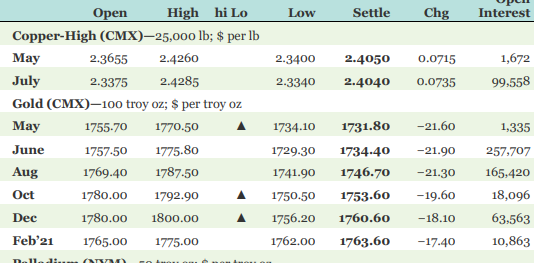

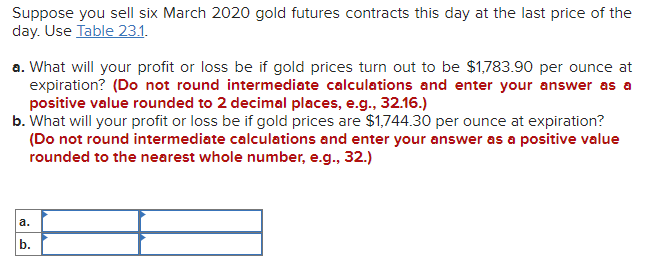

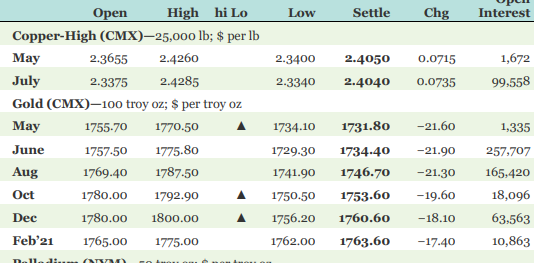

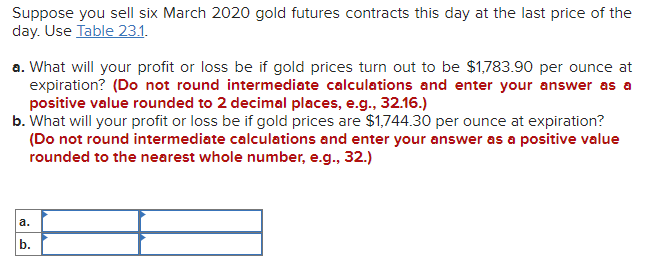

Low Settle Chg Interest 2.3400 2.4050 2.4040 0.0715 0.0735 1,672 99,558 2.3340 Open High hi Lo Copper-High (CMX)25,000 lb; $ per lb May 2.3655 2.4260 July 2.3375 2.4285 Gold (CMX)-100 troy oz; $ per troy oz May 1755.70 1770.50 June 1757.50 1775.80 Aug 1769.40 1787.50 Oct 1780.00 1792.90 Dec 1780.00 1800.00 Feb'21 1765.00 1775.00 -21.60 1,335 1734.10 1729-30 1741.90 1750.50 1756.20 1762.00 1731.80 1734-40 1746.70 1753.60 1760.60 1763.60 -21.90 -21.30 -19.60 -18.10 257,707 165,420 18,096 63,563 10,863 -17.40 n.11: Suppose you sell six March 2020 gold futures contracts this day at the last price of the day. Use Table 23.1. a. What will your profit or loss be if gold prices turn out to be $1,783.90 per ounce at expiration? (Do not round intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, e.g., 32.16.) b. What will your profit or loss be if gold prices are $1,744.30 per ounce at expiration? (Do not round intermediate calculations and enter your answer as a positive value rounded to the nearest whole number, e.g., 32.) a. b. Low Settle Chg Interest 2.3400 2.4050 2.4040 0.0715 0.0735 1,672 99,558 2.3340 Open High hi Lo Copper-High (CMX)25,000 lb; $ per lb May 2.3655 2.4260 July 2.3375 2.4285 Gold (CMX)-100 troy oz; $ per troy oz May 1755.70 1770.50 June 1757.50 1775.80 Aug 1769.40 1787.50 Oct 1780.00 1792.90 Dec 1780.00 1800.00 Feb'21 1765.00 1775.00 -21.60 1,335 1734.10 1729-30 1741.90 1750.50 1756.20 1762.00 1731.80 1734-40 1746.70 1753.60 1760.60 1763.60 -21.90 -21.30 -19.60 -18.10 257,707 165,420 18,096 63,563 10,863 -17.40 n.11: Suppose you sell six March 2020 gold futures contracts this day at the last price of the day. Use Table 23.1. a. What will your profit or loss be if gold prices turn out to be $1,783.90 per ounce at expiration? (Do not round intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, e.g., 32.16.) b. What will your profit or loss be if gold prices are $1,744.30 per ounce at expiration? (Do not round intermediate calculations and enter your answer as a positive value rounded to the nearest whole number, e.g., 32.) a. b