Looking for answer to Problem 2.49 in the Cost Management 2nd Edition Textbook

Looking for answer to Problem 2.49 in the Cost Management 2nd Edition Textbook

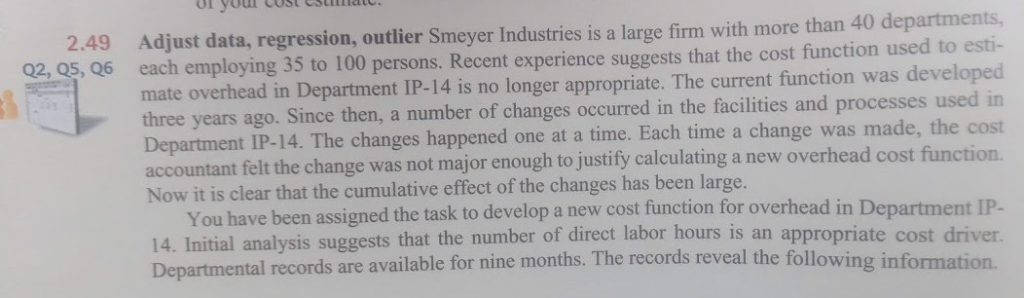

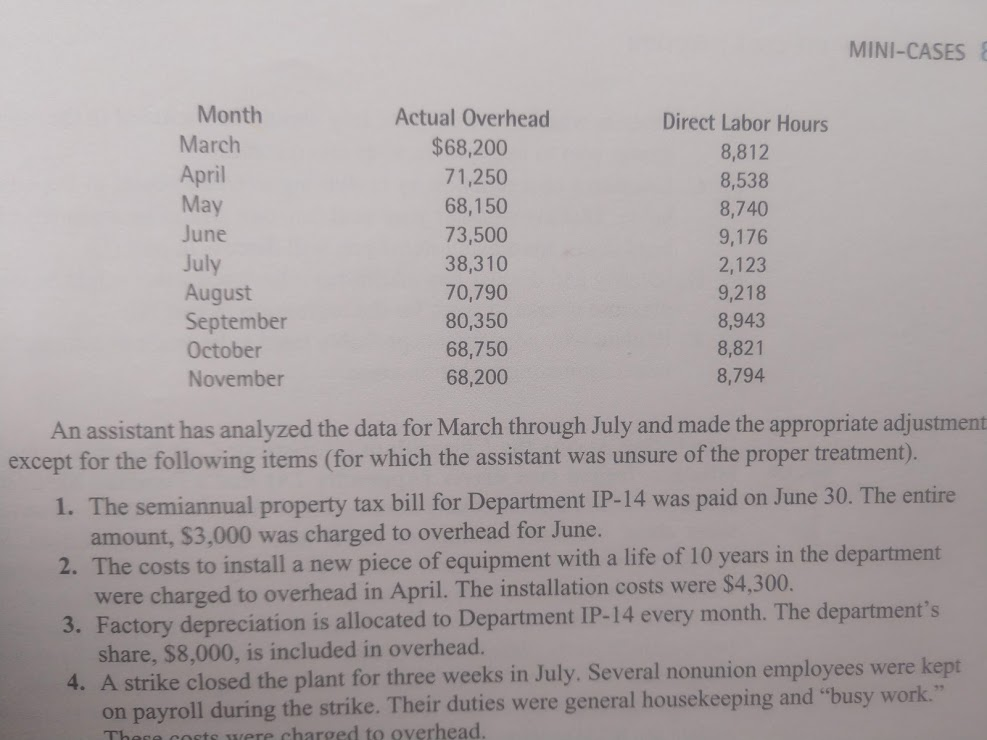

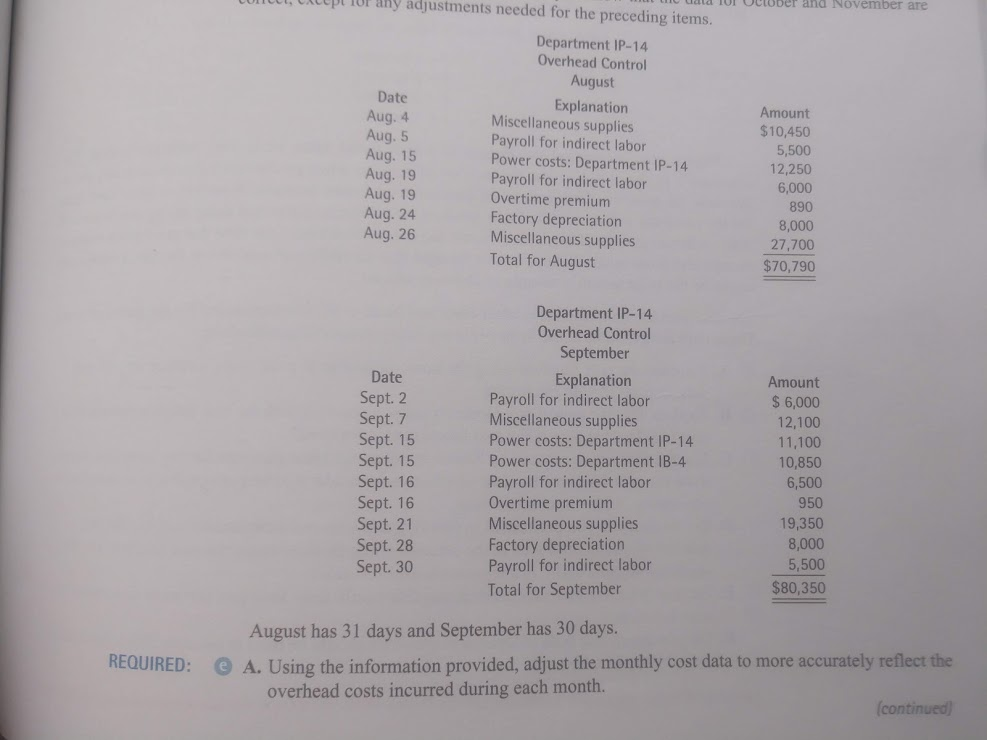

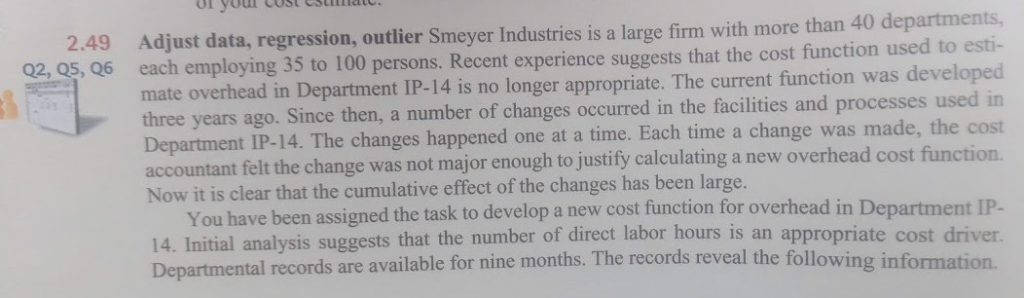

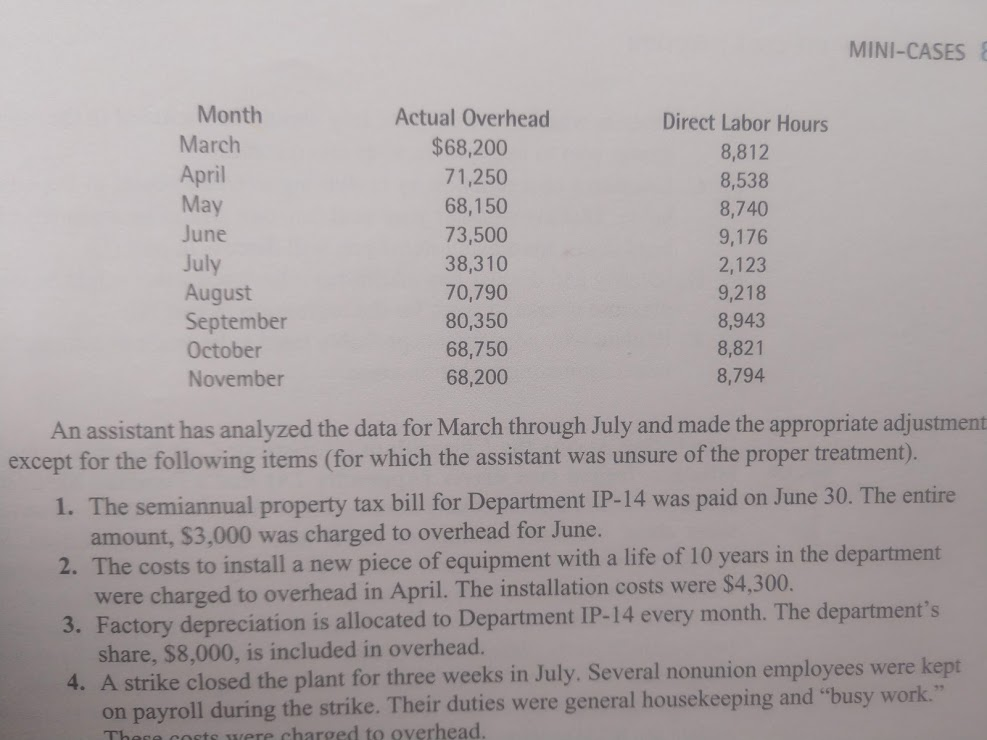

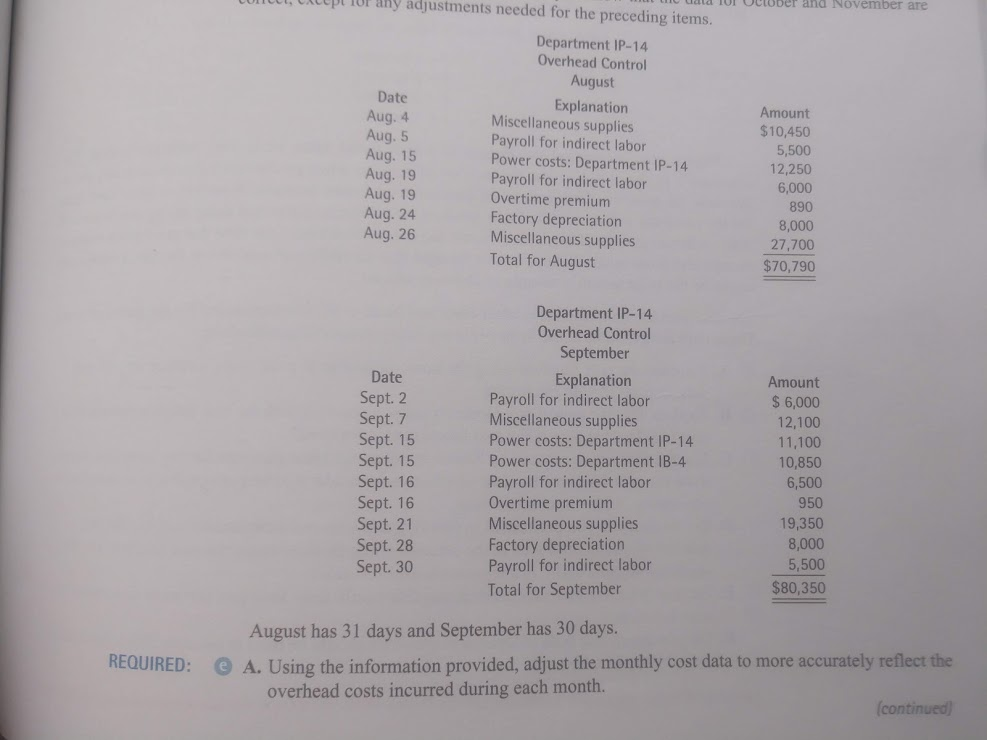

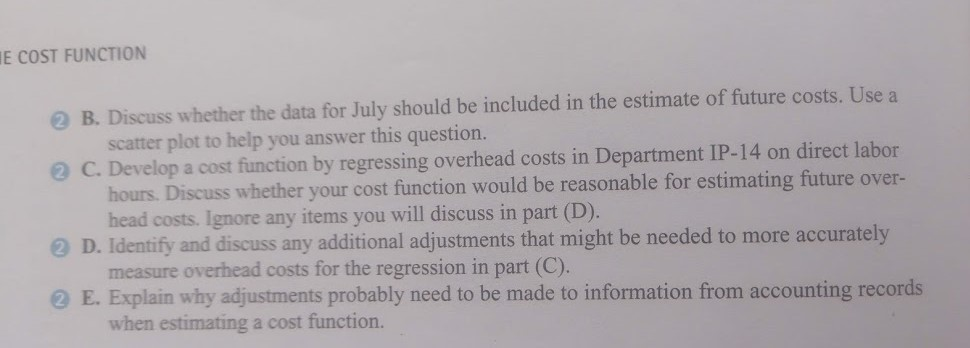

l youl cust estmat 2.49 02, 05, Q6 Adjust data, regression, outlier Smeyer Industries is a large firm with more than 40 departments, h employing 35 to 100 persons. Recent experience suggests that the cost function used to esti- mate overhead in Department IP-14 is no longer appropriate. The current function was developed ses used in eac three years ago. Since then, a number of changes occurred in the facilities and proces Department IP-14. The changes happened one at a time. Each time a change was made, the cost verhead cost function. accountant felt the change was not major enough to justify calculating a new o Now it is clear that the cumulative effect of the changes has been large. You have been assigned the task to develop a new cost function for overhead in Department IP- 14. Initial analysis suggests that the number of direct labor hours is an appropriate cost driver ental records are available for nine months. The records reveal the following information MINI-CASES Month March April May June July August September October November Actual Overhead $68,200 71,250 68,150 73,500 38,310 70,790 80,350 68,750 68,200 Direct Labor Hours 8,812 8,538 8,740 9,176 2,123 9,218 8,943 8,821 8,794 An assistant has analyzed the data for March through July and made the appropriate adjustment except for the following items (for which the assistant was unsure of the proper treatment). 1. The semiannual property tax bill for Department IP-14 was paid on June 30. The entire 2. The costs to install a new piece of equipment with a life of 10 years in the department 3. Factory depreciation is allocated to Department IP-14 every month. The department 4. A strike closed the plant for three weeks in July. Several nonunion employees were kept amount, $3,000 was charged to overhead for June. were charged to overhead in April. The installation costs were $4,300. share, $8,000, is included in overhead. on payroll during the strike. Their duties were general housekeeping and "busy work. These costs were charged to overhead. Jl Tor aRY adjustments needed for the preceding items. ta lol OCober and November are Department IP-14 Overhead Control August Explanation Date Aug. 4 Aug. 5 Aug. 15 Aug. 19 Aug. 19 Aug. 24 Aug. 26 Miscellaneous supplies Payroll for indirect labor Power costs: Department IP-14 Payroll for indirect labor Overtime premium Factory depreciation Miscellaneous supplies Total for August Amount $10,450 5,500 12,250 6,000 890 8,000 27,700 $70,790 Department IP-14 Overhead Control September Explanation Date Sept. 2 Sept. 7 Sept. 15 Sept. 15 Sept. 16 Sept. 16 Sept. 21 Sept. 28 Sept. 30 Payroll for indirect labor Miscellaneous supplies Power costs: Department IP-14 Power costs: Department IB-4 Payroll for indirect labor Overtime premium Miscellaneous supplies Factory depreciation Payroll for indirect labor Total for September Amount $6,000 12,100 11,100 10,850 6,500 950 19,350 8,000 5,500 $80,350 August has 31 days and September has 30 days. REQUIRED: A. Using the information provided, adjust the monthly cost data to overhead costs incurred during each month. continued E COST FUNCTION 2 B. Discuss whether the data for July should be included in the estimate of future costs. Use a 2 C. Develop a cost function by regressing overhead costs in Department IP-14 on direct labor 2 D. Identify and discuss any additional adjustments that might be needed to more accurately 2 E. Explain why adjustments probably need to be made to information from accounting records scatter plot to help you answer this question. hours. Discuss whether your cost function would be reasonable for estimating future over- head costs. Ignore any items you will discuss in part (D). measure overhead costs for the regression in part (C). when estimating a cost function. l youl cust estmat 2.49 02, 05, Q6 Adjust data, regression, outlier Smeyer Industries is a large firm with more than 40 departments, h employing 35 to 100 persons. Recent experience suggests that the cost function used to esti- mate overhead in Department IP-14 is no longer appropriate. The current function was developed ses used in eac three years ago. Since then, a number of changes occurred in the facilities and proces Department IP-14. The changes happened one at a time. Each time a change was made, the cost verhead cost function. accountant felt the change was not major enough to justify calculating a new o Now it is clear that the cumulative effect of the changes has been large. You have been assigned the task to develop a new cost function for overhead in Department IP- 14. Initial analysis suggests that the number of direct labor hours is an appropriate cost driver ental records are available for nine months. The records reveal the following information MINI-CASES Month March April May June July August September October November Actual Overhead $68,200 71,250 68,150 73,500 38,310 70,790 80,350 68,750 68,200 Direct Labor Hours 8,812 8,538 8,740 9,176 2,123 9,218 8,943 8,821 8,794 An assistant has analyzed the data for March through July and made the appropriate adjustment except for the following items (for which the assistant was unsure of the proper treatment). 1. The semiannual property tax bill for Department IP-14 was paid on June 30. The entire 2. The costs to install a new piece of equipment with a life of 10 years in the department 3. Factory depreciation is allocated to Department IP-14 every month. The department 4. A strike closed the plant for three weeks in July. Several nonunion employees were kept amount, $3,000 was charged to overhead for June. were charged to overhead in April. The installation costs were $4,300. share, $8,000, is included in overhead. on payroll during the strike. Their duties were general housekeeping and "busy work. These costs were charged to overhead. Jl Tor aRY adjustments needed for the preceding items. ta lol OCober and November are Department IP-14 Overhead Control August Explanation Date Aug. 4 Aug. 5 Aug. 15 Aug. 19 Aug. 19 Aug. 24 Aug. 26 Miscellaneous supplies Payroll for indirect labor Power costs: Department IP-14 Payroll for indirect labor Overtime premium Factory depreciation Miscellaneous supplies Total for August Amount $10,450 5,500 12,250 6,000 890 8,000 27,700 $70,790 Department IP-14 Overhead Control September Explanation Date Sept. 2 Sept. 7 Sept. 15 Sept. 15 Sept. 16 Sept. 16 Sept. 21 Sept. 28 Sept. 30 Payroll for indirect labor Miscellaneous supplies Power costs: Department IP-14 Power costs: Department IB-4 Payroll for indirect labor Overtime premium Miscellaneous supplies Factory depreciation Payroll for indirect labor Total for September Amount $6,000 12,100 11,100 10,850 6,500 950 19,350 8,000 5,500 $80,350 August has 31 days and September has 30 days. REQUIRED: A. Using the information provided, adjust the monthly cost data to overhead costs incurred during each month. continued E COST FUNCTION 2 B. Discuss whether the data for July should be included in the estimate of future costs. Use a 2 C. Develop a cost function by regressing overhead costs in Department IP-14 on direct labor 2 D. Identify and discuss any additional adjustments that might be needed to more accurately 2 E. Explain why adjustments probably need to be made to information from accounting records scatter plot to help you answer this question. hours. Discuss whether your cost function would be reasonable for estimating future over- head costs. Ignore any items you will discuss in part (D). measure overhead costs for the regression in part (C). when estimating a cost function

Looking for answer to Problem 2.49 in the Cost Management 2nd Edition Textbook

Looking for answer to Problem 2.49 in the Cost Management 2nd Edition Textbook