Answered step by step

Verified Expert Solution

Question

1 Approved Answer

M. K. Berry is the managing director of CE Ltd. a small, family -owned company which manufactures cutlery. His company belongs to a trade

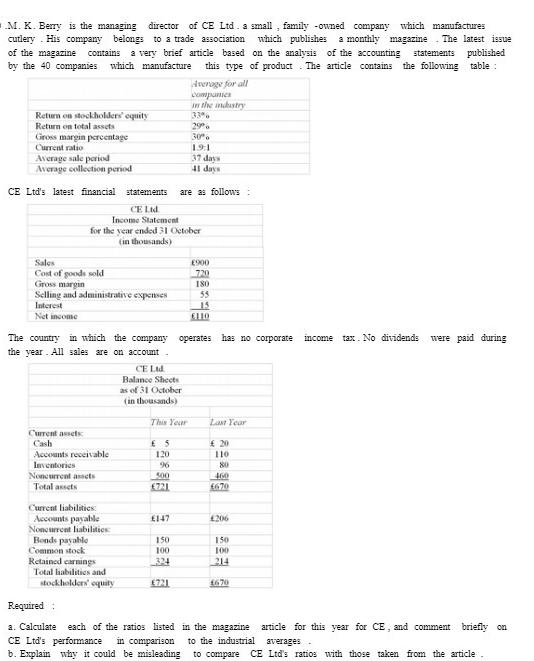

M. K. Berry is the managing director of CE Ltd. a small, family -owned company which manufactures cutlery. His company belongs to a trade association which publishes a monthly magazine. The latest issue of the magazine contains a very brief article based on the analysis of the accounting statements published by the 40 companies which manufacture this type of product. The article contains the following table: Return on stockholders' equity Return on total assets Gross margin percentage Current ratio Average sale period Average collection period CE Ltd's latest financial Sales Cost of goods sold Gross margin Selling and administrative expenses Interest Net income statements CE Ltd Income Statement for the year ended 31 October (in thousands) Current assets Cash Accounts receivable Inventories Noncurrent assets Total assets Current liabilities: Accounts payable Noncurrent liabilities Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity The country in which the company operates has no corporate income tax. No dividends were paid during the year. All sales are on account. CE Ltd. Balance Sheets as of 31 October (in thousands) This Year 5 120 96 500 721 29% 30% 19:1 37 days 41 days are as follows: 147 Average for all companies in the industry 33% 150 100 324 721 900 720 180 55 15 110 Last Year 20 110 80 460 670 206 150 100 214 670 Required: a. Calculate each of the ratios listed in the magazine article for this year for CE, and comment briefly on CE Ltd's performance in comparison to the industrial averages. b. Explain why it could be misleading to compare CE Ltd's ratios with those taken from the article

Step by Step Solution

★★★★★

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Return on Equity Return on total assets Gross margin percentage Current ratio Average sale period Av...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started