Answered step by step

Verified Expert Solution

Question

1 Approved Answer

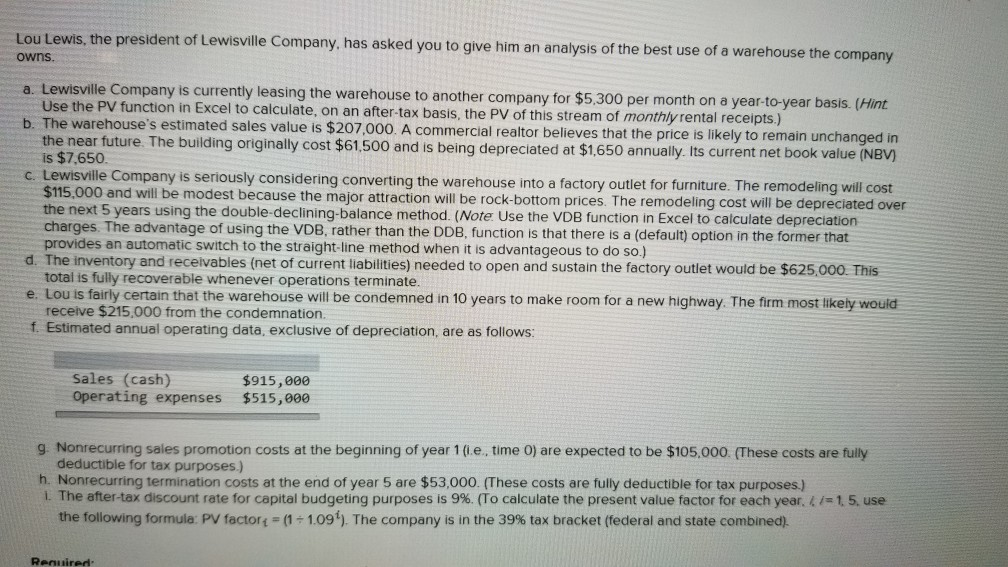

Lou Lewis, the president owns. of Lewisville Company, has asked you to give him an analysis of the best use of a warehouse the company

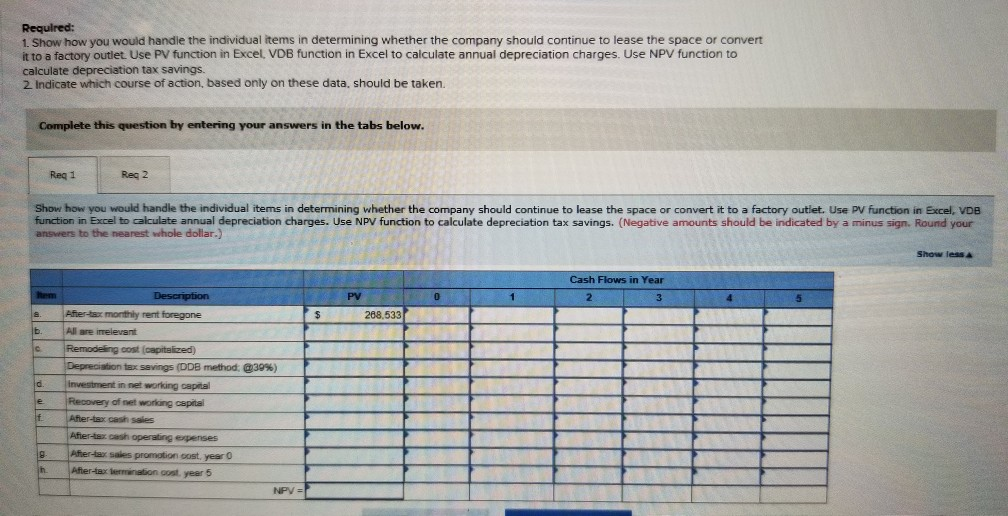

Lou Lewis, the president owns. of Lewisville Company, has asked you to give him an analysis of the best use of a warehouse the company a Lewisville Company is currently leasing the warehouse to another company for $5.300 per month on a year-to-year basis. (Hint leasing the warehouse to another company for $5,300 per month on a year-to-year basis. (Hint Use the PV function in Excel to calculate, on an after-tax basis, the PV of this stream of monthly rental receipts.) b. The warehouse's esti mated sales value is $207, 000. A commercial realtor believes that the price is likely to remain unchanged in the near future. The building originally cost $61,500 and is being depreciated is $7.650 at $1,650 annually. Its current net book value (NBV) seriously considering converting the warehouse into a factory outlet for furniture. The remodeling will cost O and will be modest because the major attraction will be rock-bottom prices. The remodeling cost will be depreciated over next 5 years using the double-declining-balance method. (Note Use the VDB function in Excel to calculate depreciation charges. The advantage of using the VDB, rather than the DDB, function is that there is a (default) option in the former that provides an automatic switch to the straight-line method when it is advantageous to do so.) d. The inventory and receivables (net of current liabilities) needed to open and sustain the factory outlet would be $625,000 This e Lou is fairly certain that the warehouse will be condemned in 10 years to make room for a new highway. The firm most likely would f. Estimated annual operating data, exclusive of depreciation, are as follows: total is fully recoverable whenever operations terminate receive $215,000 from the condemnation. Sales (cash) Operating expenses $515,000 $915,00e g Nonrecurring sales promotion costs at the beginning of year 1 (.e. time 0) are expected to be $105.000. (These costs are fully deductible for tax purposes.) h. Nonrecurring termination costs at the end of year 5 are $53,000. (These costs are fully deductible for tax purposes.) l. The after-tax discount rate for capital budgeting purposes is 9%. (To calculate the present value factor for each year, 5, use the following formula: PV factor" (1 109t). The company is in the 39% tax bracket (federal and state combined). Renuirerd Required: 1. Show how you would handle the individual items in determining whether the company should continue to lease the space or convert it to a factory outlet Use PV function in Excel, VDB function in Excel to calculate annual depreciation charges. Use NPV function to calculate depreciation tax savings. 2 Indicate which course of action, based onty on these data, should be taken. Complete this question by entering your answers in the tabs below. Req 1 Req 2 Show how you would handle the individual items in determining whether the company should continue to lease the space or convert it to a factory outlet. Use PV function in Excel, VDB function in Excel to calculate annual depreciation charges. Use NPV function to calculate depreciation tax savings. (Negative amounts should be indicated by a minus sign. Round your answers to the nearest whole dollar.) Show less & Cash Flows in Year PV Afier-tsx monthly rent foregone 288.533 erecation tax sevngs (DDB method, @39%) n net working capfa of net working cspital cashi sales Aftier-ax sales promation cost, yesr 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started