Answered step by step

Verified Expert Solution

Question

1 Approved Answer

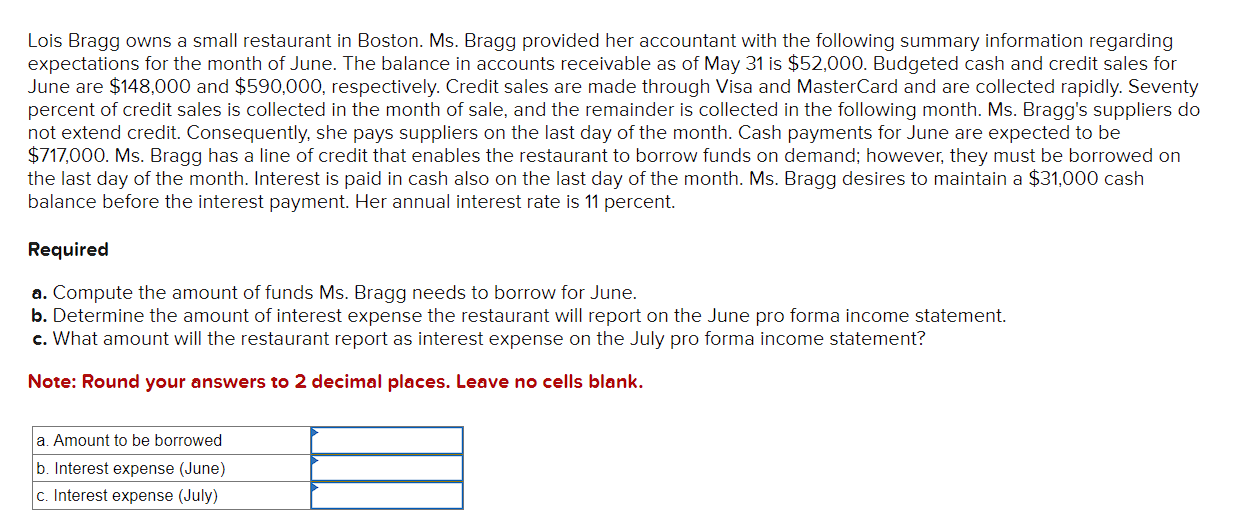

Lois Bragg owns a small restaurant in Boston. Ms . Bragg provided her accountant with the following summary information regarding expectations for the month of

Lois Bragg owns a small restaurant in Boston. Ms Bragg provided her accountant with the following summary information regarding

expectations for the month of June. The balance in accounts receivable as of May is $ Budgeted cash and credit sales for

June are $ and $ respectively. Credit sales are made through Visa and MasterCard and are collected rapidly. Seventy

percent of credit sales is collected in the month of sale, and the remainder is collected in the following month. Ms Bragg's suppliers do

not extend credit. Consequently, she pays suppliers on the last day of the month. Cash payments for June are expected to be

$ Ms Bragg has a line of credit that enables the restaurant to borrow funds on demand; however, they must be borrowed on

the last day of the month. Interest is paid in cash also on the last day of the month. Ms Bragg desires to maintain a $ cash

balance before the interest payment. Her annual interest rate is percent.

Required

a Compute the amount of funds Ms Bragg needs to borrow for June.

b Determine the amount of interest expense the restaurant will report on the June pro forma income statement.

c What amount will the restaurant report as interest expense on the July pro forma income statement?

Note: Round your answers to decimal places. Leave no cells blank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started