Answered step by step

Verified Expert Solution

Question

1 Approved Answer

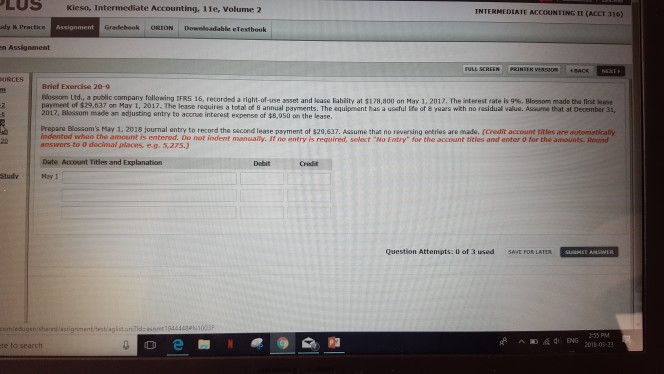

LUSKieso, Intermediate Accounting, 1le, Volume 2 INTERMEDIATE ACCOuNTING 11 (ACCT 316 n Assignment FULL L SCRE URCES Brief Exercise 20-9 som, Ltd., a public company

LUSKieso, Intermediate Accounting, 1le, Volume 2 INTERMEDIATE ACCOuNTING 11 (ACCT 316 n Assignment FULL L SCRE URCES Brief Exercise 20-9 som, Ltd., a public company following ERS 16, reco paye ent of $29 637 on May 2017. The lease requires a total of B annual payments. The eq 2017, Blossom made an adjusting entry to accrue interest expense of $8,050 on the lease de alltof use asset and lease lability t78,ano on Ha. 1. ani, The iteed tate s 9% B a swit som made that kan e na re idual alue A ume hat at December 31 ant as a full r s Prepare Blossom's May 1, 2018 journal entry to record the second lease payment of $29,637. Assume that no reversing entries are mads. (Credit account titles are automstically indented vvhen the amount is entered. Do not indent manually. If no entry is require se ect o Enti tor the aco nttiies and enteroarna aa aine sue t answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Sludy Question Attempts: 0 of 3 used SAVE FOR LATER coedugenshsignmenttest/agistun ENG 2018 03-23 re to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started