Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Logit Co. plans to issue a 5 year bond outstanding with a face value of $1,000 and a semi-annual coupon rate of 6%. Currently the

Logit Co. plans to issue a 5 year bond outstanding with a face value of $1,000 and a semi-annual coupon rate of 6%. Currently the bond is rated AAA. The current risk-free rate is 3.5%.

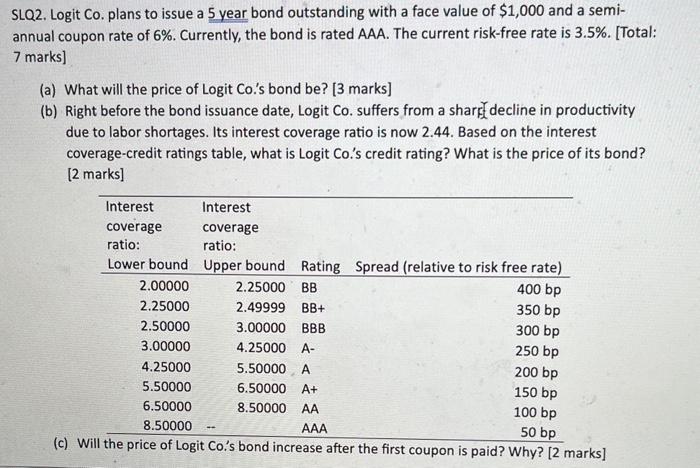

SLQ2. Logit Co. plans to issue a 5 year bond outstanding with a face value of $1,000 and a semiannual coupon rate of 6%. Currently, the bond is rated AAA. The current risk-free rate is 3.5%. [Total: 7 marks] (a) What will the price of Logit Co.'s bond be? [3 marks] (b) Right before the bond issuance date, Logit Co. suffers from a sharf due to labor shortages. Its interest coverage ratio is now 2.44. Based on the interest coverage-credit ratings table, what is Logit Co.'s credit rating? What is the price of its bond? [2 marks] (c) Win ue price or Logit co:s bond increase after the first coupon is paid? Why? [2 marks] a) what will the price of Logit Co.'s bond be?

b) Right before the bond issuance date, Logit Co. suffers from a sharp decline in productivity due to labor shortages. Its interest coverage ratio is now 2.44. Based on the interest coverage ratings table, what is Logit Co.'s credit rating? What is the price of its bond?

c) Will the price of Logit Co.'s bond increase after the first coupon is paid? Why?

Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started