Answered step by step

Verified Expert Solution

Question

1 Approved Answer

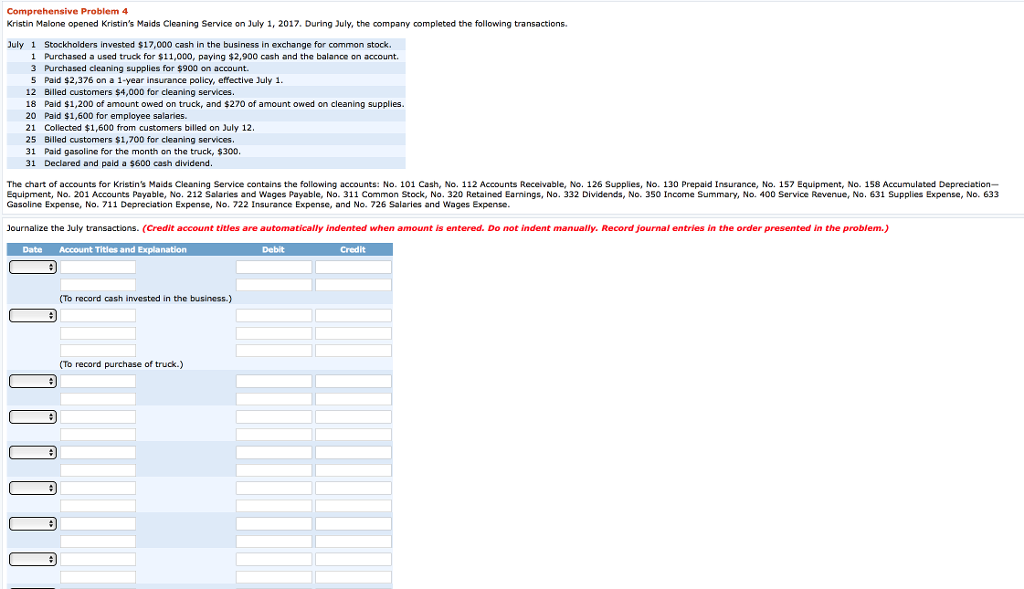

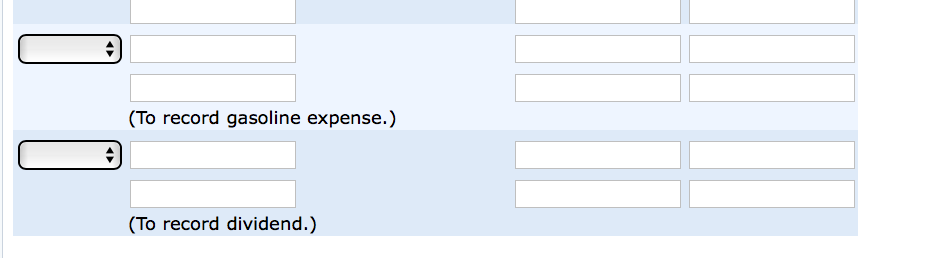

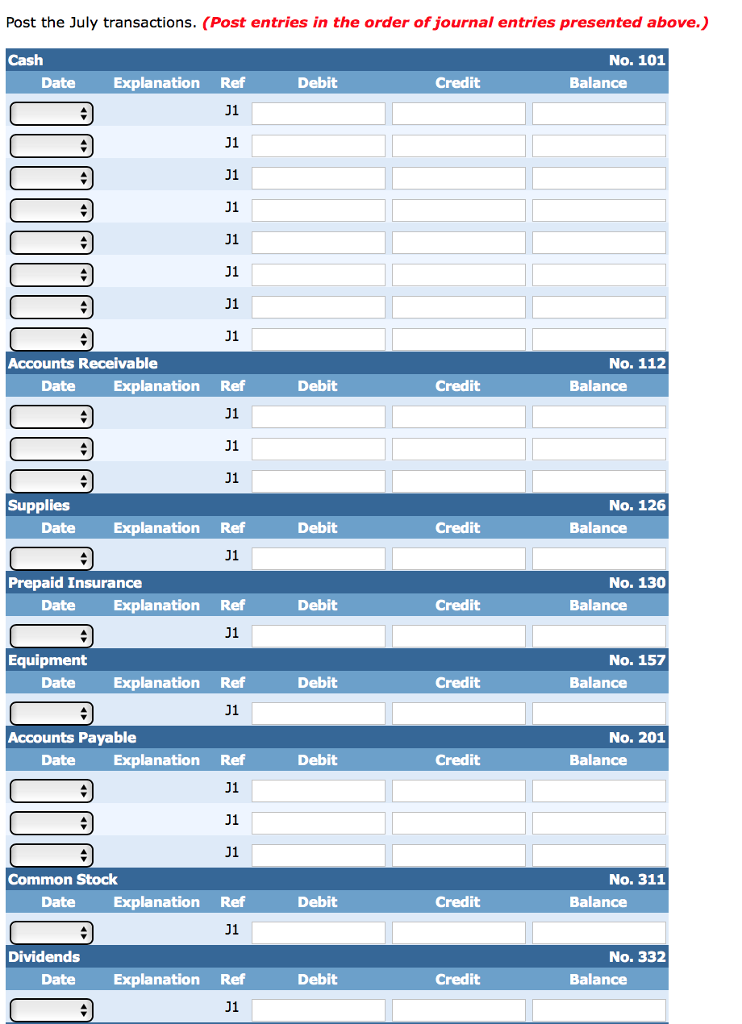

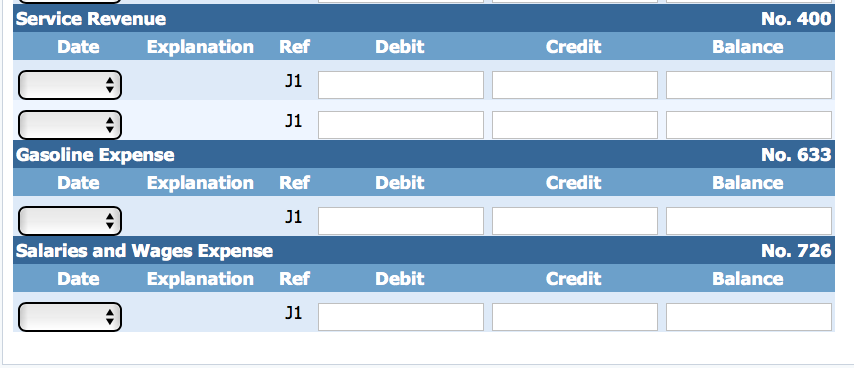

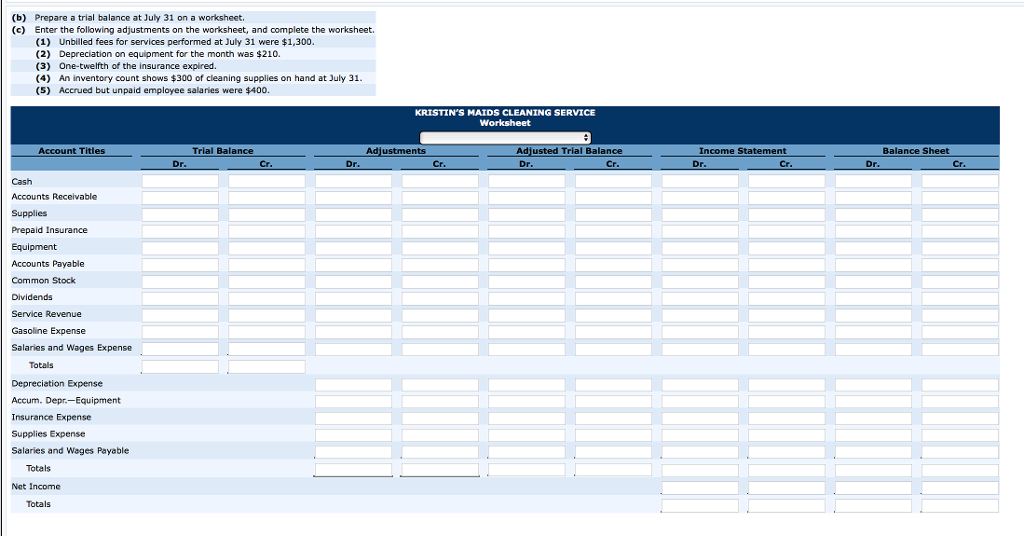

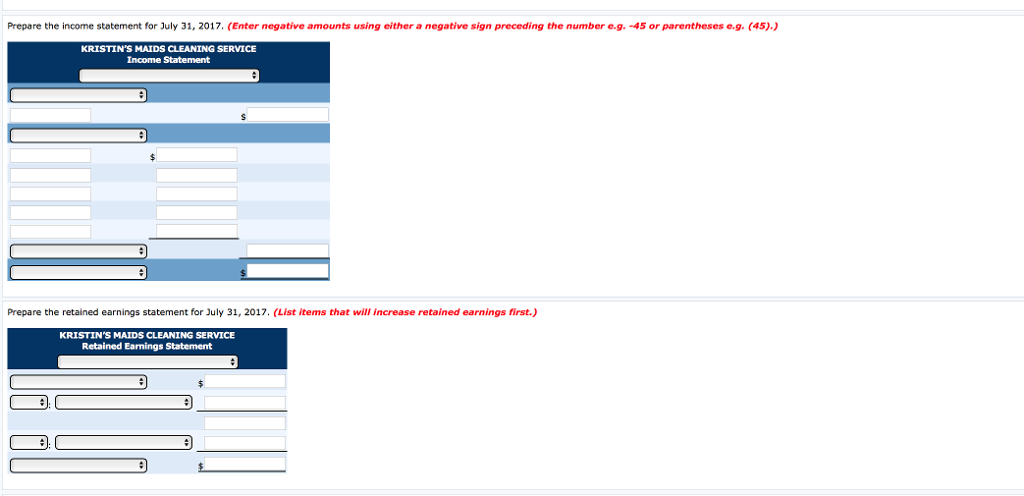

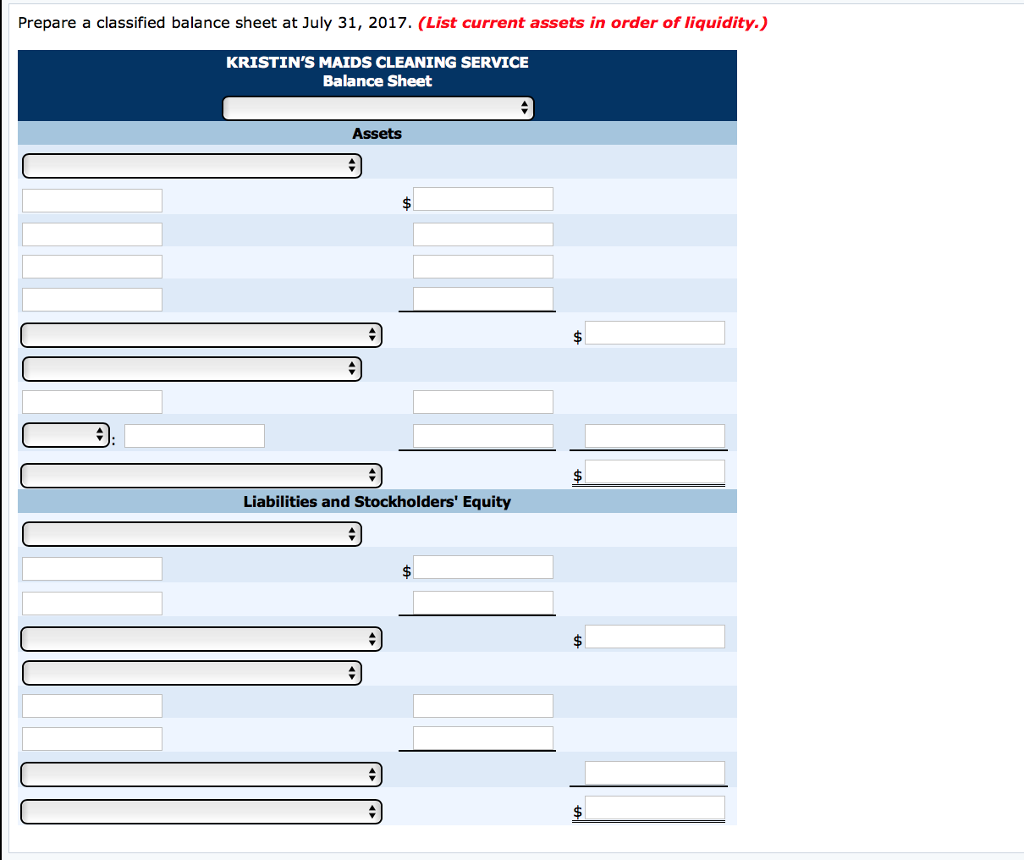

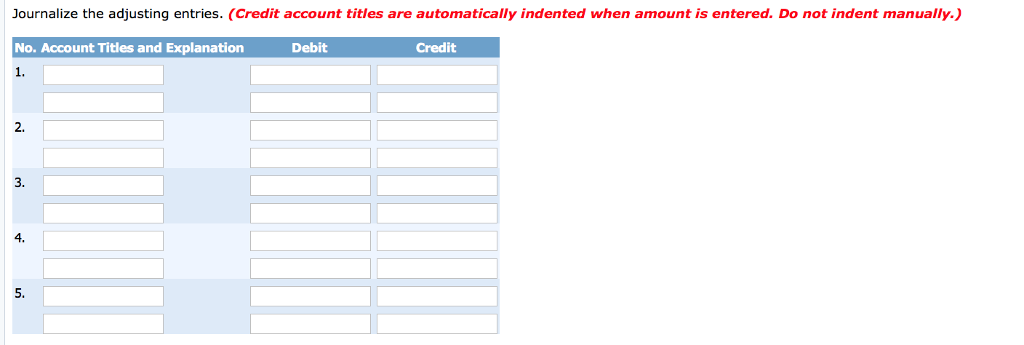

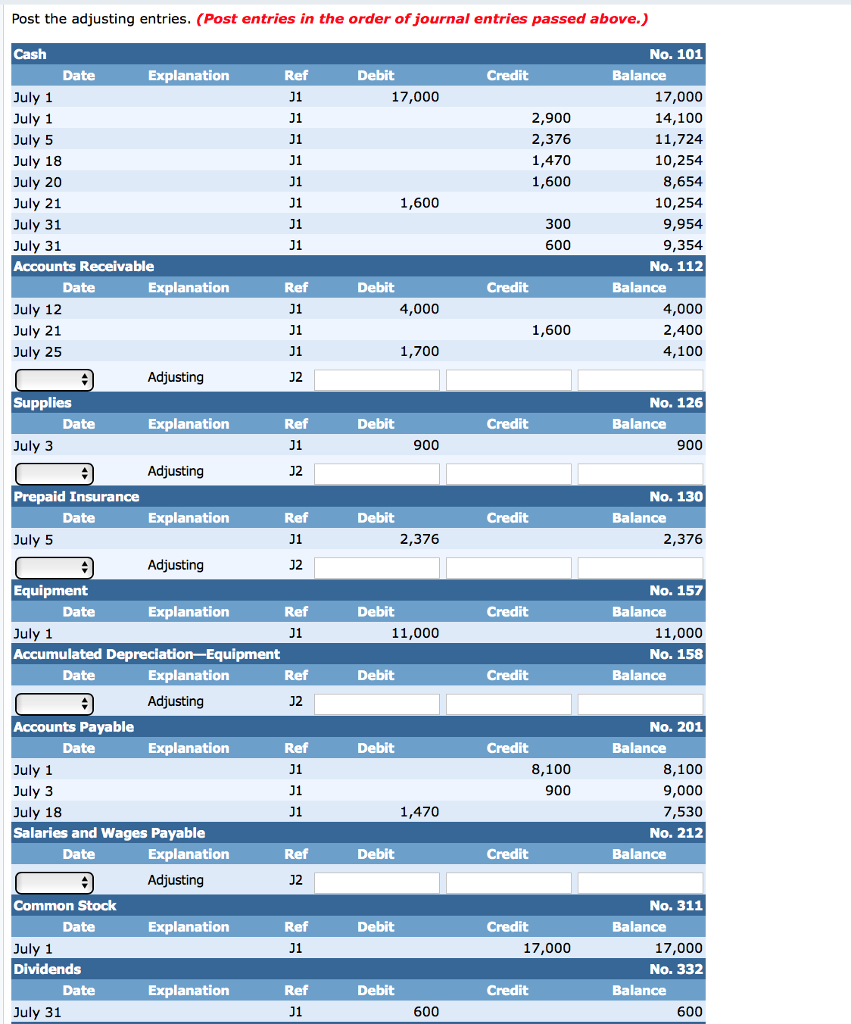

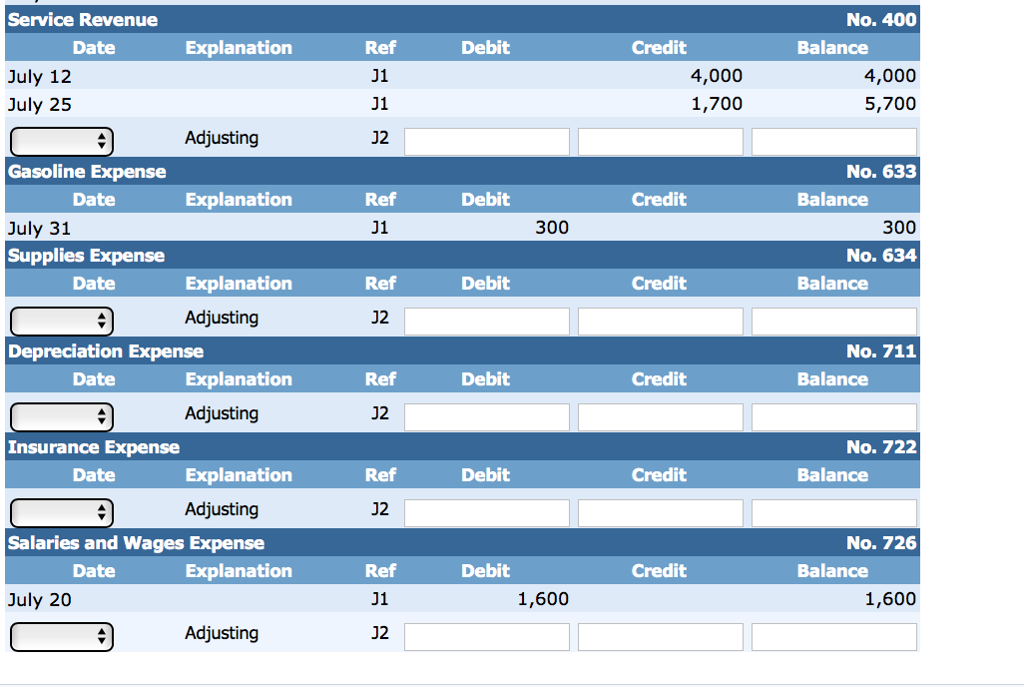

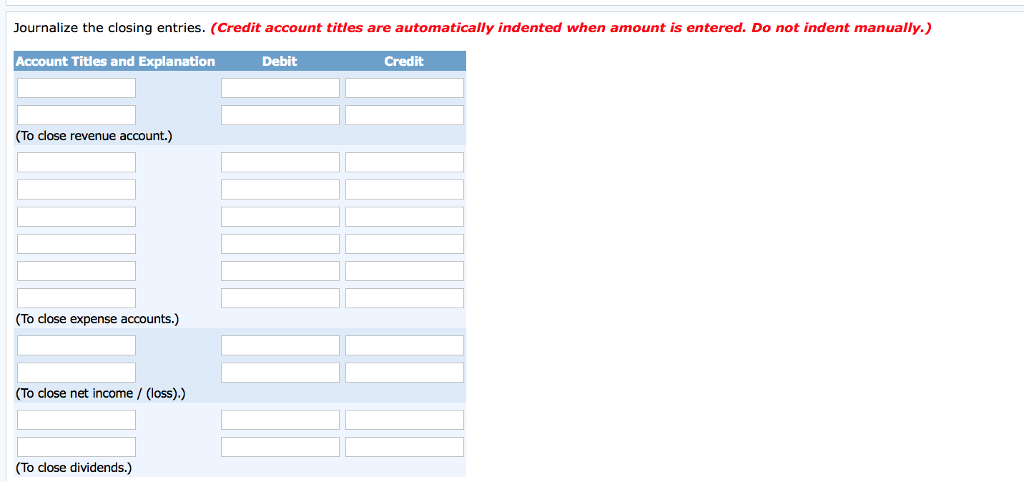

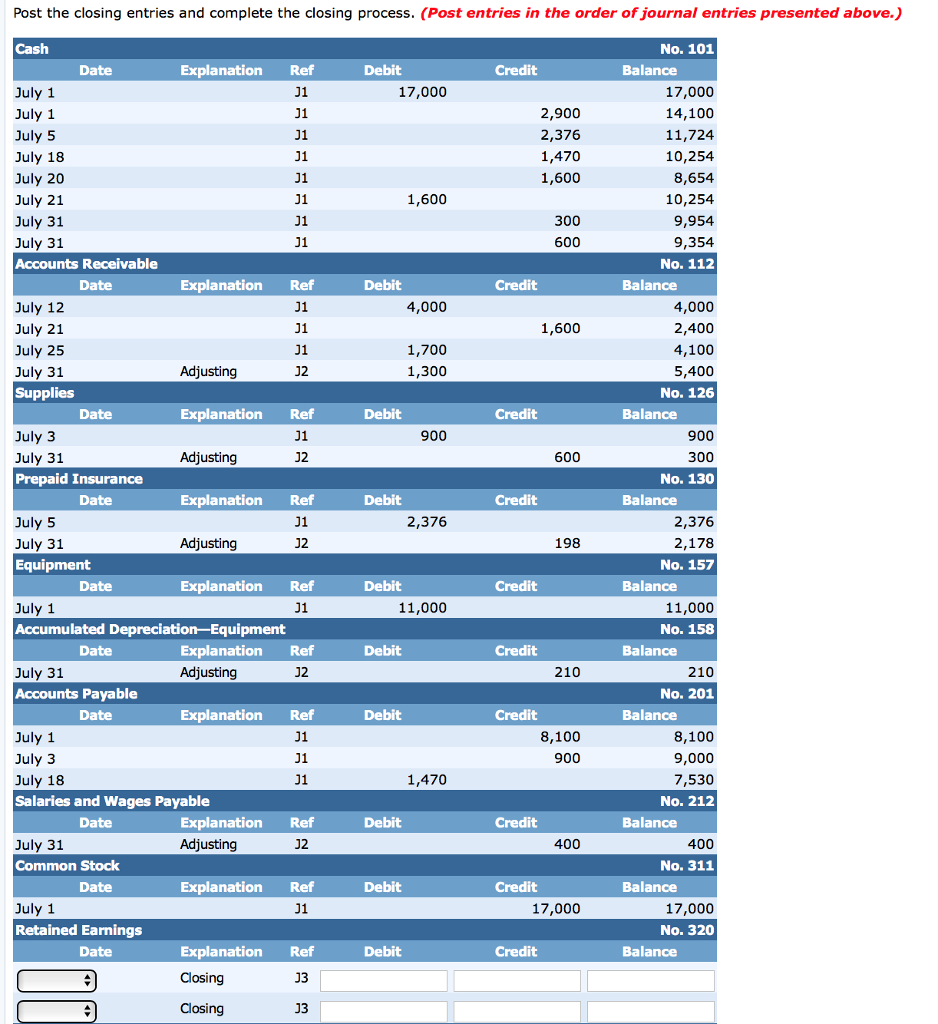

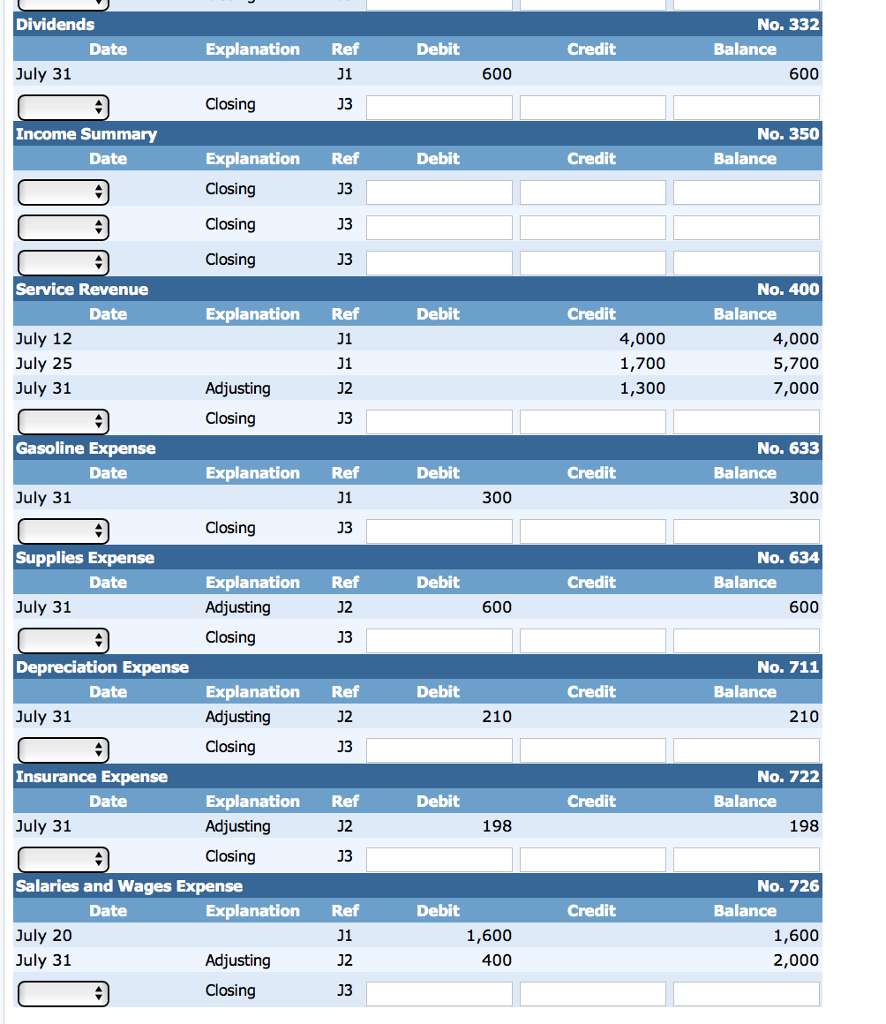

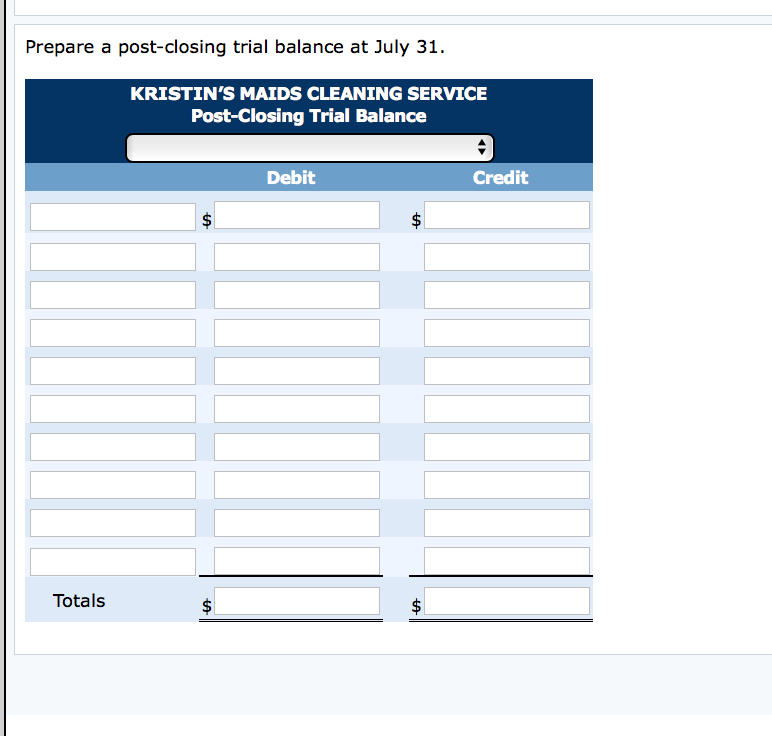

Long problem but please help out... thank you so much. Comprehensive Problem 4 Kristin Malone opened Kristin's Maids Cleaning Service on July 1, 2017. During

Long problem but please help out... thank you so much.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started