Question

Low Nail Co. now reports the following data: Annual demand increased to 2,200 kegs per year Inventory carrying costs has increased to $1.52 per keg

Low Nail Co. now reports the following data:

Annual demand increased to 2,200 kegs per year

Inventory carrying costs has increased to $1.52 per keg

Order processing costs are now only $52.00 per order

Inflation has raised interest to 1.3% per month and kegs to a cost of $42.00 each

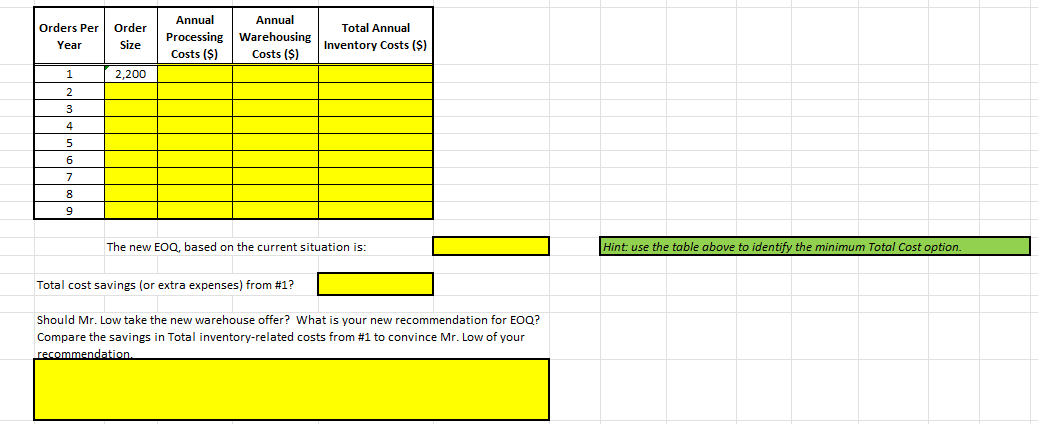

Assume that Lows warehouse offers to rent Low space on the basis of the average number of kegs Low will have in stock, rather than on the maximum number of kegs Low would need room for whenever a new shipment arrived. The storage charge per keg remains the same. Does this change the answer to Question 1? If so, what is the new answer? Should Mr. Low take the new warehouse offer? What is your new recommendation for EOQ? Compare the savings in Total inventory-related costs from #1 to convince Mr. Low of your recommendation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started