Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LU 8: FINANCIAL INSTRUMENTS - IFRS 13, IAS32, IAS 39: QUESTION 8.1 The financial directors of SW Investments Ltd (SW) and Excel Ltd (Excel) requested

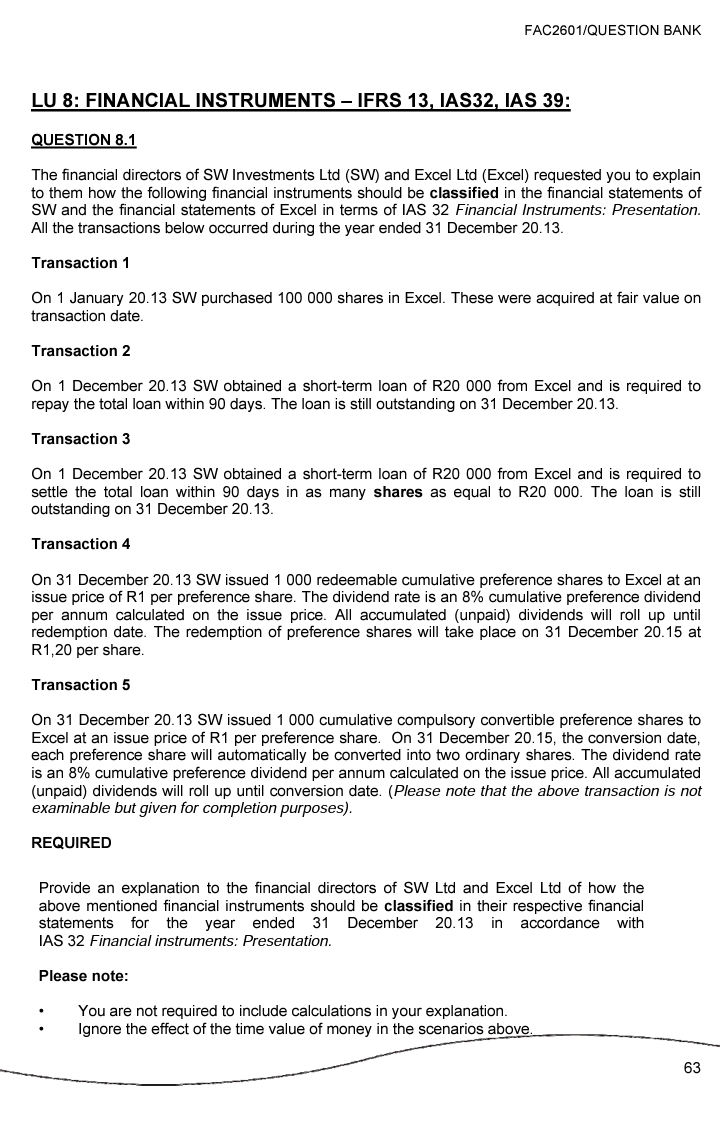

LU 8: FINANCIAL INSTRUMENTS - IFRS 13, IAS32, IAS 39: QUESTION 8.1 The financial directors of SW Investments Ltd (SW) and Excel Ltd (Excel) requested you to explain to them how the following financial instruments should be classified in the financial statements of SW and the financial statements of Excel in terms of IAS 32 Financial Instruments: Presentation. All the transactions below occurred during the year ended 31 December 20.13. Transaction 1 On 1 January 20.13 SW purchased 100000 shares in Excel. These were acquired at fair value on transaction date. Transaction 2 On 1 December 20.13 SW obtained a short-term loan of R20 000 from Excel and is required to repay the total loan within 90 days. The loan is still outstanding on 31 December 20.13. Transaction 3 On 1 December 20.13 SW obtained a short-term loan of R20 000 from Excel and is required to settle the total loan within 90 days in as many shares as equal to R20 000. The loan is still outstanding on 31 December 20.13 . Transaction 4 On 31 December 20.13SW issued 1000 redeemable cumulative preference shares to Excel at an issue price of R1 per preference share. The dividend rate is an 8% cumulative preference dividend per annum calculated on the issue price. All accumulated (unpaid) dividends will roll up until redemption date. The redemption of preference shares will take place on 31 December 20.15 at R1,20 per share. Transaction 5 On 31 December 20.13SW issued 1000 cumulative compulsory convertible preference shares to Excel at an issue price of R1 per preference share. On 31 December 20.15, the conversion date, each preference share will automatically be converted into two ordinary shares. The dividend rate is an 8% cumulative preference dividend per annum calculated on the issue price. All accumulated (unpaid) dividends will roll up until conversion date. (Please note that the above transaction is not examinable but given for completion purposes). REQUIRED Provide an explanation to the financial directors of SW Ltd and Excel Ltd of how the above mentioned financial instruments should be classified in their respective financial statements for the year ended 31 December 20.13 in accordance with IAS 32 Financial instruments: Presentation. Please note: - You are not required to include calculations in your explanation. - Ignore the effect of the time value of money in the scenarios above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started