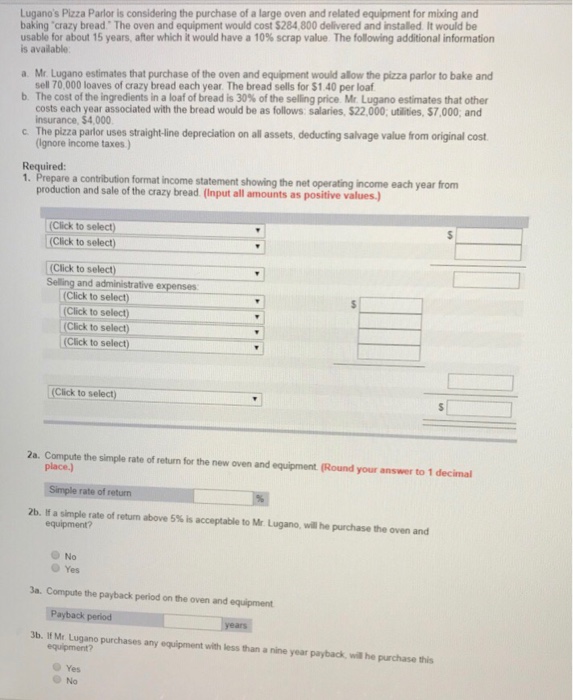

Lugano's Pizza Parlor is considering the purchase of a large oven and related equipment for mixing and baking "crazy bread The oven and equipment would cost $284,800 delivered and installed It would be usable for about 15 years, after which it would have a 10% scrap value The following additional information is available a Mr. Lugano estimates that purchase of the oven and equipment would allow the pizza parlor to bake and sell 70,000 loaves of crazy bread each year The bread sells for $1.40 per loaf b The cost of the ingredients in a loaf of bread is 30% of the selling price Mr Lugano estimates that other c The pizza parlor uses straight-line depreciation on all assets, deducting salvage value from original cost Required: costs each year associated with the bread would be as follows salaries, $22,000, utilities, $7,000; and insurance, $4,000 (ignore income taxes) 1. Prepare a contribution format income statement showing the net operating income each year from production and sale of the crazy bread (Input all amounts as positive values.) (Click to select) Click to select) Click to select) Selling and administrative expenses Click to select) (Click to select) Click to select) (Click to select) (Click to select) 2a. Compute the simple rate of return for the new oven and equipment. (Round your answer to 1 decimal place.) Simple rate of return 2b. If a simple rate of return above 5% is acceptable to Mr Lugano, will he purchase the oven and No Yes a. Compute the payback period on the oven and equipment Payback period 3b. If Mr Lugano purchases any equipment with less than a nine year payback, will he purchase this equipment? Yes No Lugano's Pizza Parlor is considering the purchase of a large oven and related equipment for mixing and baking "crazy bread The oven and equipment would cost $284,800 delivered and installed It would be usable for about 15 years, after which it would have a 10% scrap value The following additional information is available a Mr. Lugano estimates that purchase of the oven and equipment would allow the pizza parlor to bake and sell 70,000 loaves of crazy bread each year The bread sells for $1.40 per loaf b The cost of the ingredients in a loaf of bread is 30% of the selling price Mr Lugano estimates that other c The pizza parlor uses straight-line depreciation on all assets, deducting salvage value from original cost Required: costs each year associated with the bread would be as follows salaries, $22,000, utilities, $7,000; and insurance, $4,000 (ignore income taxes) 1. Prepare a contribution format income statement showing the net operating income each year from production and sale of the crazy bread (Input all amounts as positive values.) (Click to select) Click to select) Click to select) Selling and administrative expenses Click to select) (Click to select) Click to select) (Click to select) (Click to select) 2a. Compute the simple rate of return for the new oven and equipment. (Round your answer to 1 decimal place.) Simple rate of return 2b. If a simple rate of return above 5% is acceptable to Mr Lugano, will he purchase the oven and No Yes a. Compute the payback period on the oven and equipment Payback period 3b. If Mr Lugano purchases any equipment with less than a nine year payback, will he purchase this equipment? Yes No