Question

Lombardi's net profit margin is 6 percent, and the company pays out 30 percent of its earnings as cash dividends. Its sales this year were

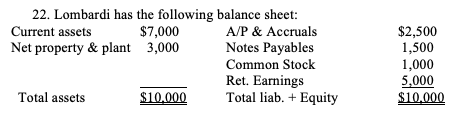

Lombardi's net profit margin is 6 percent, and the company pays out 30 percent of its earnings as cash dividends. Its sales this year were $10,000; its assets were used to full capacity and the net profit margin and dividend payout ratio are expected to remain constant. The company plans to raise capital using short-term (3-months) loans (Notes Payables) for its additional fund needed next year. If sales is expected to grow by 45 percent, what will Lombardi's current ratio be after it has raised the necessary capital from issuing Notes Payables?

22. Lombardi has the following balance sheet: Current assets $7,000 A/P & Accruals Net property & plant 3,000 Notes Payables Common Stock Ret. Earnings Total assets $10.000 Total liab. + Equity $2,500 1,500 1,000 5,000 $10.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started