Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lofty Company is a maker of electric cars. On Jan. 1, 2018, the company signed a contract to lease battery making equipment from Leafy

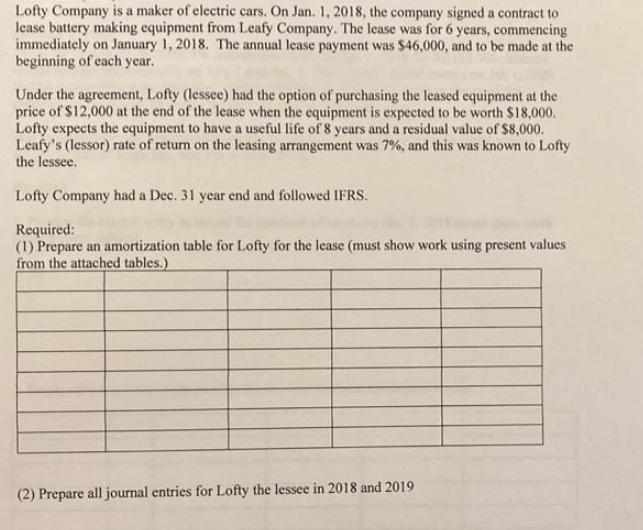

Lofty Company is a maker of electric cars. On Jan. 1, 2018, the company signed a contract to lease battery making equipment from Leafy Company. The lease was for 6 years, commencing immediately on January 1, 2018. The annual lease payment was $46,000, and to be made at the beginning of each year. Under the agreement, Lofty (lessee) had the option of purchasing the leased equipment at the price of $12,000 at the end of the lease when the equipment is expected to be worth $18,000. Lofty expects the equipment to have a useful life of 8 years and a residual value of $8,000. Leafy's (lessor) rate of return on the leasing arrangement was 7%, and this was known to Lofty the lessee. Lofty Company had a Dec. 31 year end and followed IFRS. Required: (1) Prepare an amortization table for Lofty for the lease (must show work using present values from the attached tables.) (2) Prepare all journal entries for Lofty the lessee in 2018 and 2019 (3) Prepare the journal entries Lofty the lessee would make when exercising the option of purchasing the equipment at the end of the lease.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started