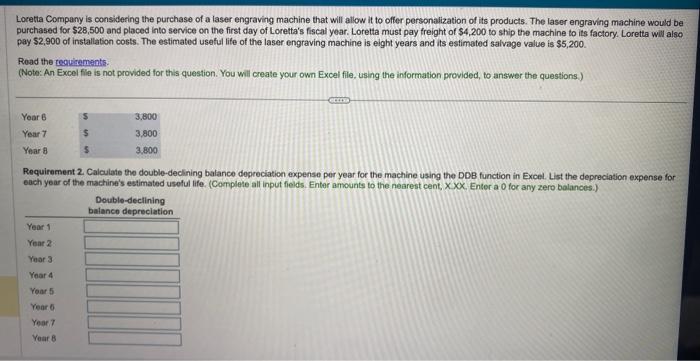

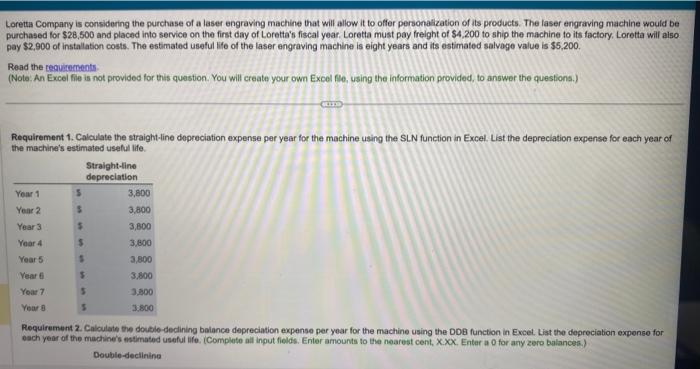

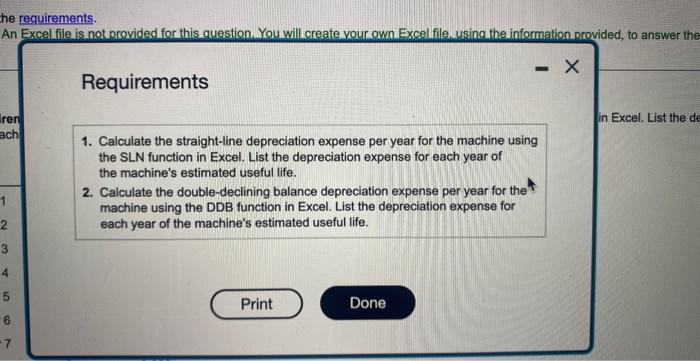

Loretta Company is considering the purchase of a laser engraving machine that will allow it to offer personalization of its products. The laser engraving machine would be purchased for $28,500 and placed into service on the first day of Loretta's fiscal year. Loretta must pay freight of $4,200 to ship the machine to its factory. Loretta will also pay $2,900 of installation costs. The estimated useful life of the laser engraving machine is eight years and its estimated salvage value is $5,200. Road the tequinements. (Note: An Excel file is not provided for this question. You will create your own Excel file, using the information provided, to answer the questions.) Requirement 2. Calculate the double-declining balance dopreciation expense per year for the machine using the DDB function in Excel. List the depreciation expense for each year of the machine's estimated useful life. (Complete all input fields. Enter amounts to the nearest cent, X XX. Enter a 0 for any zero balances.) Loretta Company is considering the purchase of a laser engraving machine that will allow it to offer personaization of its products. The laser engraving machine would be purchased for $28,500 and placed into service on the first day of Loretta's fiscal year. Loretta must pay freight of $4,200 to ship the machine to its factory. Loretta will also pay $2,900 of installation costs. The estimated useful life of the laser engraving machine is eight years and its estimated salvoge value is $5,200. Read the requirerments (Note. An Excel file is not provided for this question. You will create your own Excel fle, using the information provided, to answer the questions.) Requirement 1. Calculate the straight-line dopreciation expense per year for the machine using the SLN function in Excel. List the depreciation expense for each year of the machine's estimated useful life. Requirement 2. Caloulate the double-declining balance depreciation expense per year for the machine using the DDE function in Excel. List the depreciation expense for each year of the machine's estimated useful ilfe. (Complete all input fields. Enter amounts to the nearest cent, X. XX. Enter a 0 for any zero balances.) Double-decilinina equirements. Excel file is not provided for this question. You will create vour own Excel file. using the information provided, to answer the Requirements 1. Calculate the straight-line depreciation expense per year for the machine using the SLN function in Excel. List the depreciation expense for each year of the machine's estimated useful life. 2. Calculate the double-declining balance depreciation expense per year for the machine using the DDB function in Excel. List the depreciation expense for each year of the machine's estimated useful life