Answered step by step

Verified Expert Solution

Question

1 Approved Answer

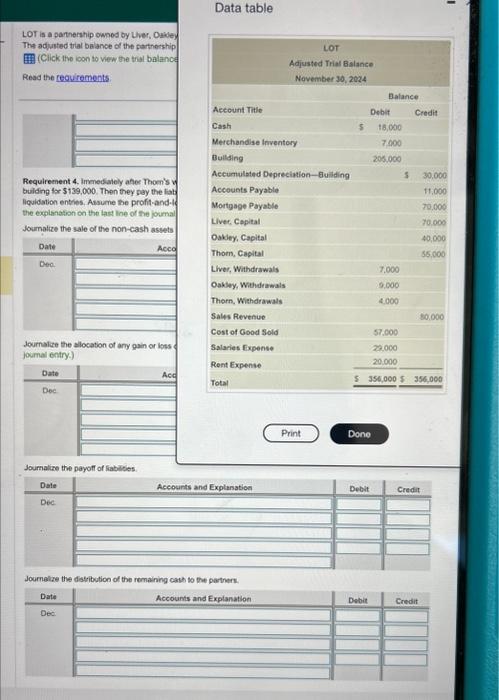

LOT is a parthership owned by Liver, Oakley, and Thorn. The partners' profit-and-loss-sharing ratio is 3:1.4, fespectively. The adjusted trial balance of the partnership at

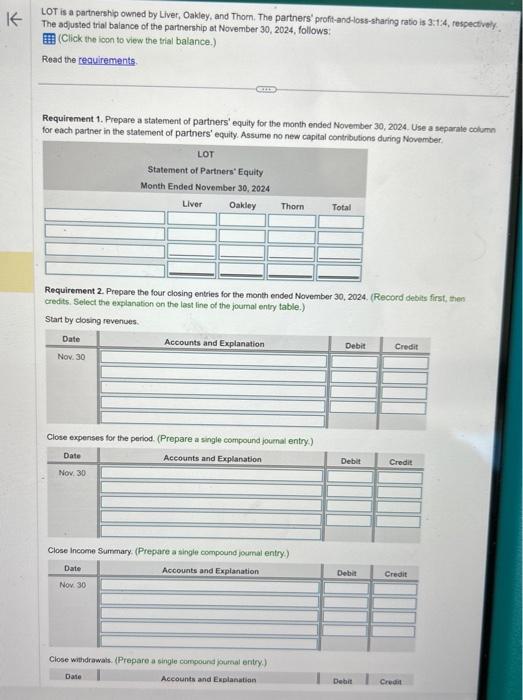

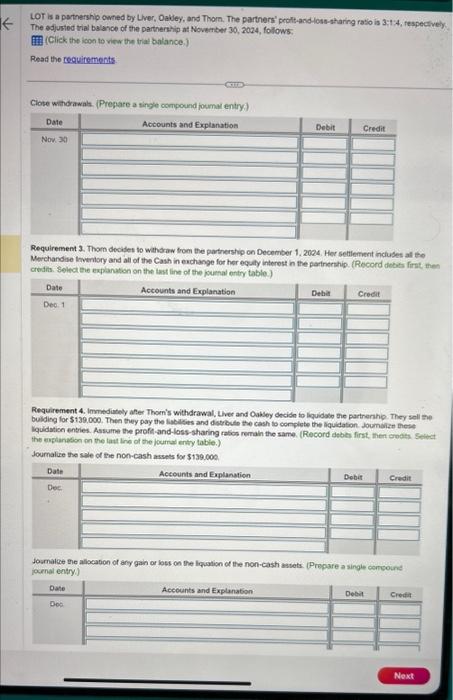

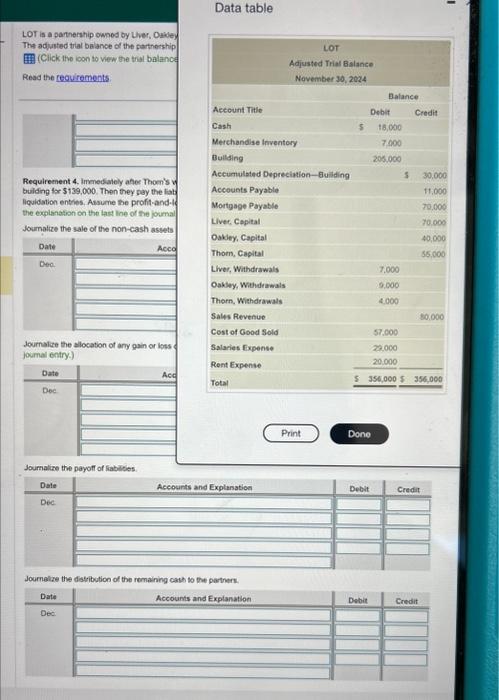

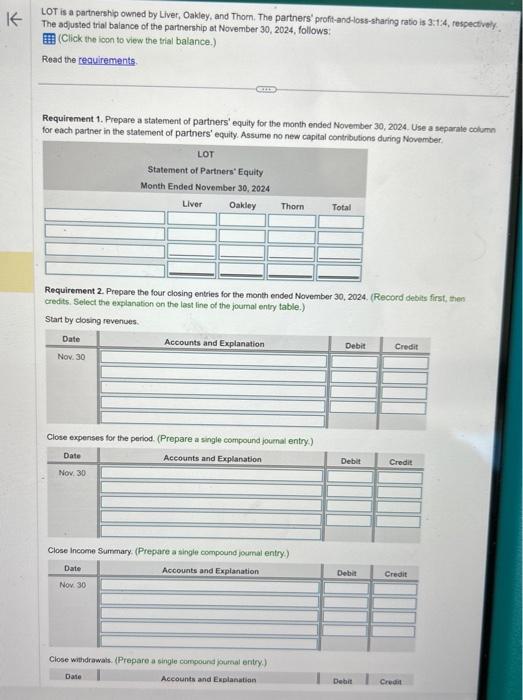

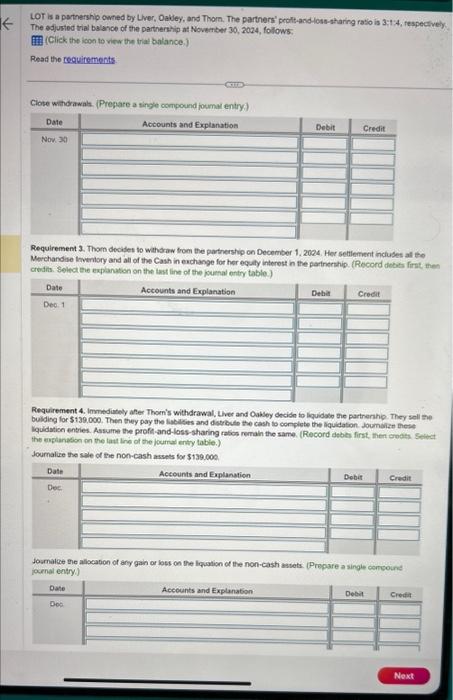

LOT is a parthership owned by Liver, Oakley, and Thorn. The partners' profit-and-loss-sharing ratio is 3:1.4, fespectively. The adjusted trial balance of the partnership at November 30,2024 , follows: (Click the ioon to view the trial balance.) Read the requirements. Requirement 1. Prepare a statement of partners' equity for the month ended November 30, 2024. Use a separate column for each parther in the statement of partners' equity. Assume no new capital contributions during November. Requirement 2. Prepare the four closing entries for the month ended November 30, 2024. (Record debils first, =hen credits. Select the explanation on the last line of the joumal entry table.) Start by closing revenues. Ciose expenses sor the penod: (Prepare a single compound joumal entry) Close income Summary. (Prepare a single compound joumal entry). Lot is a partnership owned by Lver, Oakley, and Thorn. The partners" proft-and-loss-sharing rasio is 3:1'4, fespectively. The adjusted trial balance of the parthership at Novernber 30. 2024, follows: (Cliek the icen to view the triat balance.) Read the reguirements Clote wandrawals. (Prepare a single compound joumak entrys) Requirement 3. Thom decides to wathdraw trom the parthership on December 1. 2024. Her settlemitit inclubes at the Merchandise leventory ard all of the Cash in euchange for her equly interest in the partnerthip. (Record dobita firat, then credfis. Select ene explanation on the lest line of the journal entry table.) Requirement 4. Immediately aher Thoen's withdrawal, Lher and Oakley decide to liguidabe the partnershe. They sell the buiding for $139,000. Then they pay the liablies and distreste the cash to eonplete the liquidation. Joumeize these. lequidatice entries. Assume the profe-and-loss-sharing rabos remain the same. (Record debies first, then reats geitest the erplanedion on the lat line of the jourral enty table.) Journalue the sele of the non-cash assets for $139000. Josmaice the alosabon of ary gain or loss on the lepation of the non-cash bssets. Prepare a single contcouns icurnal entry.] Data table LOT is a partnenhip owned by Uver, Oave, The adjunted trial belance of the parthership Ifll (Click the ioon to view the tral balance Read the regurements: Requireenent 4, immedialoly aher Thom's v buling for $139,000. Then they pay the lab licuidation entios. Assume the profit-and.1s. the explanation on the last ine of the joumal Joumalize the sale of the non-cash assets Journalize the allocation of any gain or isss loumal entry.) Soumalize the payof of fabilices Joumelce the dalitution of the remainng casb to fie parthers. LOT is a parthership owned by Liver, Oakley, and Thorn. The partners' profit-and-loss-sharing ratio is 3:1.4, fespectively. The adjusted trial balance of the partnership at November 30,2024 , follows: (Click the ioon to view the trial balance.) Read the requirements. Requirement 1. Prepare a statement of partners' equity for the month ended November 30, 2024. Use a separate column for each parther in the statement of partners' equity. Assume no new capital contributions during November. Requirement 2. Prepare the four closing entries for the month ended November 30, 2024. (Record debils first, =hen credits. Select the explanation on the last line of the joumal entry table.) Start by closing revenues. Ciose expenses sor the penod: (Prepare a single compound joumal entry) Close income Summary. (Prepare a single compound joumal entry). Lot is a partnership owned by Lver, Oakley, and Thorn. The partners" proft-and-loss-sharing rasio is 3:1'4, fespectively. The adjusted trial balance of the parthership at Novernber 30. 2024, follows: (Cliek the icen to view the triat balance.) Read the reguirements Clote wandrawals. (Prepare a single compound joumak entrys) Requirement 3. Thom decides to wathdraw trom the parthership on December 1. 2024. Her settlemitit inclubes at the Merchandise leventory ard all of the Cash in euchange for her equly interest in the partnerthip. (Record dobita firat, then credfis. Select ene explanation on the lest line of the journal entry table.) Requirement 4. Immediately aher Thoen's withdrawal, Lher and Oakley decide to liguidabe the partnershe. They sell the buiding for $139,000. Then they pay the liablies and distreste the cash to eonplete the liquidation. Joumeize these. lequidatice entries. Assume the profe-and-loss-sharing rabos remain the same. (Record debies first, then reats geitest the erplanedion on the lat line of the jourral enty table.) Journalue the sele of the non-cash assets for $139000. Josmaice the alosabon of ary gain or loss on the lepation of the non-cash bssets. Prepare a single contcouns icurnal entry.] Data table LOT is a partnenhip owned by Uver, Oave, The adjunted trial belance of the parthership Ifll (Click the ioon to view the tral balance Read the regurements: Requireenent 4, immedialoly aher Thom's v buling for $139,000. Then they pay the lab licuidation entios. Assume the profit-and.1s. the explanation on the last ine of the joumal Joumalize the sale of the non-cash assets Journalize the allocation of any gain or isss loumal entry.) Soumalize the payof of fabilices Joumelce the dalitution of the remainng casb to fie parthers

LOT is a parthership owned by Liver, Oakley, and Thorn. The partners' profit-and-loss-sharing ratio is 3:1.4, fespectively. The adjusted trial balance of the partnership at November 30,2024 , follows: (Click the ioon to view the trial balance.) Read the requirements. Requirement 1. Prepare a statement of partners' equity for the month ended November 30, 2024. Use a separate column for each parther in the statement of partners' equity. Assume no new capital contributions during November. Requirement 2. Prepare the four closing entries for the month ended November 30, 2024. (Record debils first, =hen credits. Select the explanation on the last line of the joumal entry table.) Start by closing revenues. Ciose expenses sor the penod: (Prepare a single compound joumal entry) Close income Summary. (Prepare a single compound joumal entry). Lot is a partnership owned by Lver, Oakley, and Thorn. The partners" proft-and-loss-sharing rasio is 3:1'4, fespectively. The adjusted trial balance of the parthership at Novernber 30. 2024, follows: (Cliek the icen to view the triat balance.) Read the reguirements Clote wandrawals. (Prepare a single compound joumak entrys) Requirement 3. Thom decides to wathdraw trom the parthership on December 1. 2024. Her settlemitit inclubes at the Merchandise leventory ard all of the Cash in euchange for her equly interest in the partnerthip. (Record dobita firat, then credfis. Select ene explanation on the lest line of the journal entry table.) Requirement 4. Immediately aher Thoen's withdrawal, Lher and Oakley decide to liguidabe the partnershe. They sell the buiding for $139,000. Then they pay the liablies and distreste the cash to eonplete the liquidation. Joumeize these. lequidatice entries. Assume the profe-and-loss-sharing rabos remain the same. (Record debies first, then reats geitest the erplanedion on the lat line of the jourral enty table.) Journalue the sele of the non-cash assets for $139000. Josmaice the alosabon of ary gain or loss on the lepation of the non-cash bssets. Prepare a single contcouns icurnal entry.] Data table LOT is a partnenhip owned by Uver, Oave, The adjunted trial belance of the parthership Ifll (Click the ioon to view the tral balance Read the regurements: Requireenent 4, immedialoly aher Thom's v buling for $139,000. Then they pay the lab licuidation entios. Assume the profit-and.1s. the explanation on the last ine of the joumal Joumalize the sale of the non-cash assets Journalize the allocation of any gain or isss loumal entry.) Soumalize the payof of fabilices Joumelce the dalitution of the remainng casb to fie parthers. LOT is a parthership owned by Liver, Oakley, and Thorn. The partners' profit-and-loss-sharing ratio is 3:1.4, fespectively. The adjusted trial balance of the partnership at November 30,2024 , follows: (Click the ioon to view the trial balance.) Read the requirements. Requirement 1. Prepare a statement of partners' equity for the month ended November 30, 2024. Use a separate column for each parther in the statement of partners' equity. Assume no new capital contributions during November. Requirement 2. Prepare the four closing entries for the month ended November 30, 2024. (Record debils first, =hen credits. Select the explanation on the last line of the joumal entry table.) Start by closing revenues. Ciose expenses sor the penod: (Prepare a single compound joumal entry) Close income Summary. (Prepare a single compound joumal entry). Lot is a partnership owned by Lver, Oakley, and Thorn. The partners" proft-and-loss-sharing rasio is 3:1'4, fespectively. The adjusted trial balance of the parthership at Novernber 30. 2024, follows: (Cliek the icen to view the triat balance.) Read the reguirements Clote wandrawals. (Prepare a single compound joumak entrys) Requirement 3. Thom decides to wathdraw trom the parthership on December 1. 2024. Her settlemitit inclubes at the Merchandise leventory ard all of the Cash in euchange for her equly interest in the partnerthip. (Record dobita firat, then credfis. Select ene explanation on the lest line of the journal entry table.) Requirement 4. Immediately aher Thoen's withdrawal, Lher and Oakley decide to liguidabe the partnershe. They sell the buiding for $139,000. Then they pay the liablies and distreste the cash to eonplete the liquidation. Joumeize these. lequidatice entries. Assume the profe-and-loss-sharing rabos remain the same. (Record debies first, then reats geitest the erplanedion on the lat line of the jourral enty table.) Journalue the sele of the non-cash assets for $139000. Josmaice the alosabon of ary gain or loss on the lepation of the non-cash bssets. Prepare a single contcouns icurnal entry.] Data table LOT is a partnenhip owned by Uver, Oave, The adjunted trial belance of the parthership Ifll (Click the ioon to view the tral balance Read the regurements: Requireenent 4, immedialoly aher Thom's v buling for $139,000. Then they pay the lab licuidation entios. Assume the profit-and.1s. the explanation on the last ine of the joumal Joumalize the sale of the non-cash assets Journalize the allocation of any gain or isss loumal entry.) Soumalize the payof of fabilices Joumelce the dalitution of the remainng casb to fie parthers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started