Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Looking for the answers to the empty blue boxes. Please enter your Number (including the V) to begin the project. You are responsible for filling

Looking for the answers to the empty blue boxes.

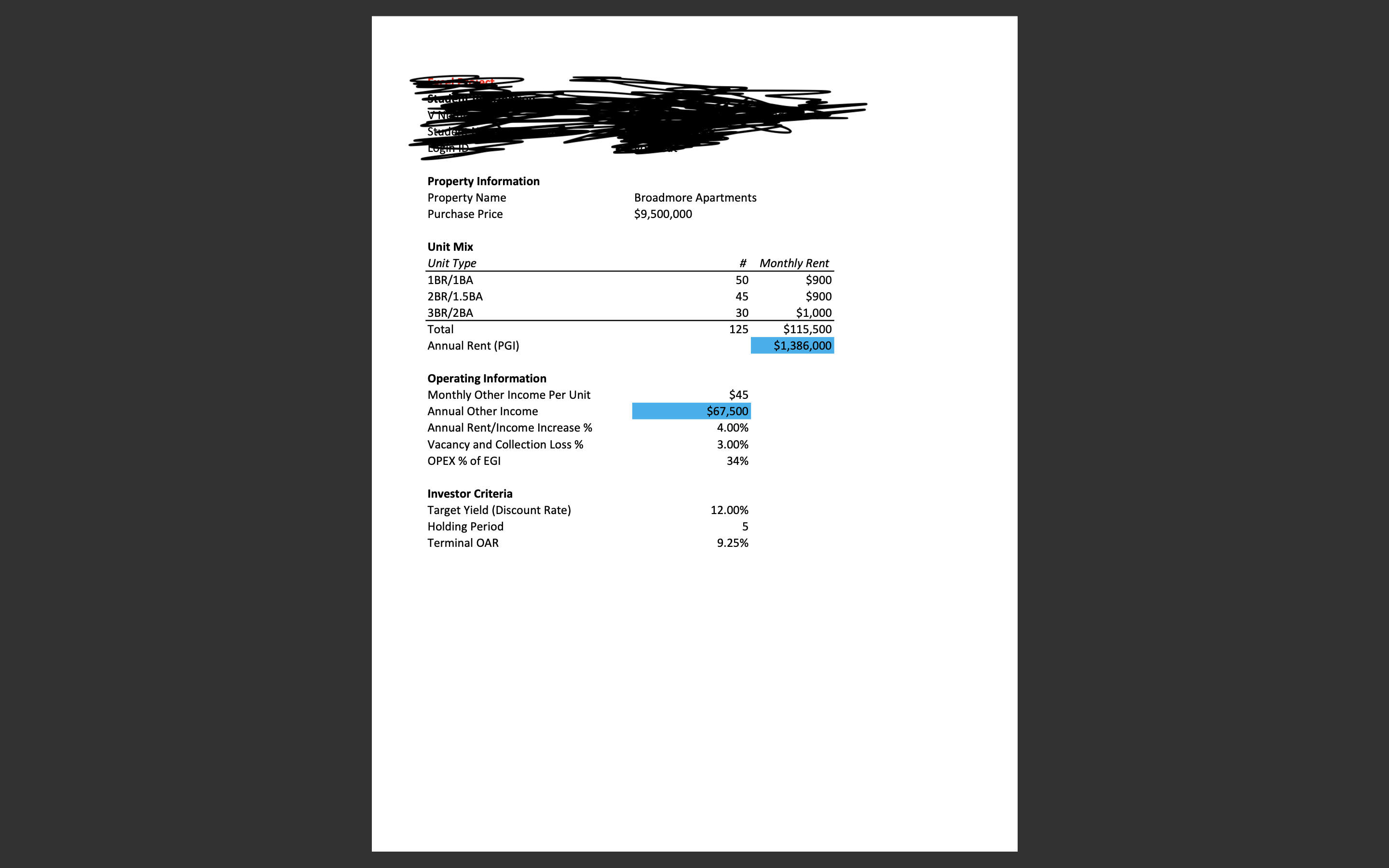

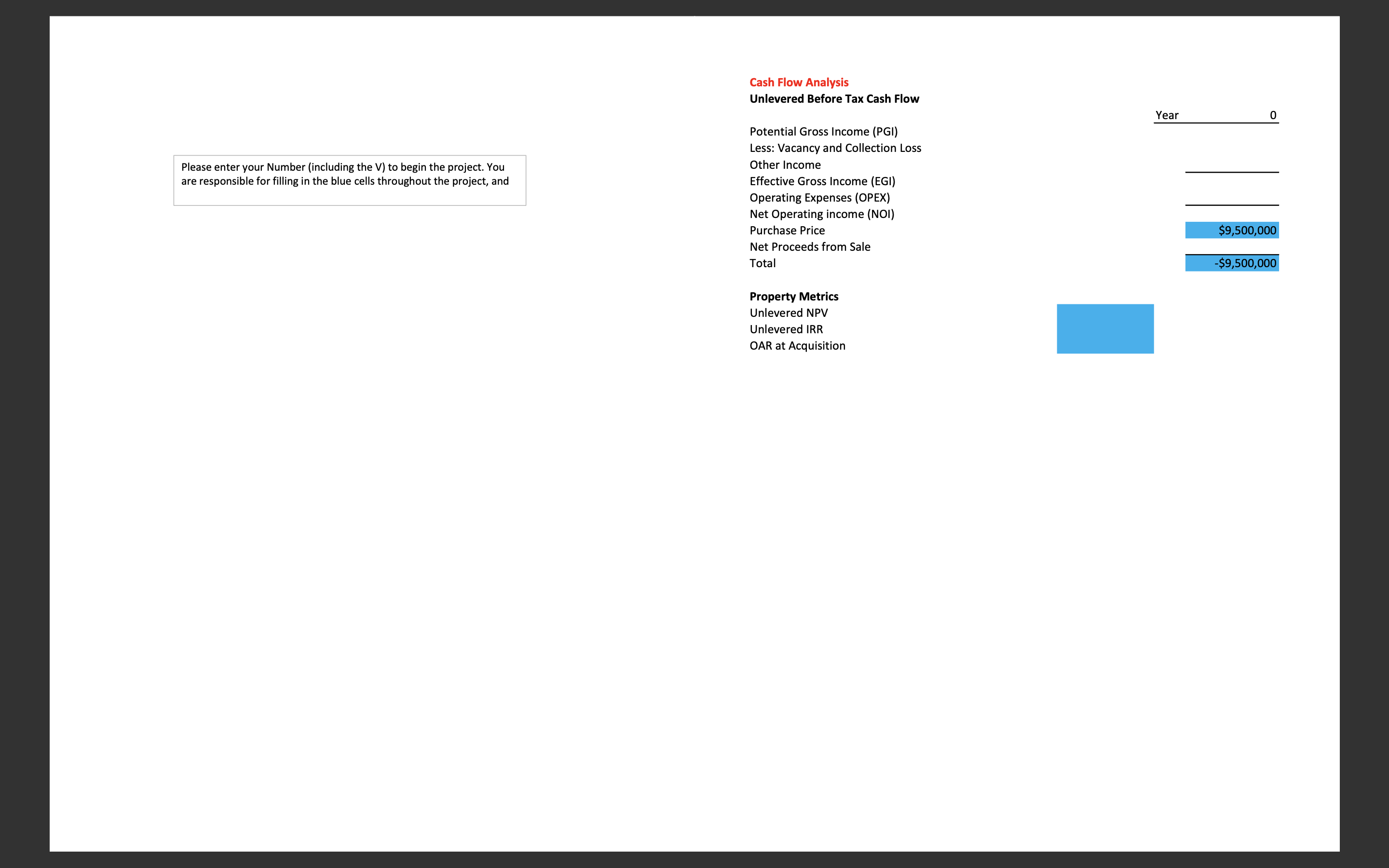

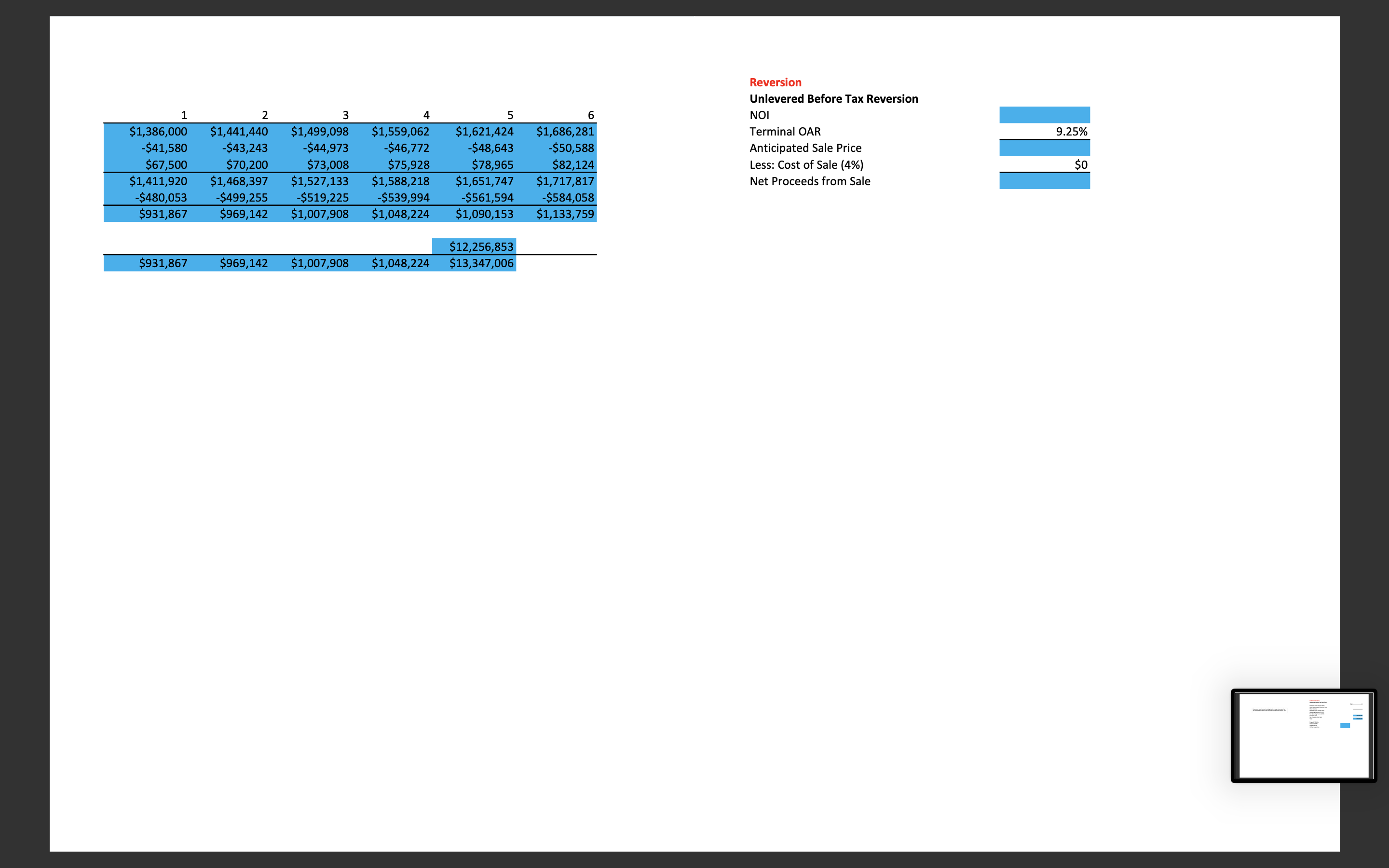

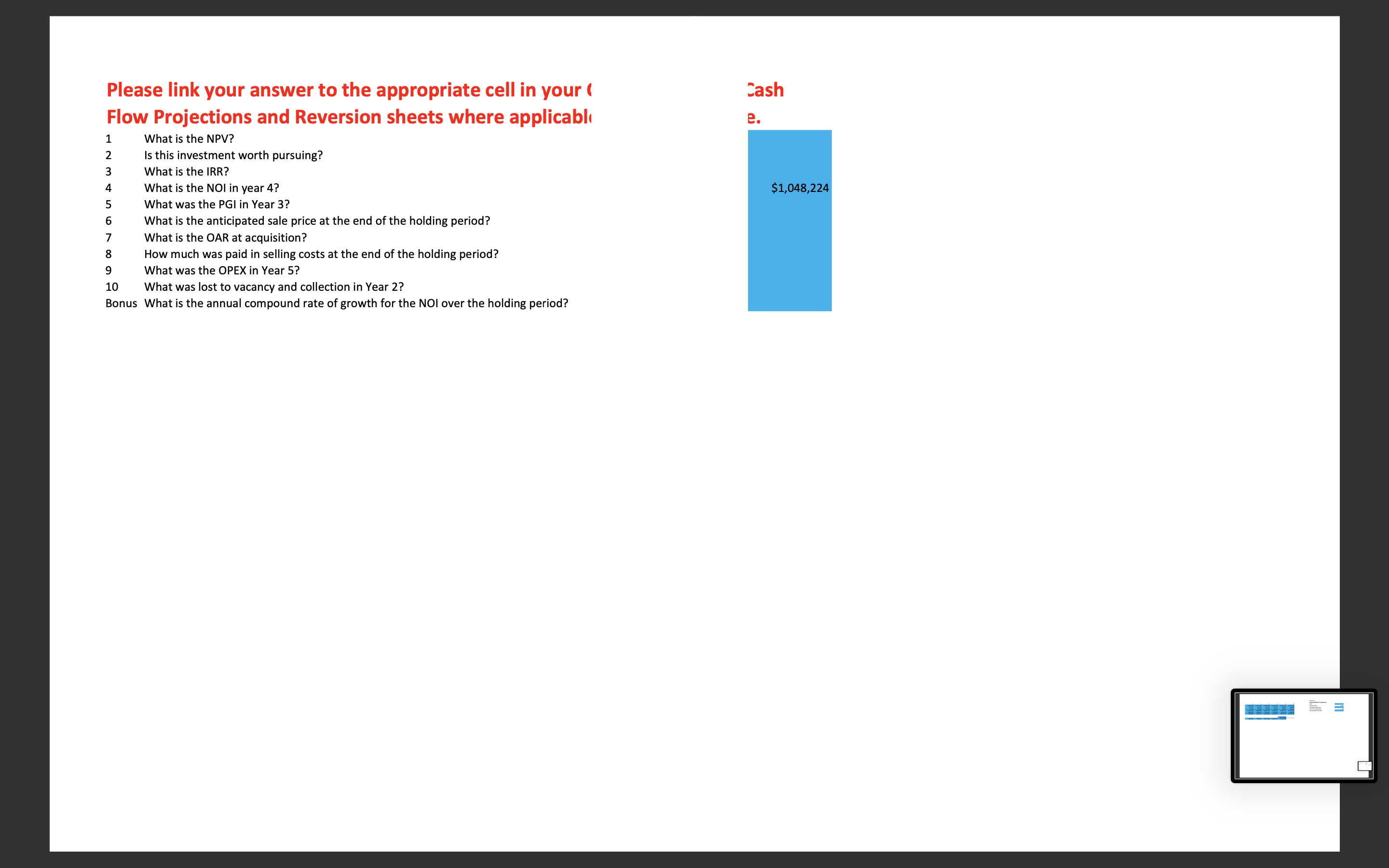

Please enter your Number (including the V) to begin the project. You are responsible for filling in the blue cells throughout the project, and Reversion Unlevered Before Tax Reversion NOI Terminal OAR Anticipated Sale Price Less: Cost of Sale (4\%) Net Proceeds from Sale Please link your answer to the appropriate cell in your 1 Flow Projections and Reversion sheets where applicabl 12345678910WhatistheNPV?Isthisinvestmentworthpursuing?WhatistheIRR?WhatistheNOIinyear4?WhatwasthePGIinYear3?Whatistheanticipatedsalepriceattheendoftheholdingperiod?WhatistheOARatacquisition?Howmuchwaspaidinsellingcostsattheendoftheholdingperiod?WhatwastheOPEXinYear5?WhatwaslosttovacancyandcollectioninYear2? What is the NPV? Is this investment worth pursuing? What is the IRR? What is the NOI in year 4 ? What was the PGI in Year 3? What is the anticipated sale price at the end of the holding period? What is the OAR at acquisition? How much was paid in selling costs at the end of the holding period? What was the OPEX in Year 5? What was lost to vacancy and collection in Year 2? Bonus What is the annual compound rate of growth for the NOI over the holding period? Please enter your Number (including the V) to begin the project. You are responsible for filling in the blue cells throughout the project, and Reversion Unlevered Before Tax Reversion NOI Terminal OAR Anticipated Sale Price Less: Cost of Sale (4\%) Net Proceeds from Sale Please link your answer to the appropriate cell in your 1 Flow Projections and Reversion sheets where applicabl 12345678910WhatistheNPV?Isthisinvestmentworthpursuing?WhatistheIRR?WhatistheNOIinyear4?WhatwasthePGIinYear3?Whatistheanticipatedsalepriceattheendoftheholdingperiod?WhatistheOARatacquisition?Howmuchwaspaidinsellingcostsattheendoftheholdingperiod?WhatwastheOPEXinYear5?WhatwaslosttovacancyandcollectioninYear2? What is the NPV? Is this investment worth pursuing? What is the IRR? What is the NOI in year 4 ? What was the PGI in Year 3? What is the anticipated sale price at the end of the holding period? What is the OAR at acquisition? How much was paid in selling costs at the end of the holding period? What was the OPEX in Year 5? What was lost to vacancy and collection in Year 2? Bonus What is the annual compound rate of growth for the NOI over the holding period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started