looking for some help with excel

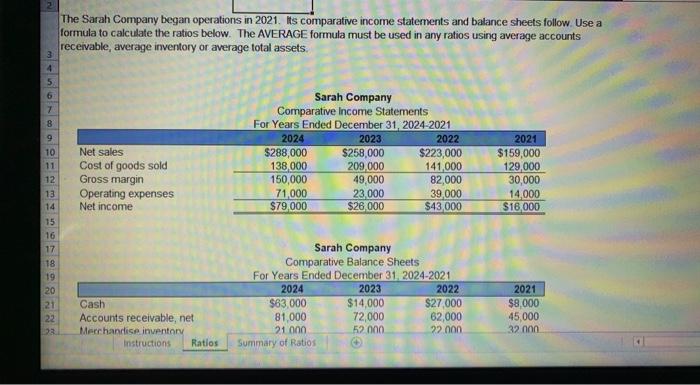

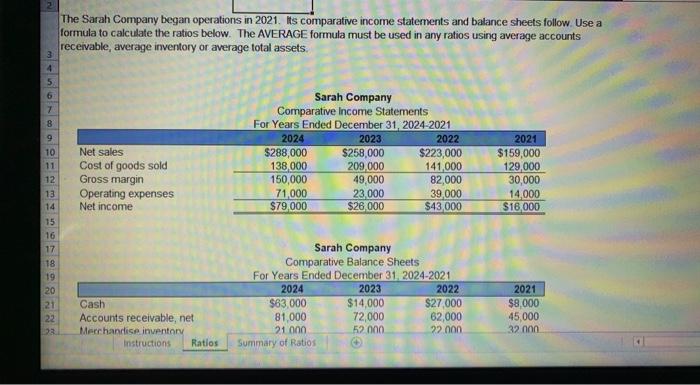

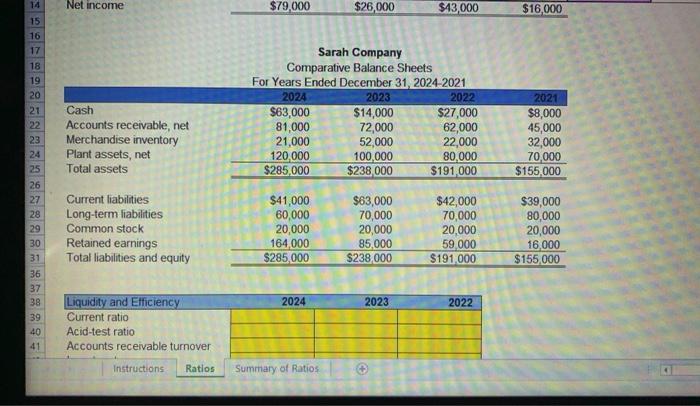

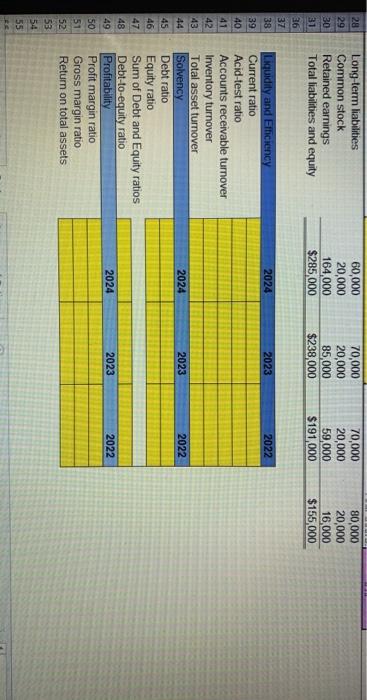

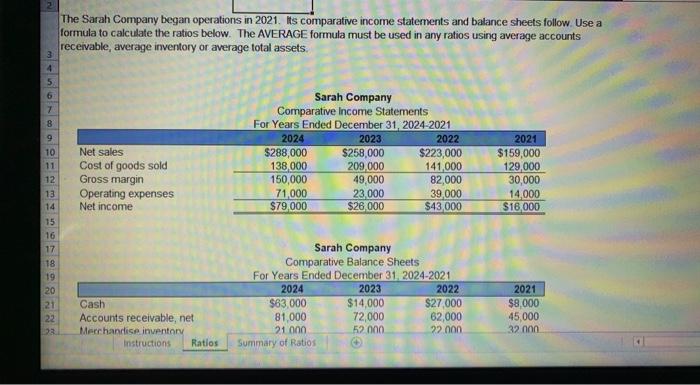

The Sarah Company began operations in 2021. Its comparative income statements and balance sheets follow. Use a formula to calculate the ratios below. The AVERAGE formula must be used in any ratios using average accounts receivable, average inventory or average total assets 3 4 5 6 7 8 9 10 11 12 13 Net sales Cost of goods sold Gross margin Operating expenses Net income Sarah Company Comparative Income Statements For Years Ended December 31, 2024-2021 2024 2023 2022 $288,000 $258,000 $223,000 138,000 209,000 141,000 150,000 49,000 82,000 71.000 23.000 39000 $79.000 $26.000 $43,000 2021 $159,000 129,000 30,000 14,000 $16,000 14 15 16 17 18 19 20 21 22 23 Sarah Company Comparative Balance Sheets For Years Ended December 31, 2024-2021 2024 2023 2022 $63,000 $14,000 $27,000 81,000 72,000 62,000 21 000 52.000 22.000 Summary of Ratios Cash Accounts receivable, net Merchandise inventory Instructions Ratios 2021 $8,000 45,000 32.000 Net income $79,000 $26,000 $13,000 $16.000 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 36 37 38 39 40 41 Cash Accounts receivable, net Merchandise inventory Plant assets, net Total assets Sarah Company Comparative Balance Sheets For Years Ended December 31, 2024 2021 2024 2023 2022 $63,000 $14,000 $27,000 81,000 72,000 62,000 21,000 52,000 22,000 120,000 100,000 80,000 $285.000 $238.000 $191,000 2021 $8,000 45,000 32,000 70,000 $155.000 Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and equity $41,000 60,000 20,000 164,000 $285,000 $63,000 70,000 20,000 85.000 $238 000 $42,000 70,000 20,000 59 000 $191,000 $39,000 80,000 20,000 16,000 $155,000 2024 2023 2022 Liquidity and Efficiency Current ratio Acid-test ratio Accounts receivable turnover Instructions Ratios Summary of Ratios 28 29 30 31 Long term liabilities Common stock Retained earnings Total liabilities and equity 60,000 20,000 164,000 $285,000 70,000 20,000 85,000 $238,000 70,000 20,000 59,000 $191,000 80,000 20,000 16,000 $155,000 2024 2023 2022 36 37 38 39 40 41 42 143 44 2024 2023 2022 45 46 47 48 Liquidity and Efficiency Current ratio Acid-test ratio Accounts receivable turnover Inventory turnover Total asset tumover Solvency Debt ratio Equity ratio Sum of Debt and Equity ratios Debt-to-equity ratio Profitability Profit margin ratio Gross margin ratio Return on total assets 2024 2023 2022 49 50 51 52 53 54 55