Question

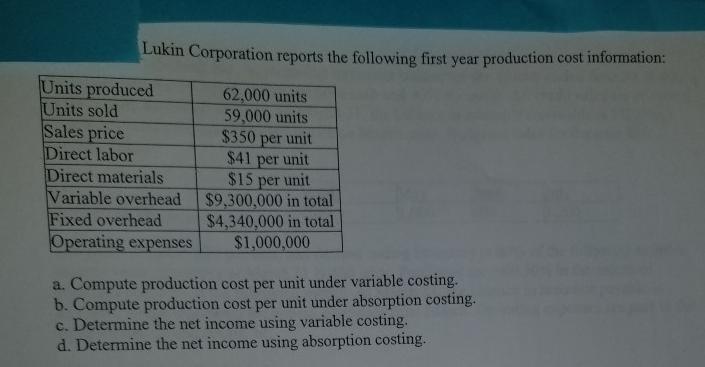

Lukin Corporation reports the following first year production cost information: Units produced Units sold Sales price Direct labor Direct materials Variable overhead Fixed overhead

Lukin Corporation reports the following first year production cost information: Units produced Units sold Sales price Direct labor Direct materials Variable overhead Fixed overhead Operating expenses 62,000 units 59,000 units $350 per unit $41 per unit $15 unit per $9,300,000 in total $4,340,000 in total $1,000,000 a. Compute production cost per unit under variable costing. b. Compute production cost per unit under absorption costing. c. Determine the net income using variable costing. d. Determine the net income using absorption costing.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Solution Required a Computation of production cost per unit Variable costing Per Unit Direct materia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Loren A Nikolai, D. Bazley and Jefferson P. Jones

10th Edition

324300980, 978-0324300987

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App