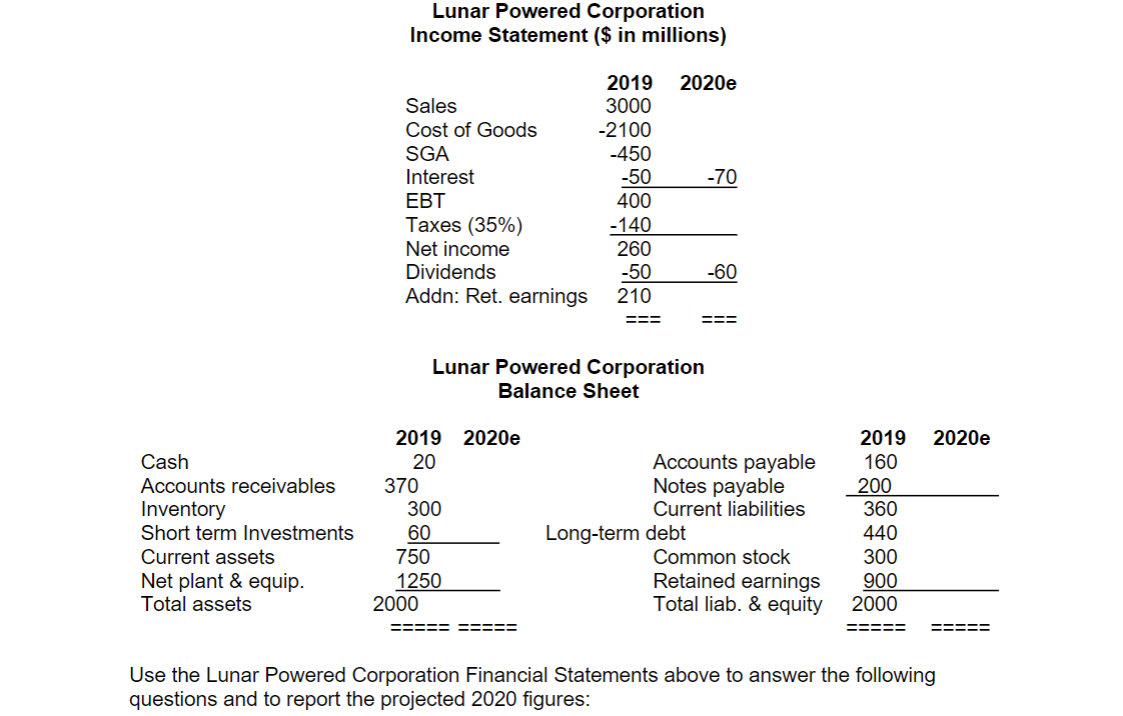

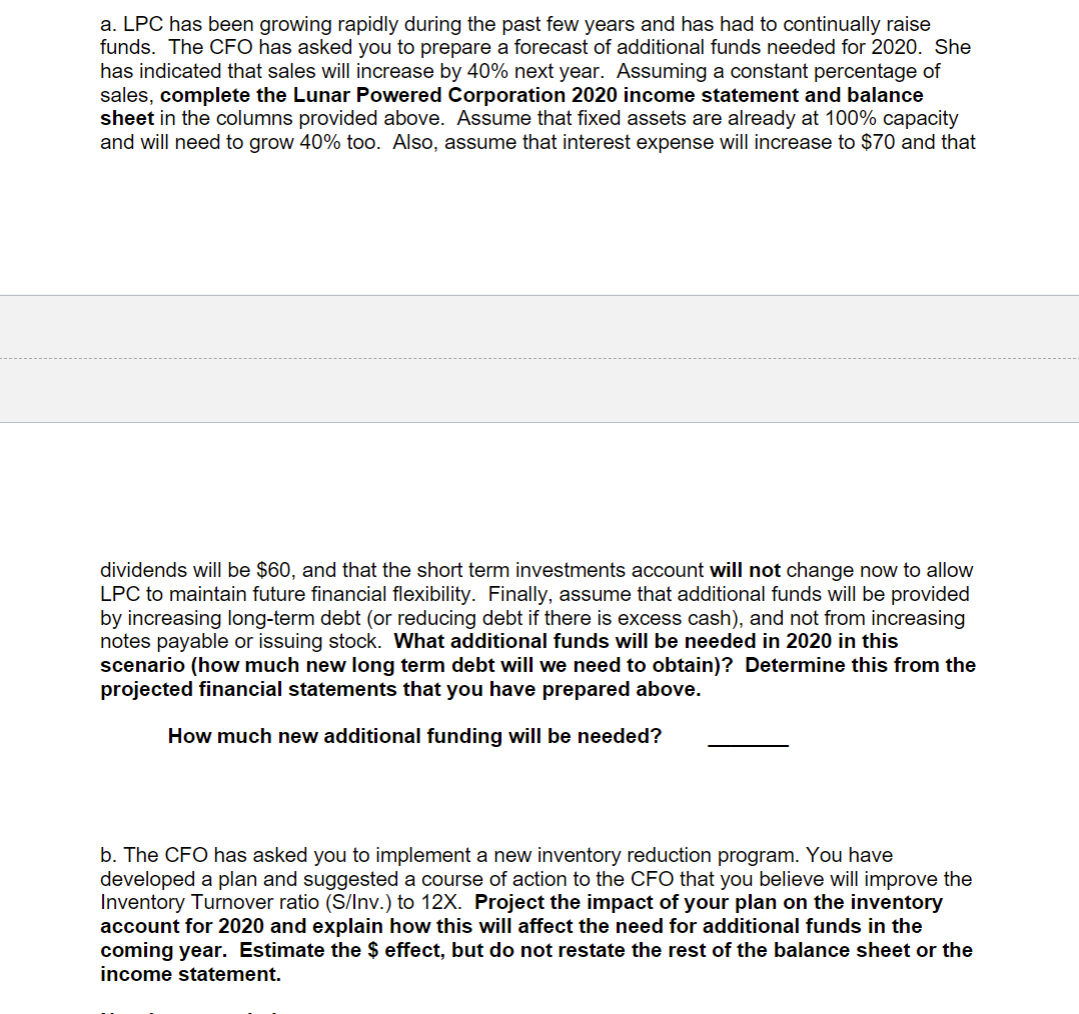

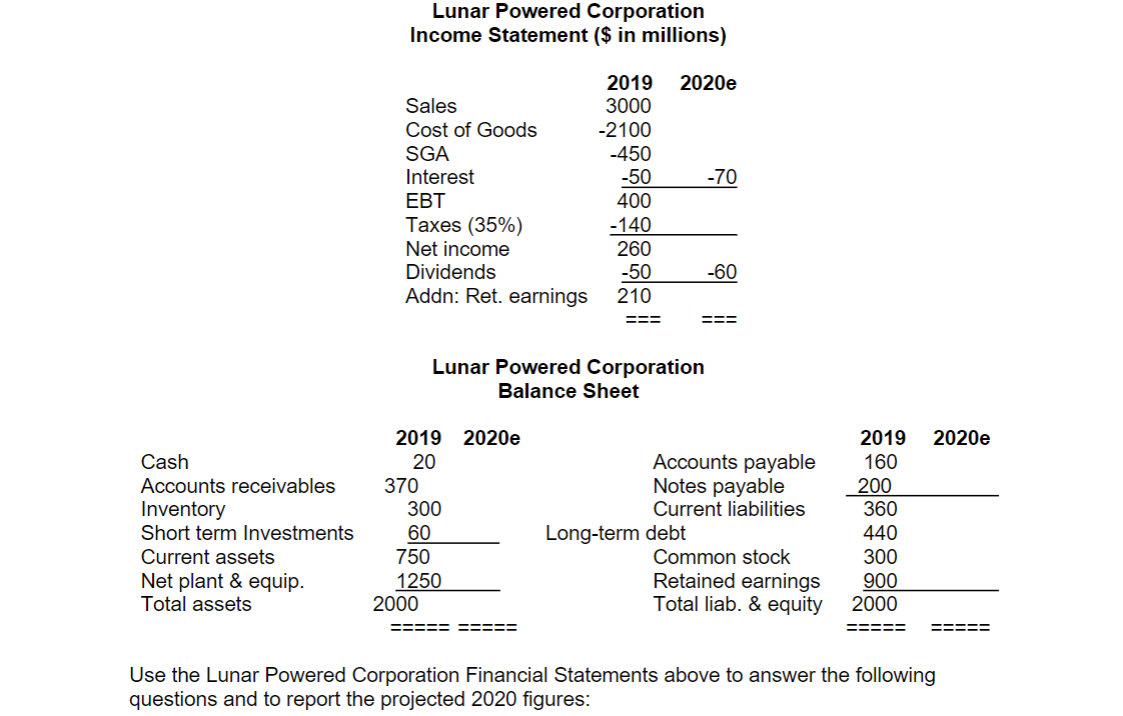

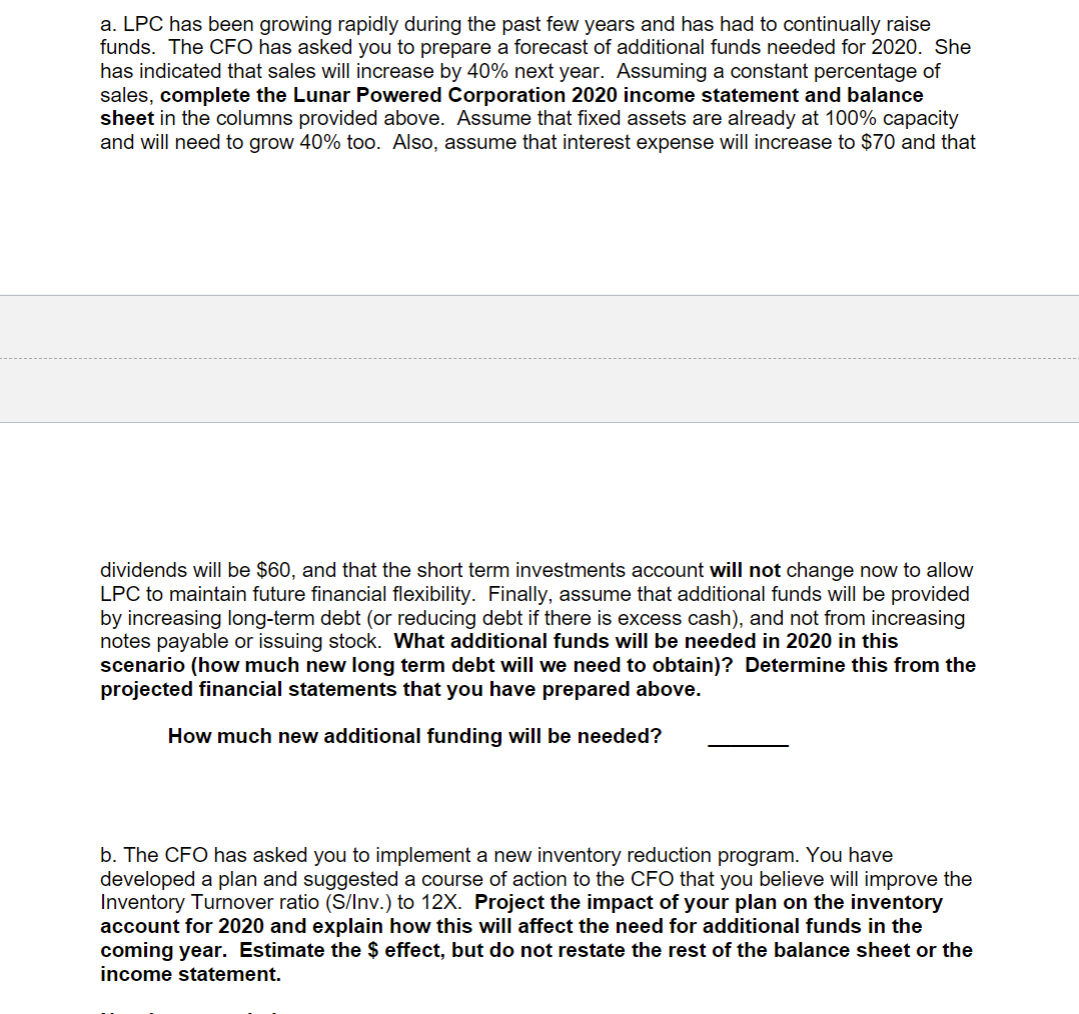

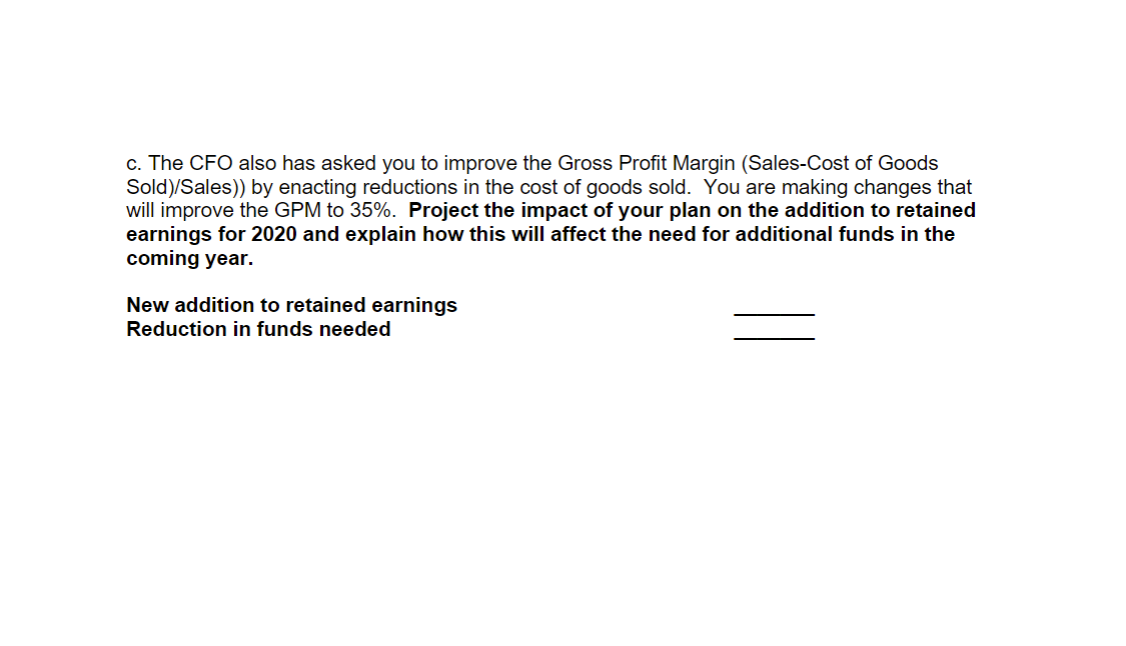

Lunar Powered Corporation Income Statement ($ in millions) 2020 Sales Cost of Goods SGA Interest EBT Taxes (35%) Net income Dividends Addn: Ret. earnings 2019 3000 -2100 -450 -50 400 - 140 260 -50 210 === -60 === Lunar Powered Corporation Balance Sheet 2020e 2019 2020 20 370 Cash Accounts receivables Inventory Short term Investments Current assets Net plant & equip. Total assets 300 60 750 1250 2000 ===== ==== Accounts payable Notes payable Current liabilities Long-term debt Common stock Retained earnings Total liab. & equity 2019 160 200 360 440 300 900 2000 ===== ==== Use the Lunar Powered Corporation Financial Statements above to answer the following questions and to report the projected 2020 figures: a. LPC has been growing rapidly during the past few years and has had to continually raise funds. The CFO has asked you to prepare a forecast of additional funds needed for 2020. She has indicated that sales will increase by 40% next year. Assuming a constant percentage of sales, complete the Lunar Powered Corporation 2020 income statement and balance sheet in the columns provided above. Assume that fixed assets are already at 100% capacity and will need to grow 40% too. Also, assume that interest expense will increase to $70 and that dividends will be $60, and that the short term investments account will not change now to allow LPC to maintain future financial flexibility. Finally, assume that additional funds will be provided by increasing long-term debt (or reducing debt if there is excess cash), and not from increasing notes payable or issuing stock. What additional funds will be needed in 2020 in this scenario (how much new long term debt will we need to obtain)? Determine this from the projected financial statements that you have prepared above. How much new additional funding will be needed? b. The CFO has asked you to implement a new inventory reduction program. You have developed a plan and suggested a course of action to the CFO that you believe will improve the Inventory Turnover ratio (S/Inv.) to 12X. Project the impact of your plan on the inventory account for 2020 and explain how this will affect the need for additional funds in the coming year. Estimate the $ effect, but do not restate the rest of the balance sheet or the income statement. c. The CFO also has asked you to improve the Gross Profit Margin (Sales-Cost of Goods Sold)/Sales)) by enacting reductions in the cost of goods sold. You are making changes that will improve the GPM to 35%. Project the impact of your plan on the addition to retained earnings for 2020 and explain how this will affect the need for additional funds in the coming year. New addition to retained earnings Reduction in funds needed