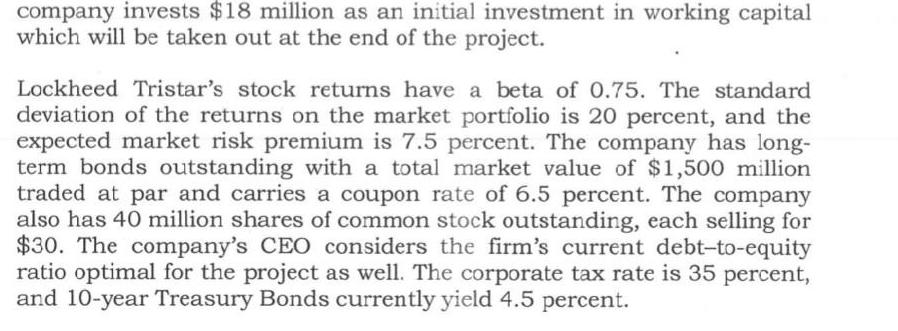

Lockheed Tristar is the world's leading Aerospace company. It is (3. considering building a new plant to manufacture its latest F35- Lightning III aircraft in Western Texas in the USA. Defense Research Institute performed the feasibility study of the project for $5 million. The Institute suggests that undertaking the project will not change the risk level of the firm as the business risk profile of the new project will be similar to the company. The life of the project is 5 years and it will entail an upfront investment in plant and machinery of $200 million. Lockheed Tristar depreciates the plant by a straight-line method with a net salvage value of $50 million. The plant is expected to generate sales of $300, $320, $340, $360 and $400 million in the year 1,2,3,4 and 5 respectively. Fixed costs and operating expenses are expected to be 65% of sales each year. The company invests $18 million as an initial investment in working capital which will be taken out at the end of the project. Lockheed Tristar's stock returns have a beta of 0.75. The standard deviation of the returns on the market portfolio is 20 percent, and the expected market risk premium is 7.5 percent. The company has long- term bonds outstanding with a total market value of $1,500 million traded at par and carries a coupon rate of 6.5 percent. The company also has 40 million shares of common stock outstanding, each selling for $30. The company's CEO considers the firm's current debt-to-equity ratio optimal for the project as well. The corporate tax rate is 35 percent, and 10-year Treasury Bonds currently yield 4.5 percent. a. Use the weighted average cost of capital approach to determine the NPV of the project. b. Suppose the company decides to fund the project with a 50% debt-to- asset ratio. Lockheed Tristar raises required debt at a 7% interest rate from Miami Bank. What is the cost of capital for the project now? Explain.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a calculations for NPV using WACC approach Cost of equity Rf Rm Rf 45 07575 45 8625 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started