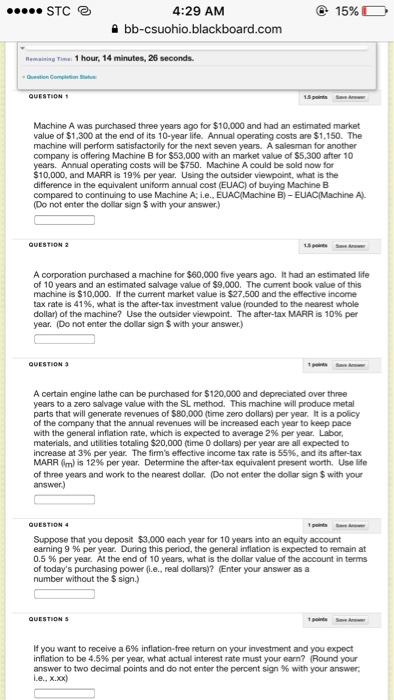

Machine A was purchased three years ago for exist10,000 and had an estimated market value of exist1, 300 at the end of its 10-year life. Annual operating costs are exist1, 150. The machine will perform satisfactorily for the next seven years. A salesman for another company is offering Machine B for exist53,000 with an market value of exist5, 300 after 10 years. Annual operating costs will be exist750. Machine A could be sold now for exist10,000, and MARR is 19% per year. Using the outsider viewpoint, what is the difference in the equivalent uniform annual cost (EUAC) of buying Machine B compared to continuing to use Machine A: i.e., EUAC(Machine B) - EUAC(Machine A). (Do not enter the dollar sign exist with your answer.) A corporation purchased a machine for exist60,000 five years ago. It had an estimated life of 10 years and an estimated salvage value of exist9,000. The current book value of this machine is exist10,000. If the current market value is exist27, 500 and the effective income tax rate is 41%, what is the after-tax investment value (rounded to the nearest whole dollar) of the machine? Use the outsider viewpoint. The after-tax MARR is 10% per year. (Do not enter the dollar sign exist with your answer.) A certain engine lathe can be purchased for exist120,000 and depreciated over three years to a zero salvage value with the SL method. This machine will produce metal parts that will generate revenues of exist80,000 (time zero dollars) per year. It is a policy of the company that the annual revenues will be increased each year to keep pace with the general inflation rate, which is expected to average 2% per year. Labor, materials, and utilities totaling exist20,000 (time 0 dollars) per year are all expected to increase at 3% per year. The firm's effective income tax rate is 55%, and its after-tax MARR (i_m) is 12% per year. Determine the after-tax equivalent present worth. Use life of three years and work to the nearest dollar. (Do not enter the dollar sign exist with your answer.) Suppose that you deposit exist3,000 each year for 10 years into an equity account earning 9 % per year. During this period, the general inflation is expected to remain at 0.5 % per year. At the end of 10 years, what is the dollar value of the account in terms of today's purchasing power (i.e., real dollars)? (Enter your answer as a number without the exist sign.) If you want to receive a 6% inflation-free return on your investment and you expect inflation to be 4.5% per year, what actual interest rate must your earn? (Round your answer to two decimal points and do not enter the percent sign % with your answer: i.e., x.xx)