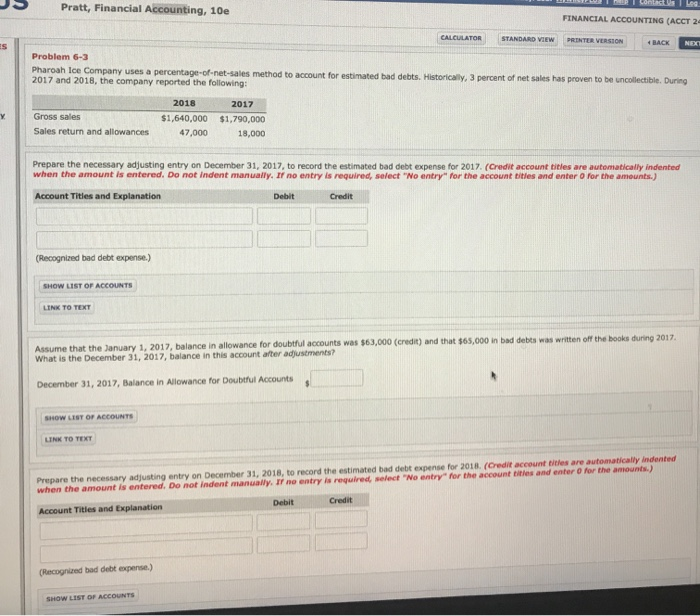

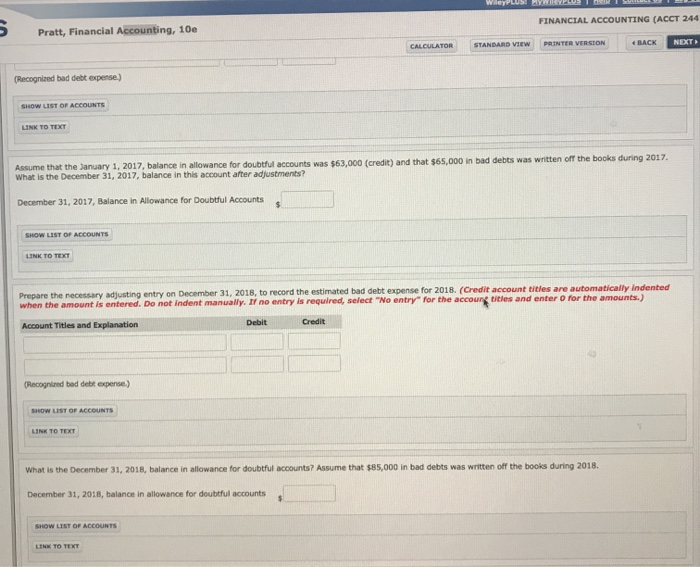

LUTP Lontact Us Los Pratt, Financial Accounting, 10e FINANCIAL ACCOUNTING (ACCT 2 PRINTER VERSION BACK NEX CALCULATOR STANDARD VIEW Problem 6-3 Pharoah Ice Company uses a percentage-of-net-sales method to account for estimated bad debts. Historically, 3 percent of net sales has proven to be uncollectible. During 2017 and 2018, the company reported the following: 2018 2017 Gross sales $1,640,000 $1,790,000 Sales return and allowances 47,000 18,000 Prepare the necessary adjusting entry on December 31, 2017, to record the estimated bad debt expense for 2017. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No entry for the account titles and enter for the amounts) Account Titles and Explanation Debit Credit (Recognized bad debt expense.) SHOW LIST OF ACCOUNTS LINK TO TEXT Assume that the January 1, 2017, balance in allowance for doubtful accounts was $63,000 (credit) and that $65,000 in bad debts was written off the books during 2017, What is the December 31, 2017, balance in this account after adjustments? December 31, 2017, Balance in Allowance for Doubtful Accounts SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the necessary adjusting entry on December 31, 2018, to record the estimated bad debt expense for 2018. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If he entry is required select "No entry for the account titles and enter for the amounts) Debit Credit Account Tities and Explanation (Recognized bad debt expense.) SHOW LIST OF ACCOUNTS Pratt, Financial Accounting, 10e FINANCIAL ACCOUNTING (ACCT 244 CALCULATOR STANDARD VIEW PRINTER VERSION BACK NEXT (Recognized bad debt expense) SHOW LIST OF ACCOUNTS LINK TO TEXT Assume that the January 1, 2017, balance in allowance for doubtful accounts was $63,000 (credit) and that $65,000 in bad debts was written off the books during 2017. What is the December 31, 2017, balance in this account after adjustments? December 31, 2017, Balance in Allowance for Doubtful Accounts ACCOUNTS LINK TO TECT Prepare the necessary adjusting entry on December 31, 2018, to record the estimated bad debt expense for 2018. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry for the accountities and enter for the amounts.) Account Titles and Explanation Debit Credit Recognised bad debt pense) SHOW LIST OF ACCOUNTS LINK TO TEXT What is the December 31, 2018, balance in allowance for doubthul accounts? Assume that $85,000 in bad debts was written off the books during 2018 December 31, 2018, balance in allowance for doubtful accounts SHOW LIST OF ACCOUNTS LINK TO TEXT