Answered step by step

Verified Expert Solution

Question

1 Approved Answer

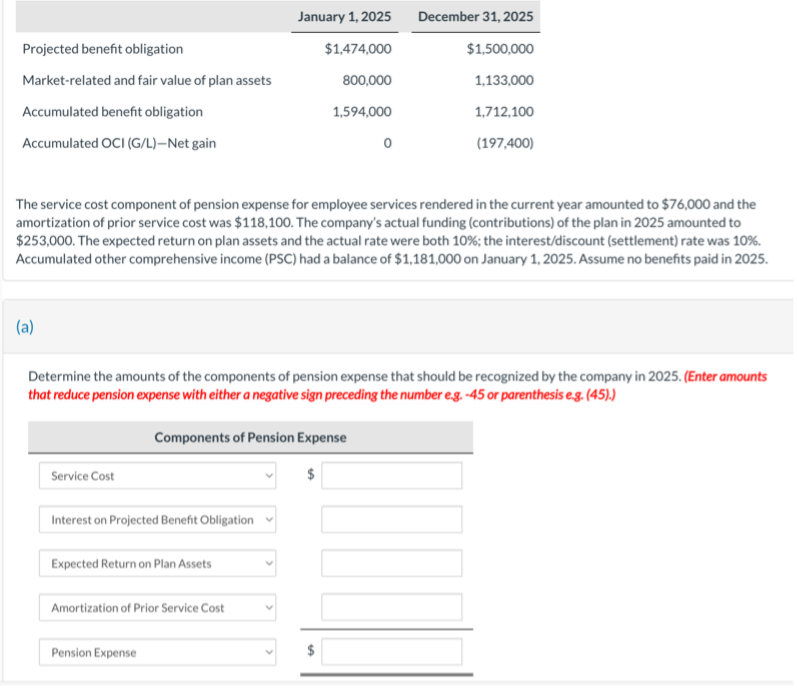

The service cost component of pension expense for employee services rendered in the current year amounted to $ 7 6 , 0 0 0 and

The service cost component of pension expense for employee services rendered in the current year amounted to $ and the amortization of prior service cost was $ The company's actual funding contributions of the plan in amounted to $ The expected return on plan assets and the actual rate were both ; the interestdiscount settlement rate was Accumulated other comprehensive income PSC had a balance of $ on January Assume no benefits paid in a Determine the amounts of the components of pension expense that should be recognized by the company in Enter amounts that reduce pension expense with either a negative sign preceding the number eg or parenthesis e Components of Pension Expense Service Cost Interest on Projected Benefit Obligation Expected Return on Plan Assets

The service cost component of pension expense for employee services rendered in the current year amounted to $ and the

amortization of prior service cost was $ The company's actual funding contributions of the plan in amounted to

$ The expected return on plan assets and the actual rate were both ; the interestdiscount settlement rate was

Accumulated other comprehensive income PSC had a balance of $ on January Assume no benefits paid in

a

Determine the amounts of the components of pension expense that should be recognized by the company in Enter amounts

that reduce pension expense with either a negative sign preceding the number eg or parenthesis e

Components of Pension Expense

Service Cost

Interest on Projected Benefit Obligation

Expected Return on Plan Assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started