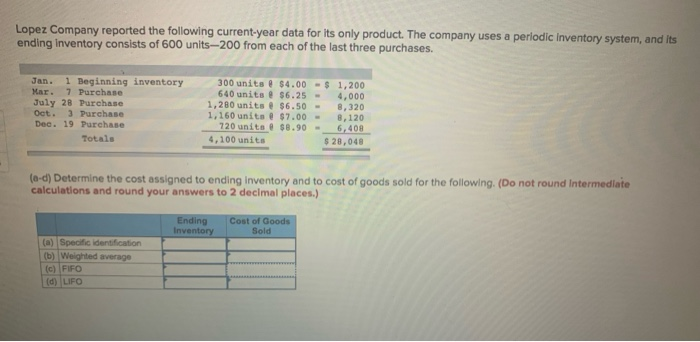

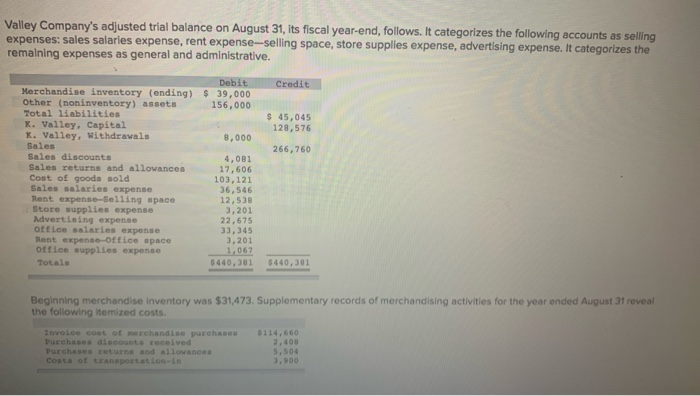

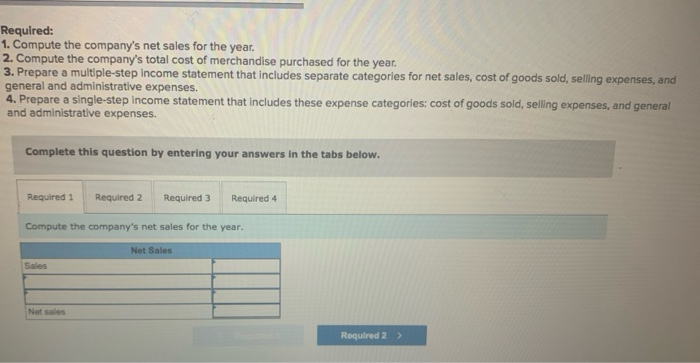

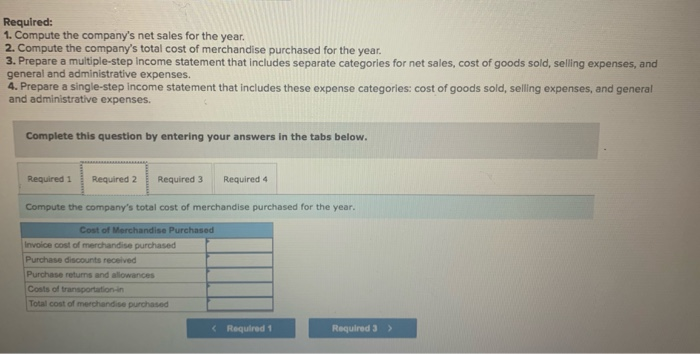

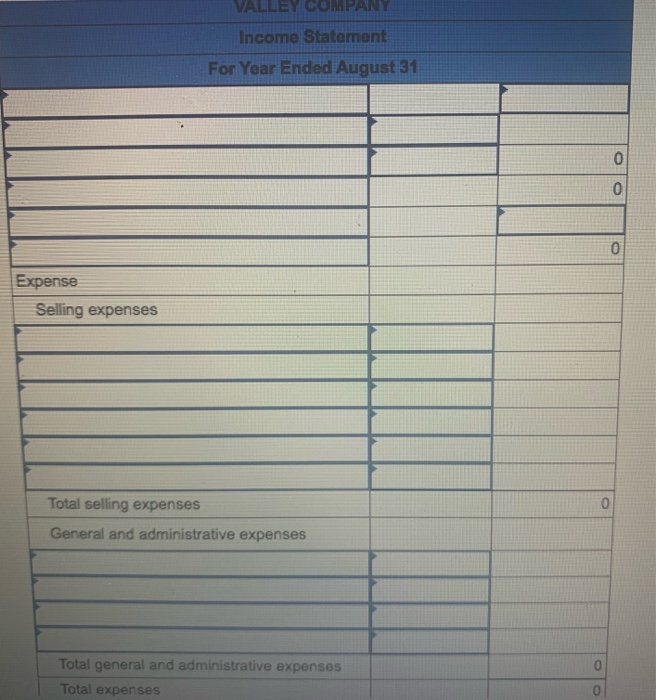

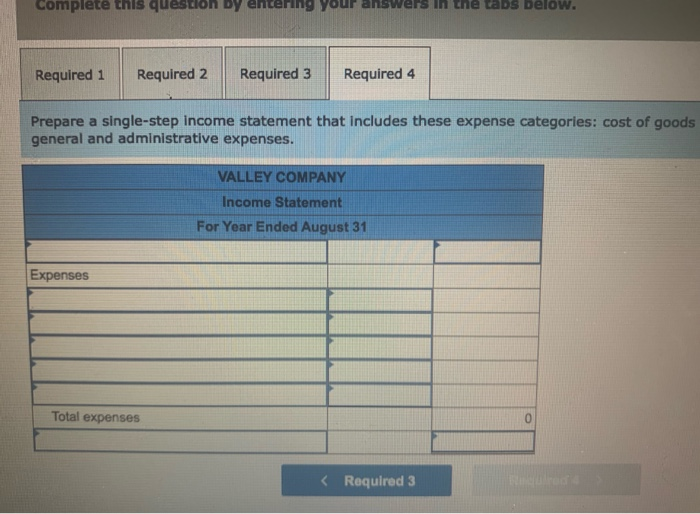

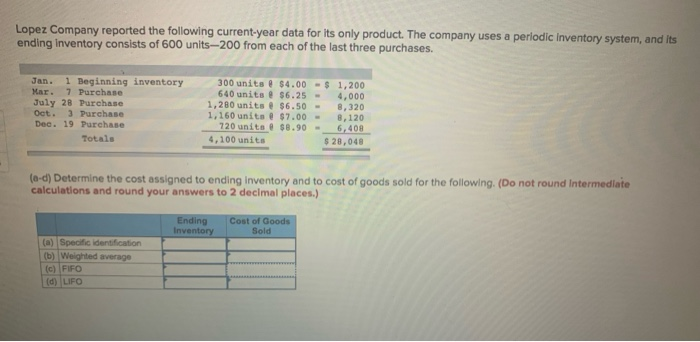

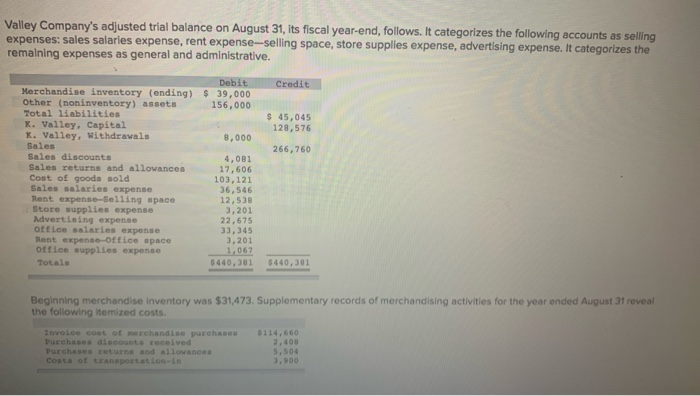

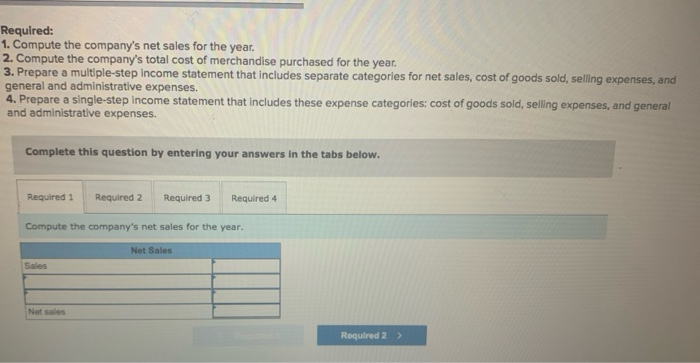

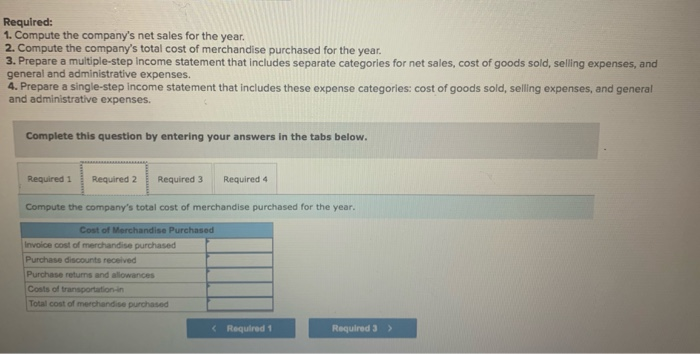

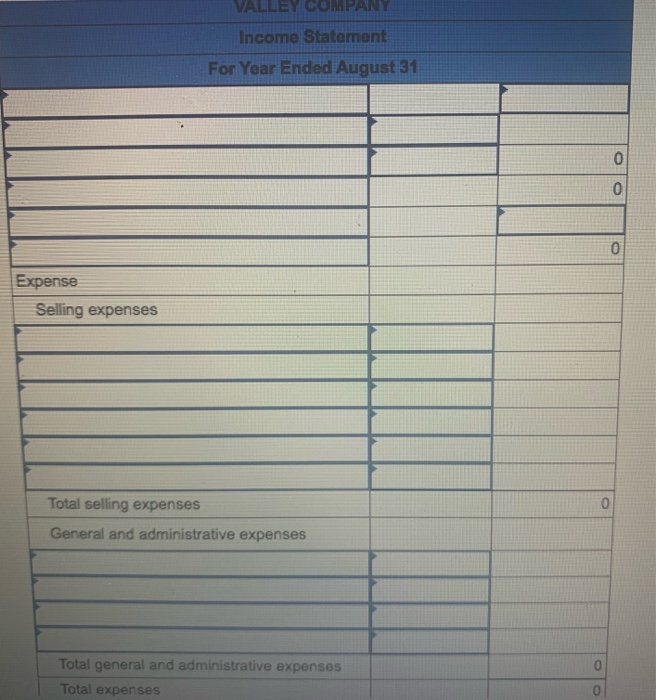

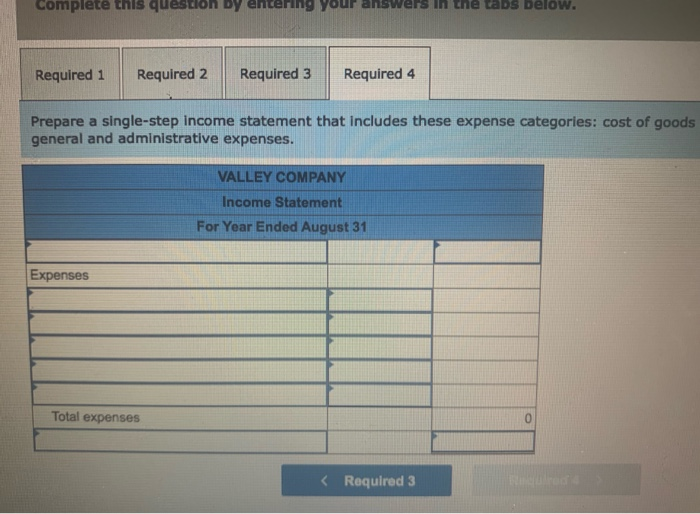

Lopez Company reported the following current-year data for its only product. The company uses a periodic Inventory system, and its ending Inventory consists of 600 units--200 from each of the last three purchases. Jan. 1 Beginning inventory Mar. 7 Purchase July 28 Purchase Oct. 3 Purchase Dec. 19 Purchase Totals 300 units $4.00 - $ 1,200 640 units @ $6.25 4,000 1,280 units $6.50 8,320 1,160 units @ $7.00 - 8,120 720 units @ $8.90 - 6,408 4,100 units $ 28,048 (-d) Determine the cost assigned to ending inventory and to cost of goods sold for the following. (Do not round Intermediate calculations and round your answers to 2 decimal places.) Ending ventory Cost of Goods Sold (a) Specific identification (b) Weighted average (c) FIFO (d) LIFO Valley Company's adjusted trial balance on August 31, its fiscal year-end, follows. It categorizes the following accounts as seling expenses: sales salaries expense, rent expense-selling space, store supplies expense, advertising expense. It categorizes the remaining expenses as general and administrative. Credit $ 45,045 128,576 266,760 Debit Merchandise inventory (ending) $ 39,000 Other (noninventory) assets 156,000 Total liabilities K. Valley, Capital K. Valley, Withdrawals 8,000 Sales Sales discounts 4,081 Sales returns and allowances 17,606 Cost of goods sold 103,121 Sales salaries expense 36,546 Rent expense-Selling space 12,538 Store supplies expense 3,201 Advertising expense 22,675 office salaries expense 33, 345 Rent expense-office space 3,201 ottice supplies expense 1,062 Totale $440,301 $440,301 Beginning merchandise Inventory was $31,473. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs $114,660 2.400 Invoice cost of merchandise purchases Durchases discounts received Purchases returns and allowances Costs of transportation in 3.900 Required: 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the company's net sales for the year. Net Sales Sales Net sales Required 2 > Required: 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step Income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the company's total cost of merchandise purchased for the year. Cost of Merchandise Purchased Invoice cost of merchandise purchased Purchase discounts received Purchase returns and allowances Costs of transportation in Total cost of merchandise purchased VALLEY COMPANY Income Statement For Year Ended August 31 0 0 0 Expense Selling expenses 0 Total selling expenses General and administrative expenses Total general and administrative expenses Total expenses complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Prepare a single-step income statement that includes these expense categories: cost of goods general and administrative expenses. VALLEY COMPANY Income Statement For Year Ended August 31 Expenses Total expenses