Question: K A B D E F G H 1 Part I: DCF Valuation 1 a. Use CAPM to find the required rate of return for

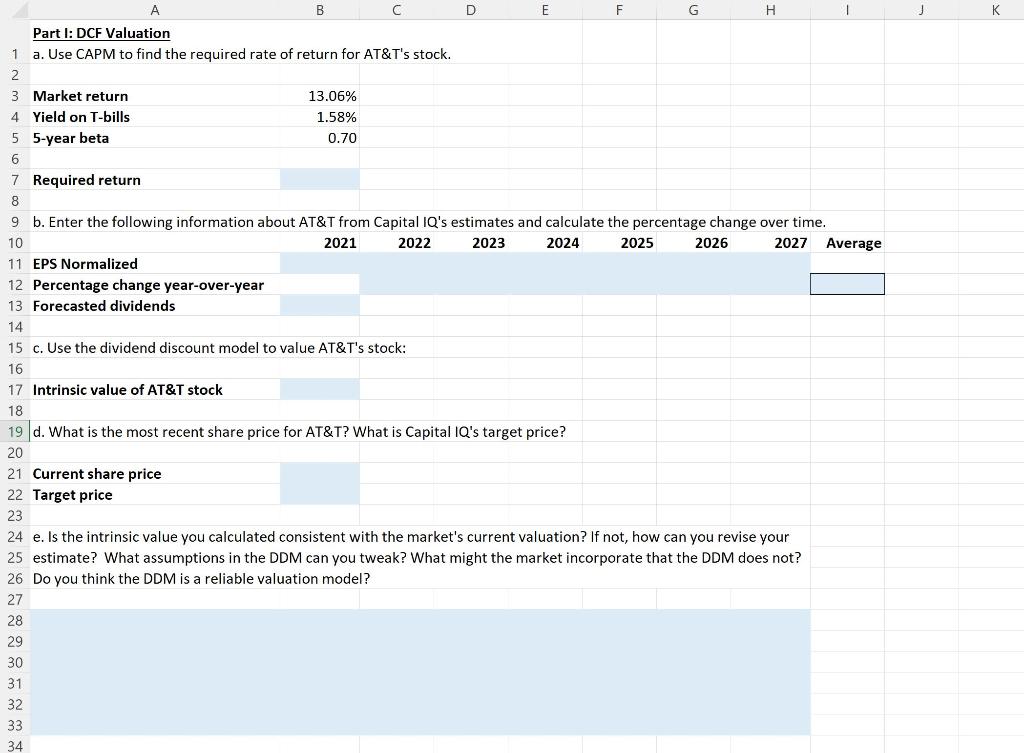

K A B D E F G H 1 Part I: DCF Valuation 1 a. Use CAPM to find the required rate of return for AT&T's stock. 2 3 Market return 13.06% 4 Yield on T-bills 1.58% 5 5-year beta 0.70 6 7 Required return 8 9 b. Enter the following information about AT&T from Capital IQ's estimates and calculate the percentage change over time. 10 2021 2022 2023 2024 2025 2026 2027 Average 11 EPS Normalized 12 Percentage change year-over-year 13 Forecasted dividends 14 15 c. Use the dividend discount model to value AT&T's stock: 16 17 Intrinsic value of AT&T stock 18 19 d. What is the most recent share price for AT&T? What is Capital IQ's target price? 20 21 Current share price 22 Target price 23 24 e. Is the intrinsic value you calculated consistent with the market's current valuation? If not, how can you revise your 25 estimate? What assumptions in the DDM can you tweak? What might the market incorporate that the DDM does not? 26 Do you think the DDM is a reliable valuation model? 27 28 29 30 31 32 33 34 K A B D E F G H 1 Part I: DCF Valuation 1 a. Use CAPM to find the required rate of return for AT&T's stock. 2 3 Market return 13.06% 4 Yield on T-bills 1.58% 5 5-year beta 0.70 6 7 Required return 8 9 b. Enter the following information about AT&T from Capital IQ's estimates and calculate the percentage change over time. 10 2021 2022 2023 2024 2025 2026 2027 Average 11 EPS Normalized 12 Percentage change year-over-year 13 Forecasted dividends 14 15 c. Use the dividend discount model to value AT&T's stock: 16 17 Intrinsic value of AT&T stock 18 19 d. What is the most recent share price for AT&T? What is Capital IQ's target price? 20 21 Current share price 22 Target price 23 24 e. Is the intrinsic value you calculated consistent with the market's current valuation? If not, how can you revise your 25 estimate? What assumptions in the DDM can you tweak? What might the market incorporate that the DDM does not? 26 Do you think the DDM is a reliable valuation model? 27 28 29 30 31 32 33 34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts