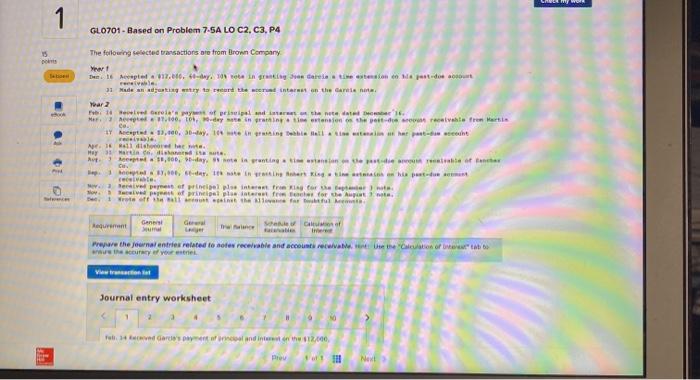

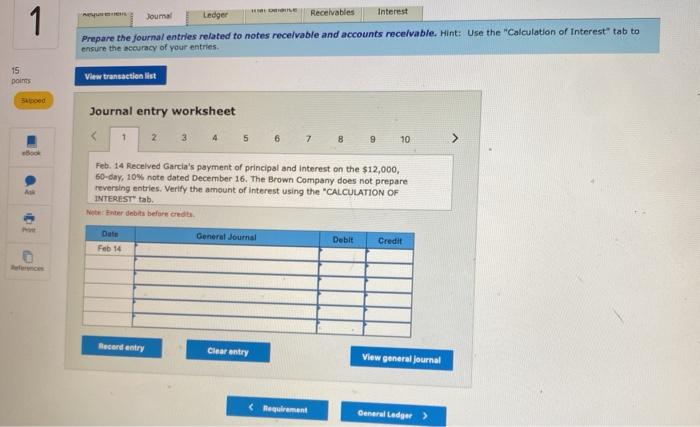

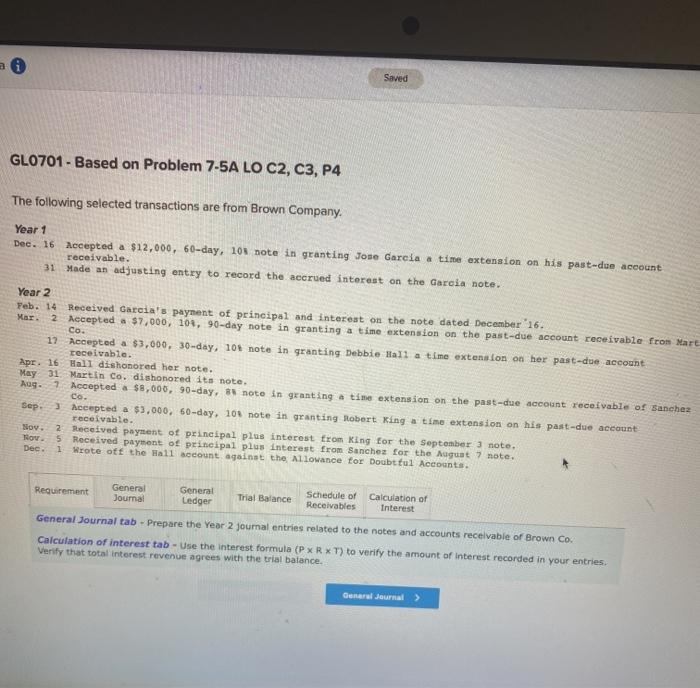

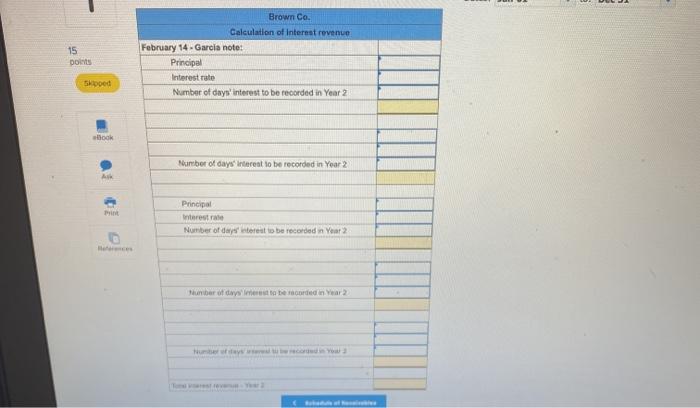

M 1 GL0701 - Based on Problem 7.5A LO C2, C3, P4 The following selected transactions are from Brown Company Year De 16 Accepted 117.610, 40-1.10 bin gran rendaria e studio do renew 31 Made dating try to read the wendinant on the Garden Yar2 elderly peispalan in the netedatter M. Accepte.10. to determination sports de recette from Martin 19 sept. 13.000, 2. 164 en in Tamil ball in all post- secht All the Hey are de Autoput. 31,800, day, we in ring of the 3,101, der eine her in the set 1 Receiver of Winele interest for the how to get plus interest rate for the at the formule Recent Geners SC Prywe the jernal entries related to oferecevable and accounts receive the lion of the course Journal entry worksheet Yol Garcia's find in the $12.000 Prov tot 1H Net Joumal Ledger Interest Receivables 1 Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation of Interest" tab to ensure the accuracy of your entries 15 points View transaction list spoed Journal entry worksheet 2 6 7 8 10 A Feb. 14 Received Garcia's payment of principal and interest on the $12,000, 60-day, 10% note dated December 16. The Brown Company does not prepare reversing entries. Verify the amount of Interest using the "CALCULATION OF INTEREST tab. Enter debit before credit General Journal Debit Credit Feb 14 Becord entry Clear entry View general Journal Saved GL0701 - Based on Problem 7-5A LO C2, C3, P4 The following selected transactions are from Brown Company Year 1 Dec. 16 Accepted a $12,000, 60-day, 108 note in granting Jose Garcia a time extension on his past-duo account receivable. 31 Made an adjusting entry to record the accrued interest on the Garcia note. Year 2 Yeb. 14 Received Garcia's payment of principal and interest on the note dated December 16. Mar. 2 Accepted a $7,000, 108, 90-day note in granting a time extension on the past-due account receivable from Mart Co. 12 Accepted a $3,000, 30-day, 109 note in granting Debbie Hall a time extension on her past-due account receivable. Apr. 16 Hall dishonored her note. May 31 Martin Co. dishonored its note. Aug. 7 Accepted a $8,000, 90-day, 88 note is granting a time extension on the past-due account receivable of Sanchez co Sep > Accepted a $3,000, 50-day, 109 note in granting Robert King a time extension on his past-due account receivable. Nov 2 Received payment of principal plus interest from King for the September 3 note. HON. 5 Received payment of principal plus interest from Sanchez for the August 7 note. Dec 1 Wote ott the Hall account against the Allowance for Doubtful Accounts. Requirement General Journal General Ledger Trial Balance Schedule of Receivables Calculation of Interest General Journal tab - Prepare the Year 2 journal entries related to the notes and accounts receivable of Brown Co. Calculation of interest tab - Use the interest formula (Px RXT) to verify the amount of interest recorded in your entries. Verify that total interest revenue agrees with the trial balance. General Journal > 15 Dots Brown Co. Calculation of Interest revenue February 14. Garcia note: Principal Interest rate Number of days interest to be recorded in Year 2 ska ock Number of days Interest to be recorded in Year 2 Principal Interest Number of sweet to be recorded in Year Humber of days met bemanded in Year 2 M 1 GL0701 - Based on Problem 7.5A LO C2, C3, P4 The following selected transactions are from Brown Company Year De 16 Accepted 117.610, 40-1.10 bin gran rendaria e studio do renew 31 Made dating try to read the wendinant on the Garden Yar2 elderly peispalan in the netedatter M. Accepte.10. to determination sports de recette from Martin 19 sept. 13.000, 2. 164 en in Tamil ball in all post- secht All the Hey are de Autoput. 31,800, day, we in ring of the 3,101, der eine her in the set 1 Receiver of Winele interest for the how to get plus interest rate for the at the formule Recent Geners SC Prywe the jernal entries related to oferecevable and accounts receive the lion of the course Journal entry worksheet Yol Garcia's find in the $12.000 Prov tot 1H Net Joumal Ledger Interest Receivables 1 Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation of Interest" tab to ensure the accuracy of your entries 15 points View transaction list spoed Journal entry worksheet 2 6 7 8 10 A Feb. 14 Received Garcia's payment of principal and interest on the $12,000, 60-day, 10% note dated December 16. The Brown Company does not prepare reversing entries. Verify the amount of Interest using the "CALCULATION OF INTEREST tab. Enter debit before credit General Journal Debit Credit Feb 14 Becord entry Clear entry View general Journal Saved GL0701 - Based on Problem 7-5A LO C2, C3, P4 The following selected transactions are from Brown Company Year 1 Dec. 16 Accepted a $12,000, 60-day, 108 note in granting Jose Garcia a time extension on his past-duo account receivable. 31 Made an adjusting entry to record the accrued interest on the Garcia note. Year 2 Yeb. 14 Received Garcia's payment of principal and interest on the note dated December 16. Mar. 2 Accepted a $7,000, 108, 90-day note in granting a time extension on the past-due account receivable from Mart Co. 12 Accepted a $3,000, 30-day, 109 note in granting Debbie Hall a time extension on her past-due account receivable. Apr. 16 Hall dishonored her note. May 31 Martin Co. dishonored its note. Aug. 7 Accepted a $8,000, 90-day, 88 note is granting a time extension on the past-due account receivable of Sanchez co Sep > Accepted a $3,000, 50-day, 109 note in granting Robert King a time extension on his past-due account receivable. Nov 2 Received payment of principal plus interest from King for the September 3 note. HON. 5 Received payment of principal plus interest from Sanchez for the August 7 note. Dec 1 Wote ott the Hall account against the Allowance for Doubtful Accounts. Requirement General Journal General Ledger Trial Balance Schedule of Receivables Calculation of Interest General Journal tab - Prepare the Year 2 journal entries related to the notes and accounts receivable of Brown Co. Calculation of interest tab - Use the interest formula (Px RXT) to verify the amount of interest recorded in your entries. Verify that total interest revenue agrees with the trial balance. General Journal > 15 Dots Brown Co. Calculation of Interest revenue February 14. Garcia note: Principal Interest rate Number of days interest to be recorded in Year 2 ska ock Number of days Interest to be recorded in Year 2 Principal Interest Number of sweet to be recorded in Year Humber of days met bemanded in Year 2