Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mackey purchased a used van for use in its business on January 1, 2020. It paid $15,000 for the van. Mackey expects the van

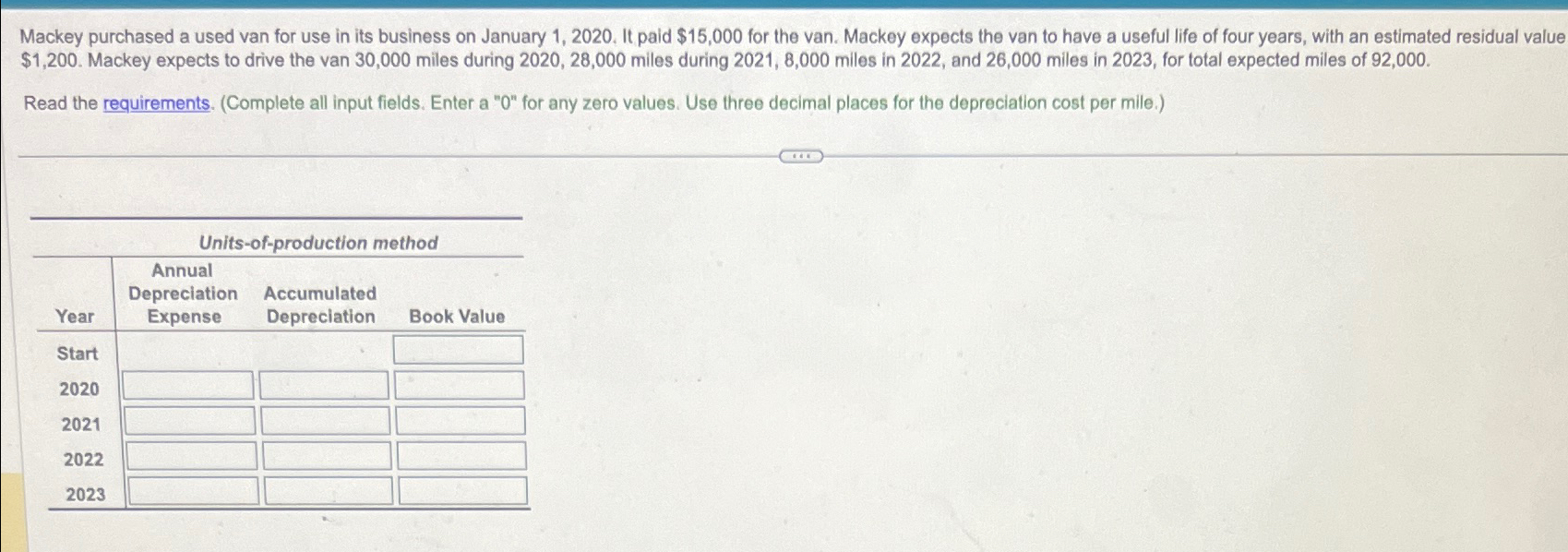

Mackey purchased a used van for use in its business on January 1, 2020. It paid $15,000 for the van. Mackey expects the van to have a useful life of four years, with an estimated residual value $1,200. Mackey expects to drive the van 30,000 miles during 2020, 28,000 miles during 2021, 8,000 miles in 2022, and 26,000 miles in 2023, for total expected miles of 92,000. Read the requirements. (Complete all input fields. Enter a "0" for any zero values. Use three decimal places for the depreciation cost per mile.) Units-of-production method Annual Depreciation Accumulated Year Expense Depreciation Book Value Start 2020 2021 2022 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the annual depreciation expense using the unitsofproduction method we need to determine the depreciation cost per mile First lets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started