Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Logic Co. recently negotiated a lump-sum purchase of serveral assets from a company that was going out of business. The purchase was completed on March

Logic Co. recently negotiated a lump-sum purchase of serveral assets from a company that was going out of business. The purchase was completed on March 1, 2020, at a total cash price of $1,260,000 and included a building, land, certain land improvements, and 12 vehiles. The estimated market values of the assets were bulding, $652,800; land, $462,400; land improvements, $68,000; and vechiles, $176,800. The company's fiscal year ends on December 31.

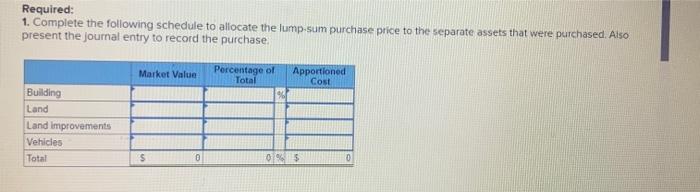

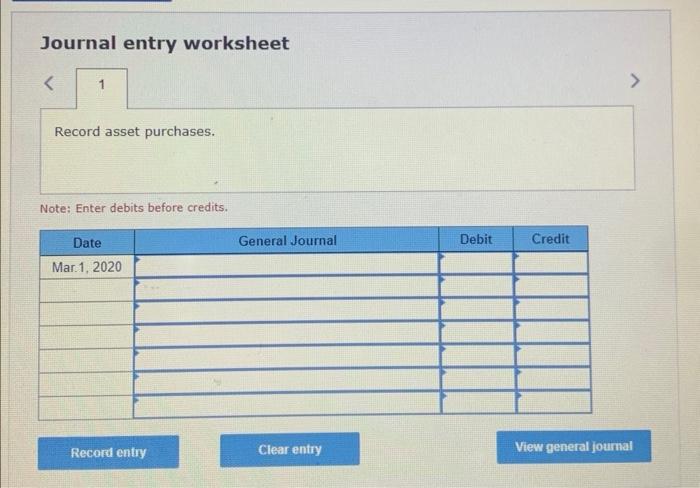

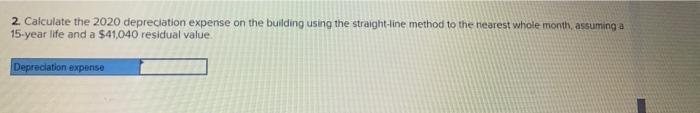

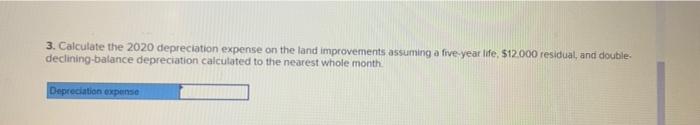

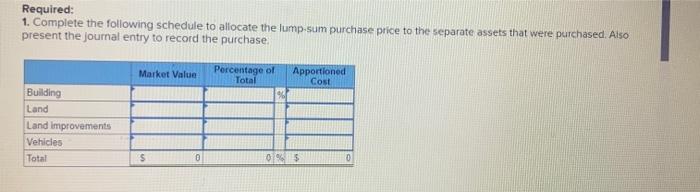

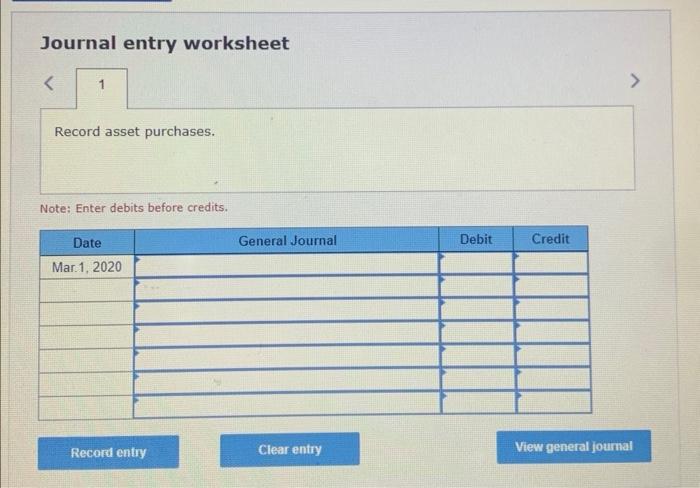

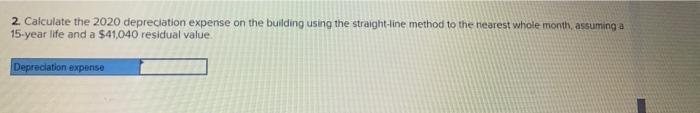

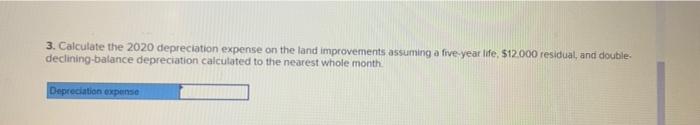

Required: 1. Complete the following schedule to allocate the lump-sum purchase price to the separate assets that were purchased. Aiso present the journal entry to record the purchase. Journal entry worksheet Note: Enter debits before credits. 2. Calculate the 2020 depreciation expense on the building using the straight-line method to the nearest whole month, assuming a 15-year life and a $41,040 residual value. 3. Calculate the 2020 depreciation expense on the land improvements assuming a fiveyear ife, $12000 residual, and double declining-batance depreciation calculated to the nearest whole month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started