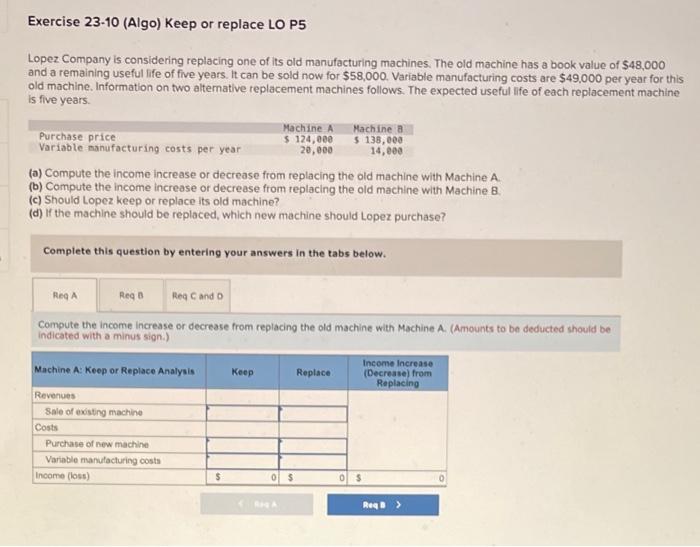

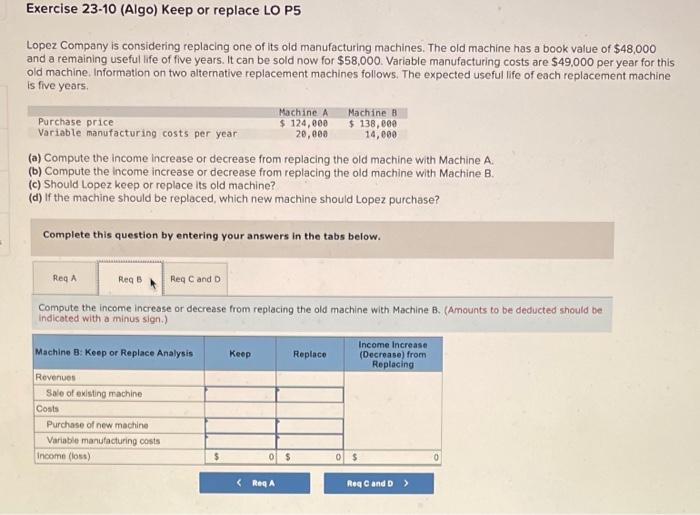

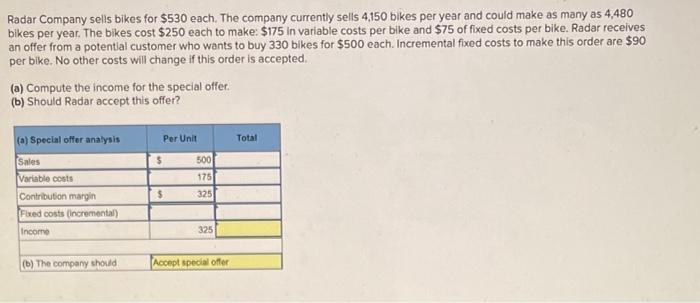

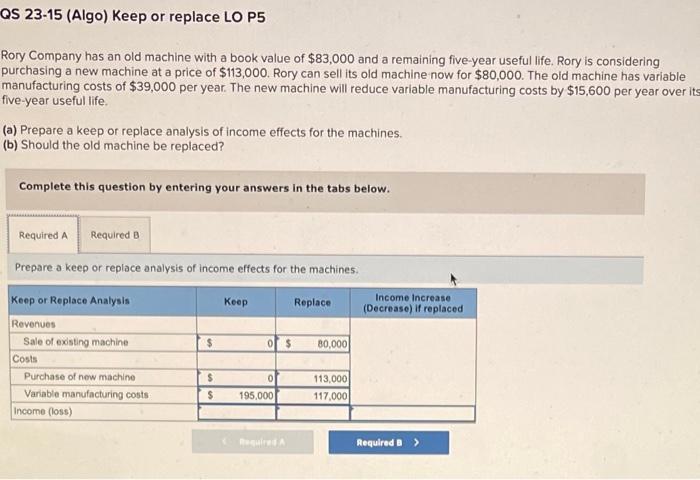

Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $48,000 and a remaining useful life of five years. It can be sold now for $58,000. Variable manufacturing costs are $49,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machine 8 (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase? Complete this question by entering your answers in the tabs below. Compute the income increase or decrease from replacing the old machine with Machine A. (Amounts to be deducted should be indicated with a minus sign.) Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $48,000 and a remaining useful life of five years. It can be sold now for $58,000. Variable manufacturing costs are $49,000 per year for this old machine, Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase? Complete this question by entering your answers in the tabs below. Compute the income increase or decrease from replacing the old machine with Machine B. (Amounts to be deducted should be indicoted with a minus sign.) Radar Company sells bikes for $530 each. The company currently sells 4,150 bikes per year and could make as many as 4,480 bikes per year. The bikes cost $250 each to make: $175 in variable costs per bike and $75 of fixed costs per bike. Radar receives an offer from a potential customer who wants to buy 330 bikes for $500 each. Incremental fixed costs to make this order are $90 per bike. No other costs will change if this order is accepted. (a) Compute the income for the special offer. (b) Should Radar accept this offer? Rory Company has an old machine with a book value of $83,000 and a remaining five-year useful life. Rory is considering purchasing a new machine at a price of $113,000. Rory can sell its old machine now for $80,000. The oid machine has variable manufacturing costs of $39,000 per year. The new machine will reduce variable manufacturing costs by $15,600 per year over it five-year useful life. (a) Prepare a keep or replace analysis of income effects for the machines. (b) Should the old machine be replaced? Complete this question by entering your answers in the tabs below. Prepare a keep or replace analysis of income effects for the machines