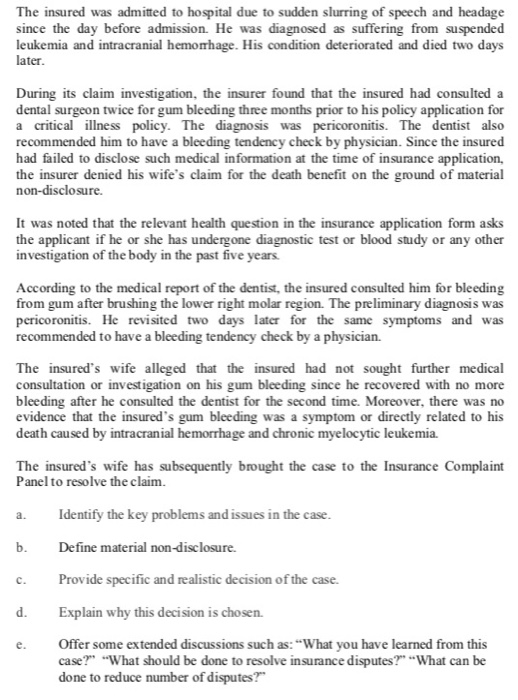

The insured was admitted to hospital due to sudden slurring of speech and headage since the day before admission. He was diagnosed as suffering from suspended leukemia and intracranial hemorrhage. His condition deteriorated and died two days later. During its claim investigation, the insurer found that the insured had consulted a dental surgeon twice for gum bleeding three months prior to his policy application for a critical illness policy. The diagnosis was pericoronitis. The dentist also recommended him to have a bleeding tendency check by physician. Since the insured had failed to disclose such medical information at the time of insurance application, the insurer denied his wife's claim for the death benefit on the ground of material non-disclosure It was noted that the relevant health question in the insurance application form asks the applicant if he or she has undergone diagnostic test or blood study or any other investigation of the body in the past five years. According to the medical report of the dentist, the insured consulted him for bleeding from gum after brushing the lower right molar region. The preliminary diagnosis was pericoronitis. He revisited two days later for the same symptoms and was recommended to have a bleeding tendency check by a physician. The insured's wife alleged that the insured had not sought further medical consultation or investigation on his gum bleeding since he recovered with no more bleeding after he consulted the dentist for the second time. Moreover, there was no evidence that the insured's gum bleeding was a symptom or directly related to his death caused by intracranial hemorrhage and chronic myelocytic leukemia The insured's wife has subsequently brought the case to the Insurance Complaint Panel to resolve the claim. a. b. Identify the key problems and issues in the case. Define material non-disclosure. Provide specific and realistic decision of the case. Explain why this decision is chosen. Offer some extended discussions such as: "What you have learned from this case?" "What should be done to resolve insurance disputes?" --What can be done to reduce number of disputes?" d. The insured was admitted to hospital due to sudden slurring of speech and headage since the day before admission. He was diagnosed as suffering from suspended leukemia and intracranial hemorrhage. His condition deteriorated and died two days later. During its claim investigation, the insurer found that the insured had consulted a dental surgeon twice for gum bleeding three months prior to his policy application for a critical illness policy. The diagnosis was pericoronitis. The dentist also recommended him to have a bleeding tendency check by physician. Since the insured had failed to disclose such medical information at the time of insurance application, the insurer denied his wife's claim for the death benefit on the ground of material non-disclosure It was noted that the relevant health question in the insurance application form asks the applicant if he or she has undergone diagnostic test or blood study or any other investigation of the body in the past five years. According to the medical report of the dentist, the insured consulted him for bleeding from gum after brushing the lower right molar region. The preliminary diagnosis was pericoronitis. He revisited two days later for the same symptoms and was recommended to have a bleeding tendency check by a physician. The insured's wife alleged that the insured had not sought further medical consultation or investigation on his gum bleeding since he recovered with no more bleeding after he consulted the dentist for the second time. Moreover, there was no evidence that the insured's gum bleeding was a symptom or directly related to his death caused by intracranial hemorrhage and chronic myelocytic leukemia The insured's wife has subsequently brought the case to the Insurance Complaint Panel to resolve the claim. a. b. Identify the key problems and issues in the case. Define material non-disclosure. Provide specific and realistic decision of the case. Explain why this decision is chosen. Offer some extended discussions such as: "What you have learned from this case?" "What should be done to resolve insurance disputes?" --What can be done to reduce number of disputes?" d