Answered step by step

Verified Expert Solution

Question

1 Approved Answer

m the partner agreement and except where it is stated differently, ccount: cal is calculated at 9% per annum. ent accounts (opening balances) at 7%

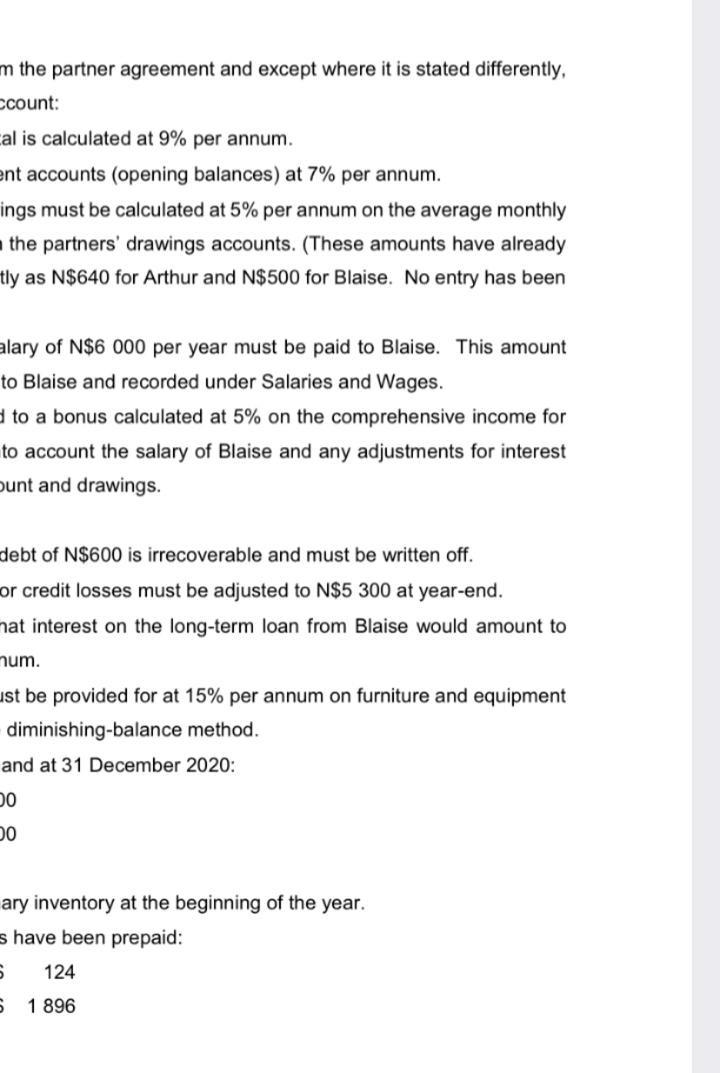

m the partner agreement and except where it is stated differently, ccount: cal is calculated at 9% per annum. ent accounts (opening balances) at 7% per annum. ings must be calculated at 5% per annum on the average monthly the partners' drawings accounts. (These amounts have already tly as N$640 for Arthur and N$500 for Blaise. No entry has been alary of N$6 000 per year must be paid to Blaise. This amount to Blaise and recorded under Salaries and Wages. to a bonus calculated at 5% on the comprehensive income for to account the salary of Blaise and any adjustments for interest bunt and drawings. debt of N$600 is irrecoverable and must be written off. or credit losses must be adjusted to N$5 300 at year-end. hat interest on the long-term loan from Blaise would amount to num. ust be provided for at 15% per annum on furniture and equipment diminishing-balance method. and at 31 December 2020: DO DO ary inventory at the beginning of the year. s have been prepaid: 5 124 5 1 896 m the partner agreement and except where it is stated differently, ccount: cal is calculated at 9% per annum. ent accounts (opening balances) at 7% per annum. ings must be calculated at 5% per annum on the average monthly the partners' drawings accounts. (These amounts have already tly as N$640 for Arthur and N$500 for Blaise. No entry has been alary of N$6 000 per year must be paid to Blaise. This amount to Blaise and recorded under Salaries and Wages. to a bonus calculated at 5% on the comprehensive income for to account the salary of Blaise and any adjustments for interest bunt and drawings. debt of N$600 is irrecoverable and must be written off. or credit losses must be adjusted to N$5 300 at year-end. hat interest on the long-term loan from Blaise would amount to num. ust be provided for at 15% per annum on furniture and equipment diminishing-balance method. and at 31 December 2020: DO DO ary inventory at the beginning of the year. s have been prepaid: 5 124 5 1 896

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started