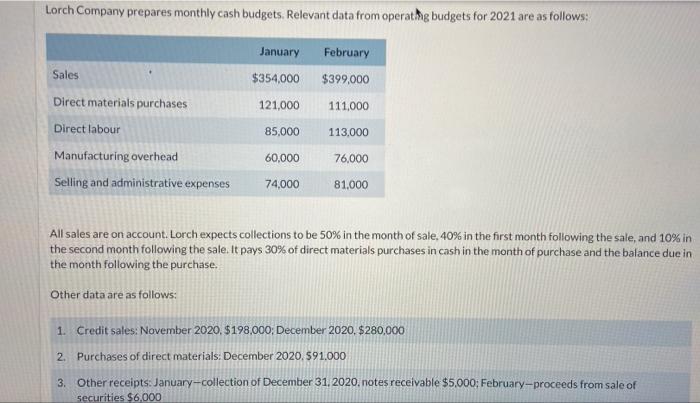

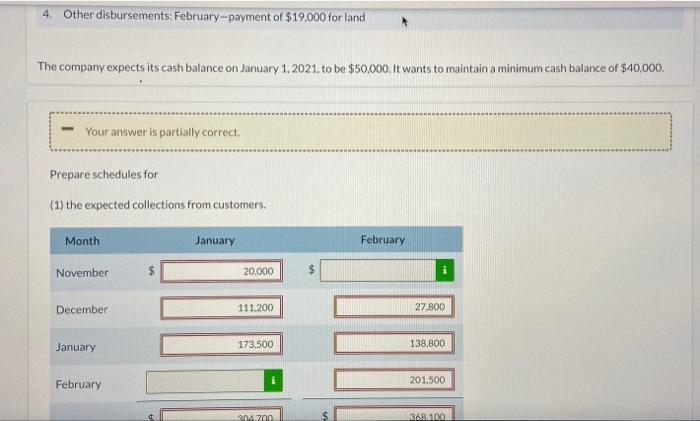

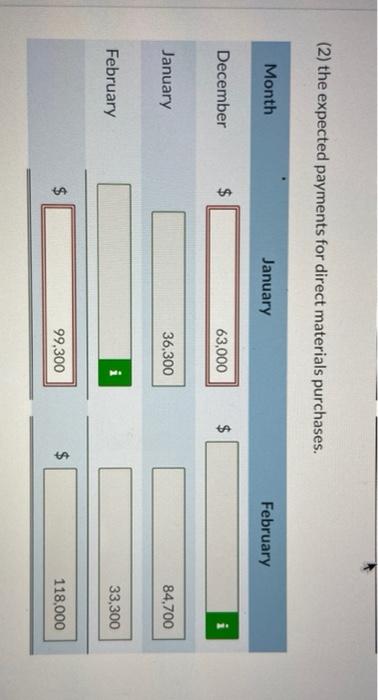

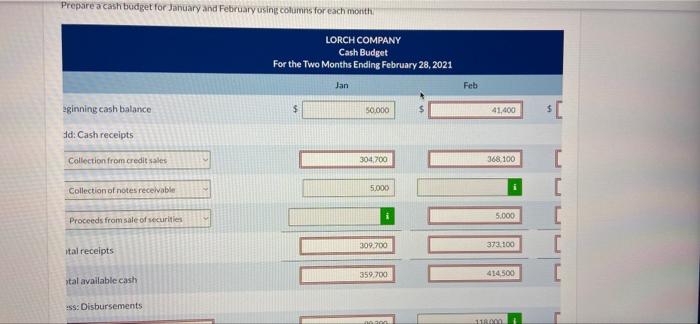

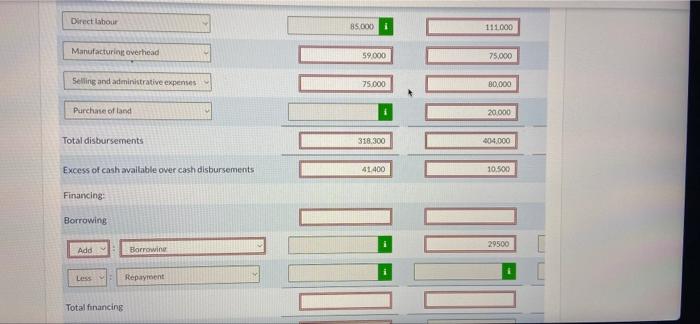

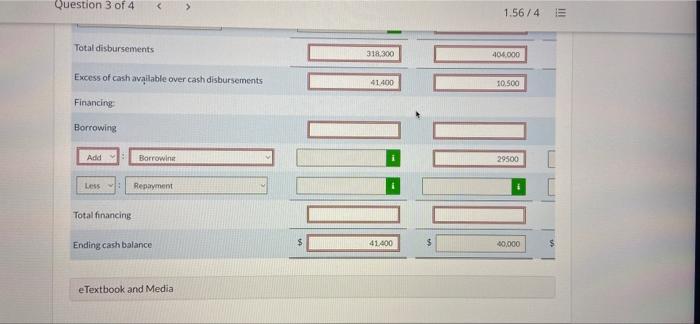

Lorch Company prepares monthly cash budgets. Relevant data from operating budgets for 2021 are as follows: January $354,000 February $399,000 Sales 121,000 111,000 113,000 85,000 Direct materials purchases Direct labour Manufacturing overhead Selling and administrative expenses 60,000 76,000 81.000 74,000 All sales are on account. Lorch expects collections to be 50% in the month of sale. 40in the first month following the sale, and 10% in the second month following the sale. It pays 30% of direct materials purchases in cash in the month of purchase and the balance due in the month following the purchase. Other data are as follows: 1. Credit sales: November 2020, $198.000, December 2020, $280,000 2. Purchases of direct materials: December 2020.991.000 3. Other receipts: January-collection of December 31, 2020. notes receivable $5,000; February-proceeds from sale of securities $6,000 4. Other disbursements: February--payment of $19,000 for land The company expects its cash balance on January 1, 2021. to be $50,000. It wants to maintain a minimum cash balance of $40,000. Your answer is partially correct Prepare schedules for (1) the expected collections from customers, Month January February November 20,000 $ December 111.200 27.000 January 173.500 138,800 February 201,500 204700 $ 3681100 (2) the expected payments for direct materials purchases. Month January February December 63,000 $ January 36,300 84,700 February 33,300 $ 99,300 $ 118,000 Prepare a cash badget for January and February using columns for each month LORCH COMPANY Cash Budget For the Two Months Ending February 28, 2021 Jan Feb eginning cash balance 50.000 41,400 $[ 1d: Cash receipts Collection from credit sales 304,700 368.100 Collection of notes receivable 5.000 [ [ [ [ 5.000 Proceeds from sale of securities 309.700 372.100 ital receipts 359,700 414500 stal available cash ss: Disbursements 11 Direct Labour 85.000 111000 Manufacturing overhead 59.000 75.000 Selling and administrative expenses 75.000 80,000 Purchase of land 00000 20.000 Total disbursements 318.300 404.000 Excess of cash available over cash disbursements 41.400 10.500 Financing: Borrowing 29500 Add Borrowing Repayment Total financing Question 3 of 4 1.56/4 III Total disbursements 318,300 406.000 Excess of cash available over cash disbursements Il 41400 10.500 Financing Borrowing Add Borrowing 29500 Less Repayment Total financing Ending cash balance 41.400 $ 40,000 $ e Textbook and Media