Answered step by step

Verified Expert Solution

Question

1 Approved Answer

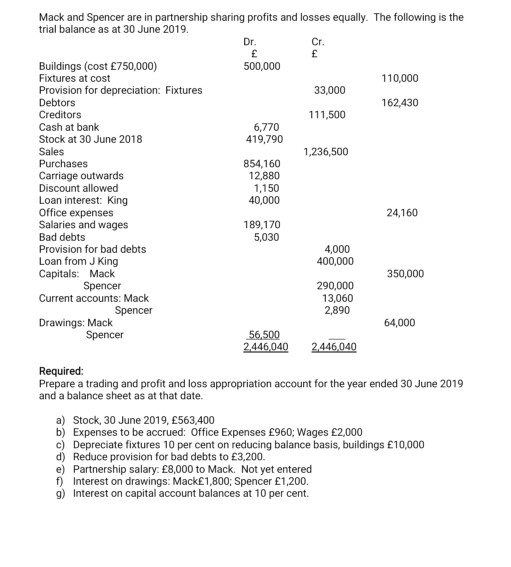

Mack and Spencer are in partnership sharing profits and losses equally. The following is the trial balance as at 30 June 2019. Dr. Cr. f

Mack and Spencer are in partnership sharing profits and losses equally. The following is the trial balance as at 30 June 2019. Dr. Cr. f Buildings (cost 750,000) 500,000 Fixtures at cost 110,000 Provision for depreciation: Fixtures 33,000 Debtors 162,430 Creditors 111,500 Cash at bank 6,770 Stock at 30 June 2018 419,790 Sales 1,236,500 Purchases 854,160 Carriage outwards 12,880 Discount allowed 1,150 Loan interest: King 40,000 Office expenses 24,160 Salaries and wages 189,170 Bad debts 5,030 Provision for bad debts 4,000 Loan from J King 400,000 Capitals: Mack 350,000 Spencer 290,000 Current accounts: Mack 13,060 Spencer 2,890 Drawings: Mack 64,000 Spencer 56,500 2446,040 2.446,040 Required: Prepare a trading and profit and loss appropriation account for the year ended 30 June 2019 and a balance sheet as at that date. a) Stock, 30 June 2019, 563,400 b) Expenses to be accrued: Office Expenses 960; Wages 2,000 c) Depreciate fixtures 10 per cent on reducing balance basis, buildings 10,000 d) Reduce provision for bad debts to 3,200. e) Partnership salary: 8,000 to Mack. Not yet entered f) Interest on drawings: Mack1,800; Spencer 1,200. 9) Interest on capital account balances at 10 per cent. Mack and Spencer are in partnership sharing profits and losses equally. The following is the trial balance as at 30 June 2019. Dr. Cr. f Buildings (cost 750,000) 500,000 Fixtures at cost 110,000 Provision for depreciation: Fixtures 33,000 Debtors 162,430 Creditors 111,500 Cash at bank 6,770 Stock at 30 June 2018 419,790 Sales 1,236,500 Purchases 854,160 Carriage outwards 12,880 Discount allowed 1,150 Loan interest: King 40,000 Office expenses 24,160 Salaries and wages 189,170 Bad debts 5,030 Provision for bad debts 4,000 Loan from J King 400,000 Capitals: Mack 350,000 Spencer 290,000 Current accounts: Mack 13,060 Spencer 2,890 Drawings: Mack 64,000 Spencer 56,500 2446,040 2.446,040 Required: Prepare a trading and profit and loss appropriation account for the year ended 30 June 2019 and a balance sheet as at that date. a) Stock, 30 June 2019, 563,400 b) Expenses to be accrued: Office Expenses 960; Wages 2,000 c) Depreciate fixtures 10 per cent on reducing balance basis, buildings 10,000 d) Reduce provision for bad debts to 3,200. e) Partnership salary: 8,000 to Mack. Not yet entered f) Interest on drawings: Mack1,800; Spencer 1,200. 9) Interest on capital account balances at 10 per cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started