Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lorna Chavez is a line manager of Sunday Machine Works and is receiving a monthly salary of P30,000. She is the head of the

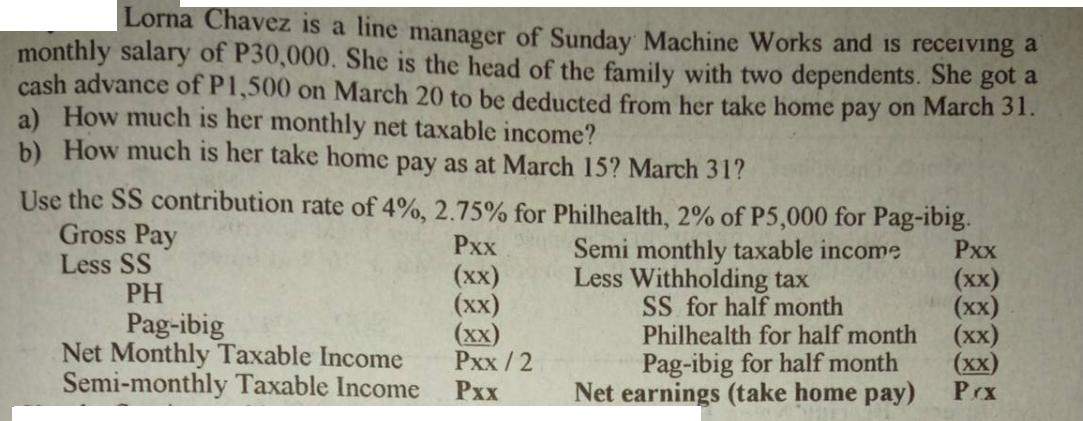

Lorna Chavez is a line manager of Sunday Machine Works and is receiving a monthly salary of P30,000. She is the head of the family with two dependents. She got a cash advance of P1,500 on March 20 to be deducted from her take home pay on March 31. a) How much is her monthly net taxable income? b) How much is her take home pay as at March 15? March 31? Use the SS contribution rate of 4%, 2.75% for Philhealth, 2% of P5,000 for Pag-ibig. Semi monthly taxable income Less Withholding tax SS for half month Gross Pay Less SS PH Pag-ibig Net Monthly Taxable Income Semi-monthly Taxable Income Pxx (xx) (xx) (xx) Pxx/2 Pxx Philhealth for half month Pag-ibig for half month Net earnings (take home pay) Pxx (xx) (xx) (xx) (xx) Prx

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Lorna Chavezs monthly net taxable income take the following steps a Monthly Net Taxable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started