Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lynn was reviewing the operating performance of Kingbird Co, a shoe manufacturer. She marveled at the numbers when she determined the company generated positive

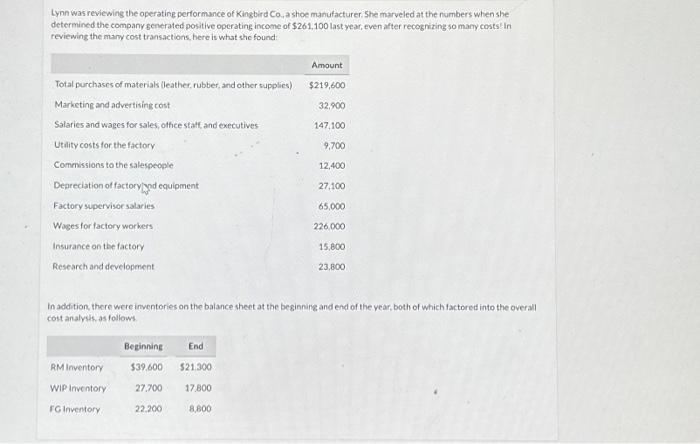

Lynn was reviewing the operating performance of Kingbird Co, a shoe manufacturer. She marveled at the numbers when she determined the company generated positive operating income of $261,100 last year, even after recognizing so many costs! In reviewing the many cost transactions, here is what she found Total purchases of materials (leather, rubber, and other supplies) Marketing and advertising cost Salaries and wages for sales, office staff, and executives Utility costs for the factory Commissions to the salespeople Depreciation of factory and equipment Factory supervisor salaries Wages for factory workers Insurance on the factory Research and development RM Inventory WIP Inventory FG Inventory Beginning End $39.600 $21.300 27,700 17,800 22,200 Amount $219,600 32,900 147,100 9,700 12,400 27,100 65,000 In addition, there were inventories on the balance sheet at the beginning and end of the year, both of which factored into the overall cost analysis, as follows. 8,800 226,000 15,800 23,800 Place an "X" in the appropriate column above to classify each of the costs as a period cost or product cost. Total purchases of materials (leather, rubber, and other supplies) Marketing and advertising cost Salaries and wages for sales, office staff, and executives Utility costs for the factory Commissions to the salespeople Depreciation of factory and equipment Factory supervisor salaries Wages for factory workers Insurance on the factory Research and development Save for Later Amount $219,600 32,900 147,100 9.700 12.400 27,100 65,000 226,000 15,800 23,800 Product cost > > < Period cost Attempts: 0 of 1 used Submit Answer

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started