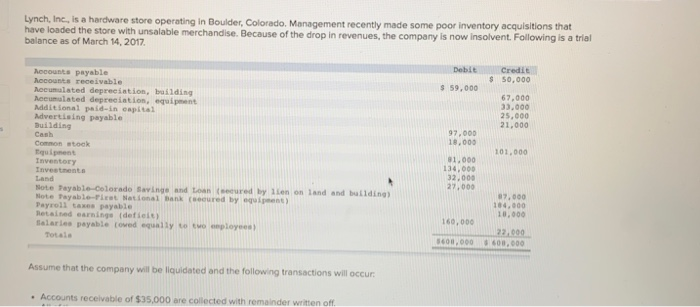

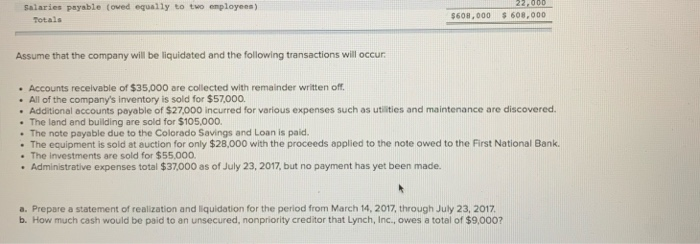

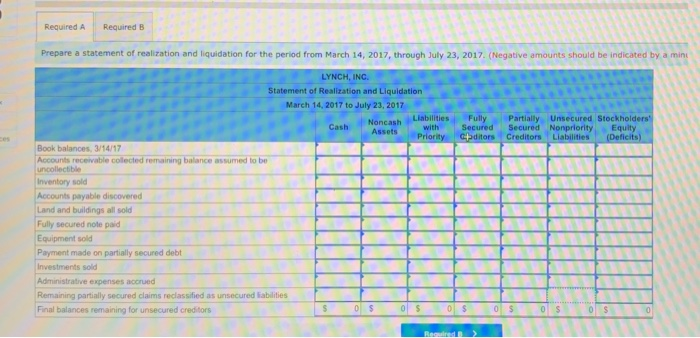

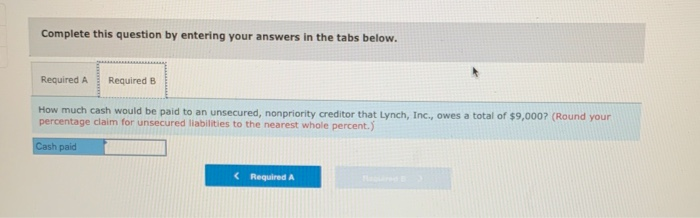

Lynch, Inc., is a hardware store operating in Boulder, Colorado, Management recently made some poor inventory acquisitions that have loaded the store with unsalable merchandise. Because of the drop in revenues, the company is now insolvent. Following is a trial balance as of March 14, 2017 Debit $ 59,000 Accounts payable Accounts receivable Accumulated depreciation, building Accumulated depreciation, equipment Additional paid in capital Advertising payable Building Credit $ 50,000 67.000 33.000 25,000 21,000 97,000 18,000 101.000 Common stock Equipment Inventory Investment Land Note Tayable-Colorado Saving and Loan (ured by len on land and buildings Note Tayable-heat National Bank (ured by went) Payroll taxes payable Retained earning (deficit) Salarios payable towed equally to the employees Totale 81.000 134.000 32.000 27.000 $7.000 184.000 10.000 160,000 3600.000 22.000 600.000 Assume that the company will be liquidated and the following transactions will occur Accounts receivable of $35,000 are collected with remainder written off Salaries payable (oved equally to two employees) Totals $600,000 22.000 $ 608,000 Assume that the company will be liquidated and the following transactions will occur Accounts receivable of $35,000 are collected with remainder written off, . All of the company's inventory is sold for $57,000 . Additional accounts payable of $27,000 incurred for various expenses such as utilities and maintenance are discovered. The land and building are sold for $105,000 The note payable due to the Colorado Savings and Loan is paid. The equipment is sold at auction for only $28,000 with the proceeds applied to the note owed to the First National Bank The investments are sold for $55,000 Administrative expenses total $37,000 as of July 23, 2017, but no payment has yet been made. a. Prepare a statement of realization and liquidation for the period from March 14, 2017, through July 23, 2017 b. How much cash would be paid to an unsecured, nonpriority creditor that Lynch, Inc., owes a total of $9,000? Required A Required B Prepare a statement of realization and liquidation for the period from March 14, 2017, through July 23, 2017. (Negative amounts should be indicated by a mint LYNCH, INC. Statement of Realization and Liquidation March 14, 2017 to July 23, 2017 Liabilities Noncash Fully Cash Partially Unsecured Stockholders with Assets Secured Secured Nonpriority Equity Priority toditors Creditors Liabilities (Deficits) Book balances, 3/14/7 Accounts receivable collected remaining balance assumed to be uncollectible Inventory sold Accounts payable discovered Land and buildings all sold Fully secured note paid Equipment sold Payment made on partially secured debt Investments sold Administrative expenses accrued Remaining partially secured claims reclassified as unsecured liabilities Final balances remaining for unsecured creditors $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 S Complete this question by entering your answers in the tabs below. Required A Required B How much cash would be paid to an unsecured, nonpriority creditor that Lynch, Inc., owes a total of $9,000? (Round your percentage claim for unsecured liabilities to the nearest whole percent.) Cash paid