Answered step by step

Verified Expert Solution

Question

1 Approved Answer

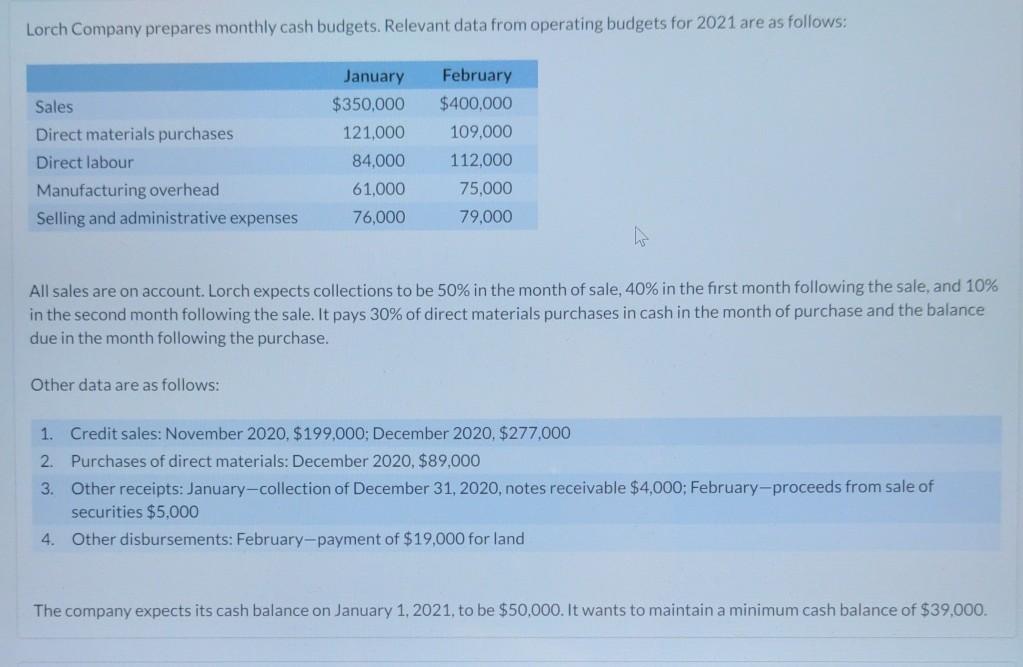

Lorch Company prepares monthly cash budgets. Relevant data from operating budgets for 2021 are as follows: Sales Direct materials purchases Direct labour Manufacturing overhead Selling

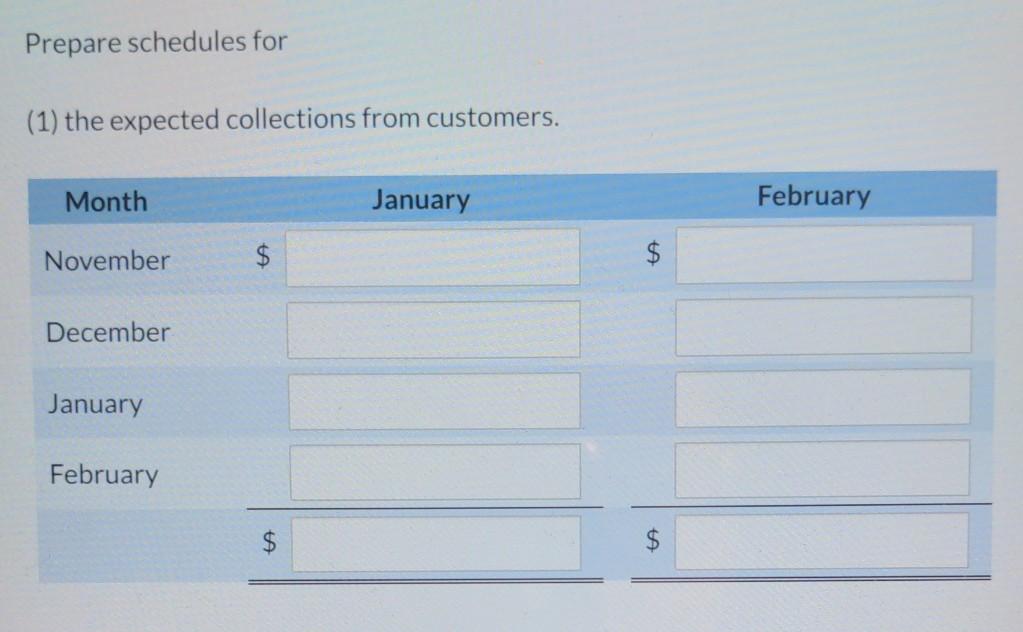

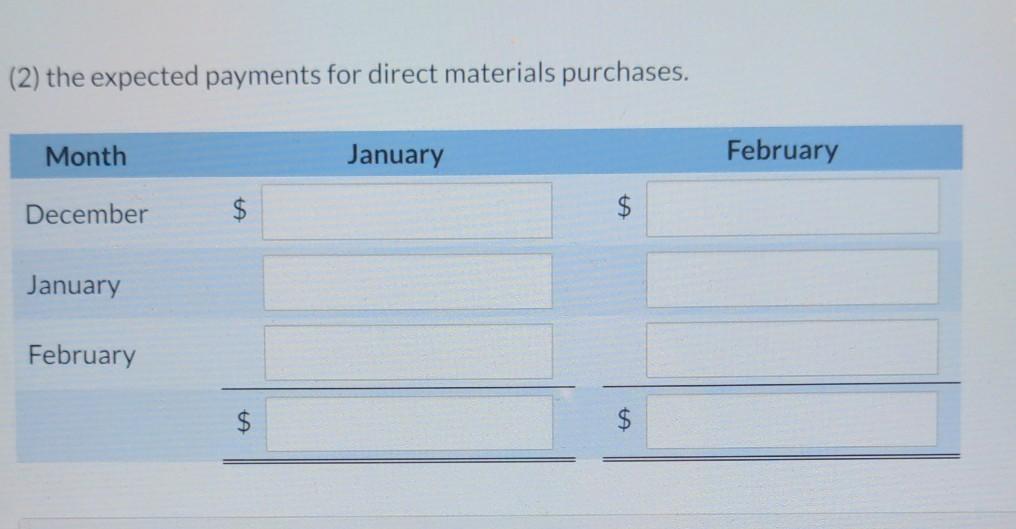

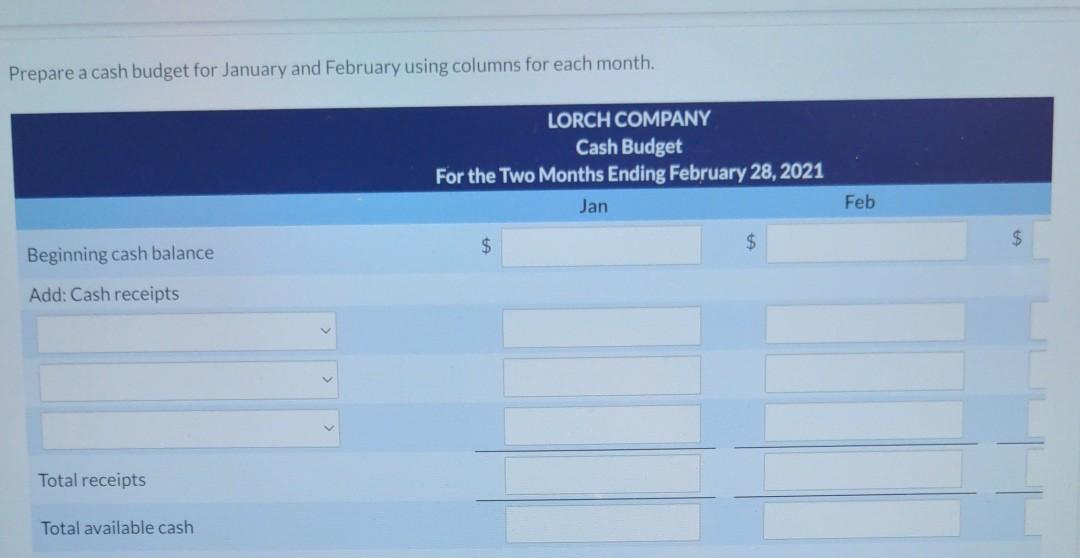

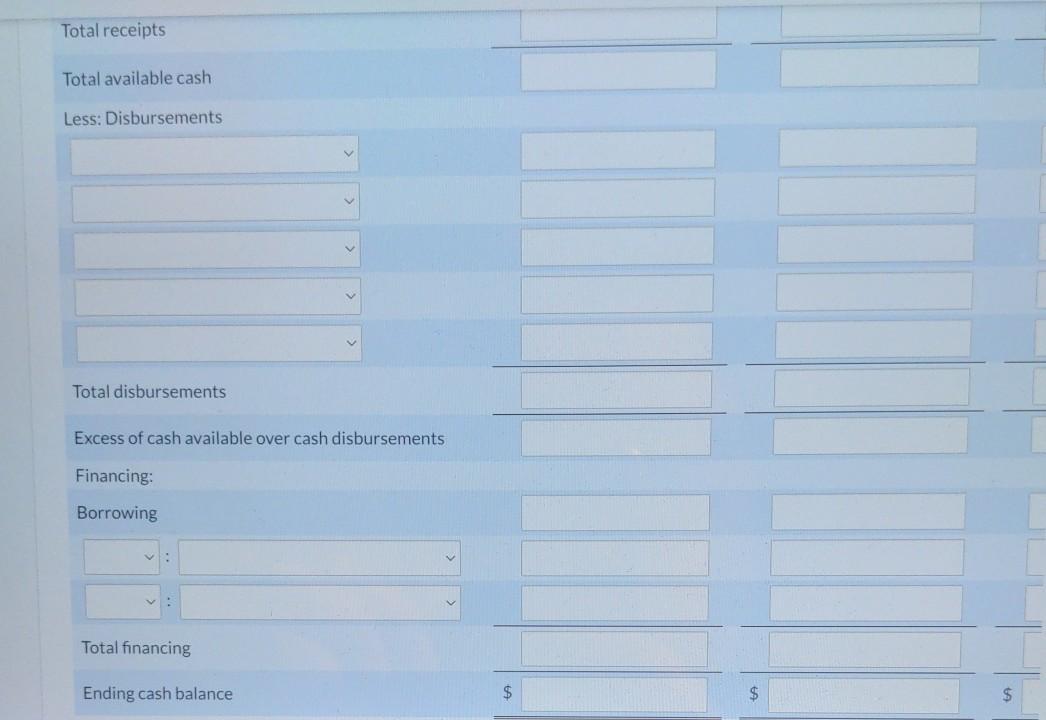

Lorch Company prepares monthly cash budgets. Relevant data from operating budgets for 2021 are as follows: Sales Direct materials purchases Direct labour Manufacturing overhead Selling and administrative expenses January $350,000 121,000 84.000 61.000 76,000 February $400,000 109,000 112,000 75,000 79,000 All sales are on account. Lorch expects collections to be 50% in the month of sale, 40% in the first month following the sale, and 10% in the second month following the sale. It pays 30% of direct materials purchases in cash in the month of purchase and the balance due in the month following the purchase. Other data are as follows: 1. Credit sales: November 2020, $199,000; December 2020, $277.000 2. Purchases of direct materials: December 2020, $89.000 3. Other receipts: January-collection of December 31, 2020, notes receivable $4,000; February-proceeds from sale of securities $5,000 4. Other disbursements: February-payment of $19,000 for land The company expects its cash balance on January 1, 2021, to be $50,000. It wants to maintain a minimum cash balance of $39,000. Prepare schedules for (1) the expected collections from customers. Month January February November $ $ December January February $ (2) the expected payments for direct materials purchases. Month January February December $ January February $ $ Prepare a cash budget for January and February using columns for each month. LORCH COMPANY Cash Budget For the Two Months Ending February 28, 2021 Jan Feb $ $ Beginning cash balance Add: Cash receipts Total receipts Total available cash Total receipts Total available cash Less: Disbursements Total disbursements Excess of cash available over cash disbursements Financing: Borrowing Total financing Ending cash balance $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started