Answered step by step

Verified Expert Solution

Question

1 Approved Answer

look at pictures! answer required 1&2. thanks! Air France-KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF's financial

look at pictures! answer required 1&2. thanks!

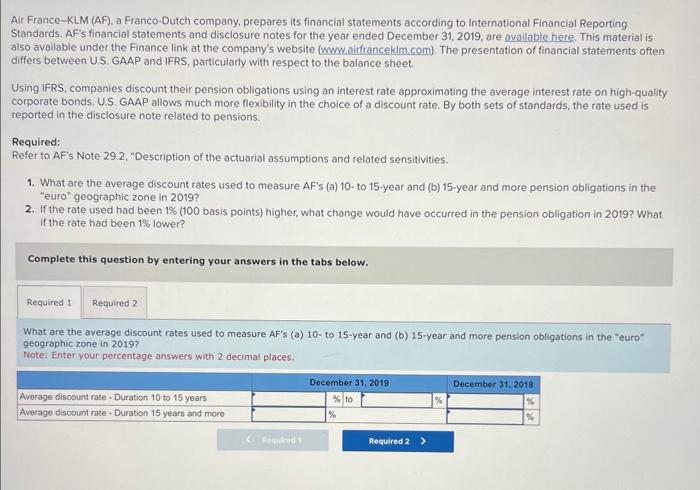

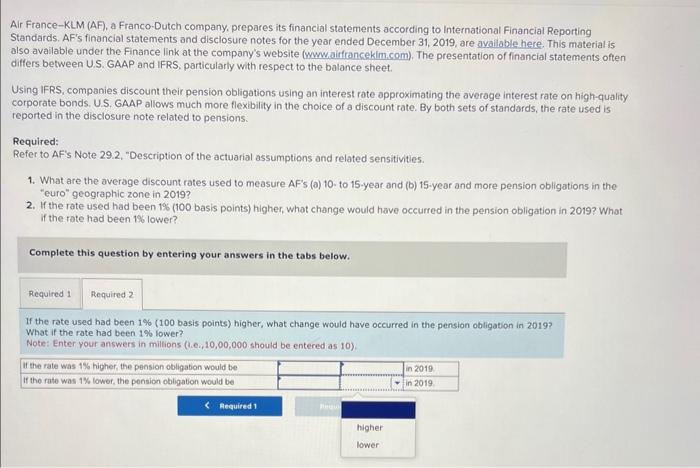

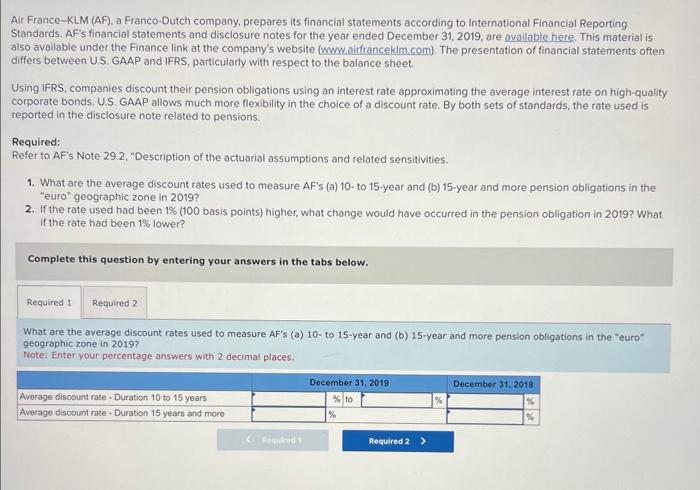

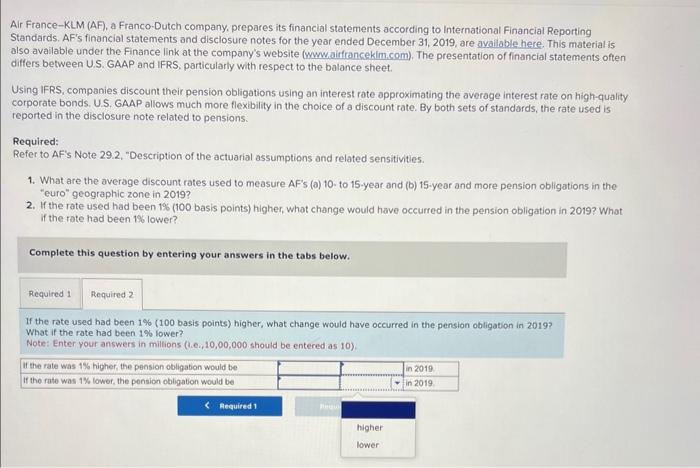

Air France-KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF's financial statements and disclosure notes for the year ended December 31, 2019, are available here. This material is also available under the Finance link at the company's website (wowwairfranceklm.com). The presentation of financial statements often differs between U.S, GAAP and IFRS, particularly with respect to the balance sheet. Using IFRS, companies discount their pension obligations using an interest rate approximating the average interest rate on high-quality corporate bonds. U.S. GAAP allows much more flexibility in the choice of a discount rate. By both sets of standards, the rate used is reported in the disclosure note related to pensions. Required: Refer to AF's Note 29.2, "Description of the actuarial assumptions and related sensitivities. 1. What are the average discount rates used to measure AF's (a) 10-to 15-year and (b) 15-year and more pension obligations in the "euro" geographic zone in 2019? 2. If the rate used had been 1% (100 basis points) higher, what change would have occurred in the pension obligation in 2019 ? What if the rate had been 1% lower? Complete this question by entering your answers in the tabs below. What are the average discount rates used to measure AF's (a) 10- to 15-year and (b) 15-year and more pension obligations in the "euro" geographic zone in 2019? Note: Enter your percentage answers with 2 decimal places. Air France-KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF's financial statements and disclosure notes for the year ended December 31, 2019, are available here. This material is also available under the Finance link at the company's website (www.airfancekim. com). The presentation of financial statements often differs between U.S. GAAP and IFRS, particularly with respect to the balance sheet: Using IFRS, companies discount their pension obligations using an interest rate approximating the average interest rate on high-quality corporate bonds. U.S. GAAP allows much more flexibility in the choice of a discount rate. By both sets of standards, the rate used is reported in the disclosure note related to pensions. Required: Refer to AF's Note 29.2, "Description of the actuarial assumptions and related sensitivities. 1. What are the average discount rates used to measure AF's (o) 10- to 15 -year and (b) 15-year and more pension obligations in the "euro" geographic zone in 2019? 2. If the rate used had been 1% (100 basis points) higher, whot change would have occurred in the pension obligation in 2019 ? What if the rate had been 19% lower? Complete this question by entering your answers in the tabs below. If the rate used had been 1% ( 100 basis points) higher, what change would have occurred in the pension obligation in 2019 ? What if the rate had been 1% lower? Note: Enter your answers in millions (1.e.,10,00,000 should be entered as 10). Air France-KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF's financial statements and disclosure notes for the year ended December 31, 2019, are available here. This material is also available under the Finance link at the company's website (wowwairfranceklm.com). The presentation of financial statements often differs between U.S, GAAP and IFRS, particularly with respect to the balance sheet. Using IFRS, companies discount their pension obligations using an interest rate approximating the average interest rate on high-quality corporate bonds. U.S. GAAP allows much more flexibility in the choice of a discount rate. By both sets of standards, the rate used is reported in the disclosure note related to pensions. Required: Refer to AF's Note 29.2, "Description of the actuarial assumptions and related sensitivities. 1. What are the average discount rates used to measure AF's (a) 10-to 15-year and (b) 15-year and more pension obligations in the "euro" geographic zone in 2019? 2. If the rate used had been 1% (100 basis points) higher, what change would have occurred in the pension obligation in 2019 ? What if the rate had been 1% lower? Complete this question by entering your answers in the tabs below. What are the average discount rates used to measure AF's (a) 10- to 15-year and (b) 15-year and more pension obligations in the "euro" geographic zone in 2019? Note: Enter your percentage answers with 2 decimal places. Air France-KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF's financial statements and disclosure notes for the year ended December 31, 2019, are available here. This material is also available under the Finance link at the company's website (www.airfancekim. com). The presentation of financial statements often differs between U.S. GAAP and IFRS, particularly with respect to the balance sheet: Using IFRS, companies discount their pension obligations using an interest rate approximating the average interest rate on high-quality corporate bonds. U.S. GAAP allows much more flexibility in the choice of a discount rate. By both sets of standards, the rate used is reported in the disclosure note related to pensions. Required: Refer to AF's Note 29.2, "Description of the actuarial assumptions and related sensitivities. 1. What are the average discount rates used to measure AF's (o) 10- to 15 -year and (b) 15-year and more pension obligations in the "euro" geographic zone in 2019? 2. If the rate used had been 1% (100 basis points) higher, whot change would have occurred in the pension obligation in 2019 ? What if the rate had been 19% lower? Complete this question by entering your answers in the tabs below. If the rate used had been 1% ( 100 basis points) higher, what change would have occurred in the pension obligation in 2019 ? What if the rate had been 1% lower? Note: Enter your answers in millions (1.e.,10,00,000 should be entered as 10)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started