Answered step by step

Verified Expert Solution

Question

1 Approved Answer

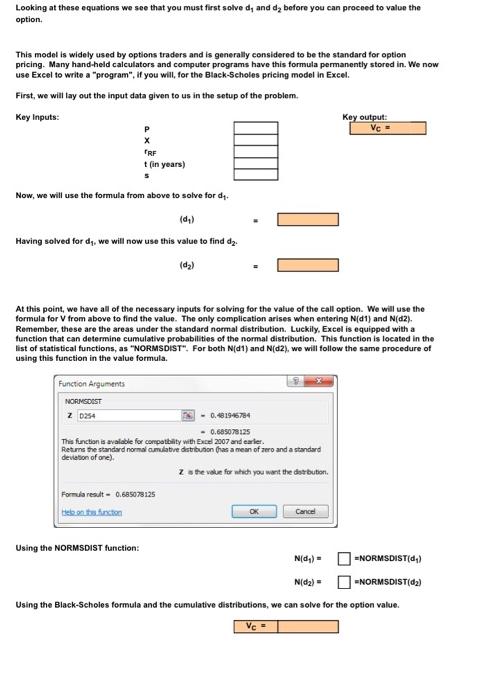

Looking at these equations we see that you must first solve d, and da before you can proceed to value the option. This model

Looking at these equations we see that you must first solve d, and da before you can proceed to value the option. This model is widely used by options traders and is generally considered to be the standard for option pricing. Many hand-held calculators and computer programs have this formula permanently stored in. We now use Excel to write a "program", if you will, for the Black-Scholes pricing model in Excel. First, we will lay out the input data given to us in the setup of the problem. Key Inputs: Key output: Ve = FRF t (in years) Now, we will use the formula from above to solve for dy. Having solved for d, we will now use this value to find dz. (d2) At this point, we have all of the necessary inputs for solving for the value of the call option. We will use the formula for V from above to find the value. The only complication arises when entering N(d1) and N(d2). Remember, these are the areas under the standard normal distribution. Luckily, Excel is equipped with a function that can determine cumulative probabilities of the normal distribution. This function is located in the list of statistical functions, as "NORMSDIST". For both N(d1) and N(d2), we will follow the same procedure of using this function in the value formula. Function Arguments NORMEDEST z D2s4 - 0.481946784 0.60507125 The function is avalable for compatbity with Excel 2007 and earler. Retuns the standard normal aumulatve detrbuton (has a mean of zero and a standard deviation of one). Z she value for whch you want the dstrbution. Formua result - 0.685078125 tele on t uncton OK Cancel Using the NORMSDIST function: N(d,) - O-NORMSDIST(4,) N(da) - O-NORMSDIST(d2) Using the Black-Scholes formula and the cumulative distributions, we can solve for the option value. Ve =

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Since No data has been givenin questions So calculated on the assumed data Input Data Stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started