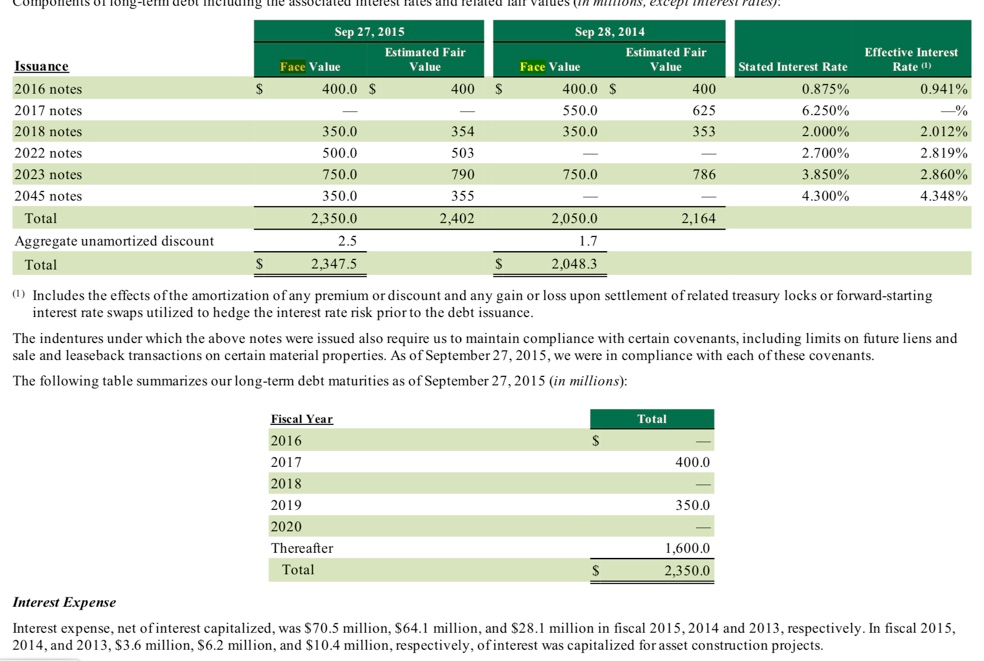

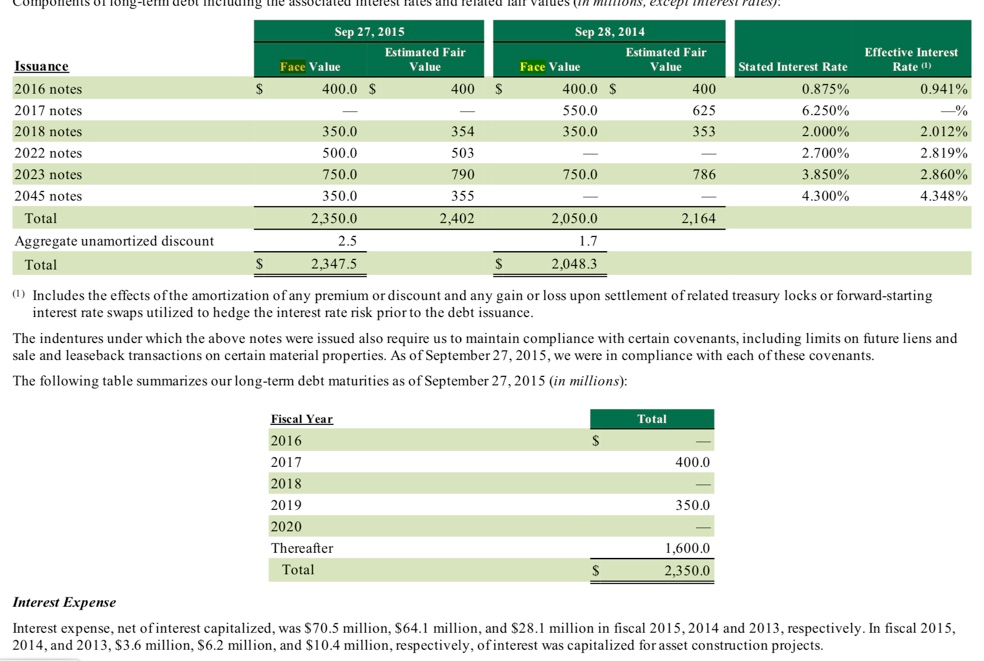

Look at the table that shows the face amounts of debt outstanding. Ignoring the retired 2017 notes, identify which of the notes were issued at a discount and which of the notes were issued at a premium.

Note 9 describes interest expense. In fiscal 2015, interest cost was $70.5m + $3.6m = $74.1 million. Remember that anytime a company incurs a cost, it must decide whether that cost benefits only the current period (an expense) or whether that cost benefits future periods (an asset). The general rule for interest cost is that it is expensed. However, if you are self-constructing a long-lived asset that you will use yourself or will sell or lease to another party, you may treat the interest on a construction loan as an asset. Starbucks followed this rule and capitalized (i.e., increased an asset) $3.6m of the interest cost. When many debt issues are outstanding, analysts will estimate an average effectiveinterest rate on long-term debt. This interest rate is useful to constructively capitalize leases (which they no longer have to do given the new lease standard) and to estimate the weighted-average cost of capital or WACC (a finance topic that you will learn about later).

Sep 27, 2015 Sep 28, 2014 Estimated Fair Estimated Fair Value Effective Interest Rate (1) Issuance 2016 notes 2017 notes 2018 notes 2022 notes 2023 notes 2045 notes Stated Interest Rate 0.875% 6.250% 2.000% 2.700% 3.850% 4.300% Face Valu Valu Face Value 400.0 S 400 625 353 400 S 0.941 % 400.0 $ 550.0 350.0 350.0 500.0 750.0 350.0 2,350.0 2.5 2,347.5 354 503 790 355 2,402 2.012% 2.819% 2.860% 4.34890 750.0 786 Total 2,050.0 2,164 Aggregate unamortized discount Total 2,048.3 Includes the effects ofthe amortization of any premium or discount and any gain or loss upon settlement of related treasury locks or forward-starting interest rate swaps utilized to hedge the interest rate risk prior to the debt issuance The indentures under which the above notes were issued also require us to maintain compliance with certain covenants, including limits on future liens and sale and leaseback transactions on certain material properties. As of September 27,2015, we were in compliance with each of these covenants. The following table summarizes our long-term debt maturities as of September 27,2015 (in millions): Total 2016 2017 2018 2019 2020 Thereafter 400.0 350.0 1,600.0 2,350.0 Total Interest Expense Interest expense, net of interest capitalized, was $70.5 million, $64.1 million, and $28.1 million in fiscal 2015,2014 and 2013, respectively. In fiscal 2015, 2014, and 2013, $3.6 million, S6.2 million, and $10.4 million, respectively, ofinterest was capitalized for asset construction projects. Sep 27, 2015 Sep 28, 2014 Estimated Fair Estimated Fair Value Effective Interest Rate (1) Issuance 2016 notes 2017 notes 2018 notes 2022 notes 2023 notes 2045 notes Stated Interest Rate 0.875% 6.250% 2.000% 2.700% 3.850% 4.300% Face Valu Valu Face Value 400.0 S 400 625 353 400 S 0.941 % 400.0 $ 550.0 350.0 350.0 500.0 750.0 350.0 2,350.0 2.5 2,347.5 354 503 790 355 2,402 2.012% 2.819% 2.860% 4.34890 750.0 786 Total 2,050.0 2,164 Aggregate unamortized discount Total 2,048.3 Includes the effects ofthe amortization of any premium or discount and any gain or loss upon settlement of related treasury locks or forward-starting interest rate swaps utilized to hedge the interest rate risk prior to the debt issuance The indentures under which the above notes were issued also require us to maintain compliance with certain covenants, including limits on future liens and sale and leaseback transactions on certain material properties. As of September 27,2015, we were in compliance with each of these covenants. The following table summarizes our long-term debt maturities as of September 27,2015 (in millions): Total 2016 2017 2018 2019 2020 Thereafter 400.0 350.0 1,600.0 2,350.0 Total Interest Expense Interest expense, net of interest capitalized, was $70.5 million, $64.1 million, and $28.1 million in fiscal 2015,2014 and 2013, respectively. In fiscal 2015, 2014, and 2013, $3.6 million, S6.2 million, and $10.4 million, respectively, ofinterest was capitalized for asset construction projects