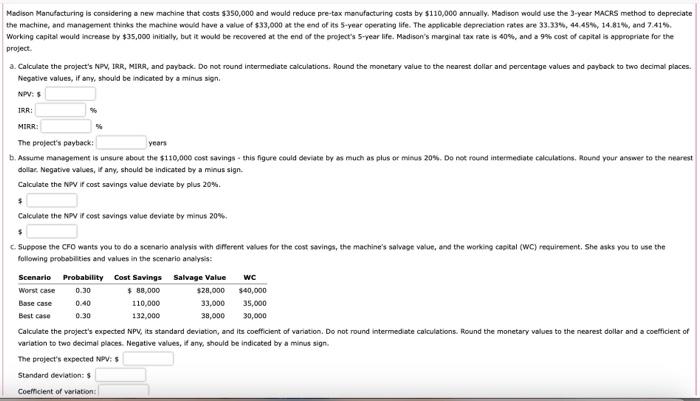

Madison Manufocturing is considering a new machine that costs 5350,000 and would reduce pre-tax manufacturing costs by $110,000 annusilly. Modison would use the 3 -year MaCAS method to deprecia the mochine, and management thinks the machine would have a value of $33,000 at the end of its 5 -year cperating life. The applicable deprecation rates are 33.33%, 44.45%, 14.81\%, and 7.41%. Working capital would increase by $35,000 initially, but it would be recovered at the end of the project's 5 -pear life. Madison's marginat tax rate is 40%, and a 9% cost of capital is appropriate for the project. a. Calculate the project's NPV, IRR, MIRG, and payback. Do not round intermediate calculations. Round the monetary value to the nearest dollar and percentage values and payback to two decimal place Negative values, if any, should be indicated by a minus sign. APV: 5 IRR: MIRR: The peoject's payback: years b. Assume mandgement is unsure about the $110,000 cost savings - this figure could deviate by as much as plus or minus 20%, Do not round intermediate calculations, Round your answer to the neare dollar, Negative values, it any, should be indicated by a minus sign. Calculste the NPV if cost savings value deviate by plus 20%. Calculate the NPV if cost savings value deviate by minus 20%. C. Suppose the CFO wants you to do a scenario analysis with 6 fferent values for the cost savings, the machine's salvage value, and the working capital (WC) requirement. She asks you to use the following probobities and values in the scenario analysis: Calculate the project's expected NPV, its standard deviation, and its coefficient of variotion, Do not round intermediote caiculations. found the monetary values to the nearest dollar and a coefficient o variation to two decimal places. Negative values, if any, should be indicated by a minus sign. The project's expected NPV: 5 Standard deviation: \$ Coefficient of veriation: Madison Manufocturing is considering a new machine that costs 5350,000 and would reduce pre-tax manufacturing costs by $110,000 annusilly. Modison would use the 3 -year MaCAS method to deprecia the mochine, and management thinks the machine would have a value of $33,000 at the end of its 5 -year cperating life. The applicable deprecation rates are 33.33%, 44.45%, 14.81\%, and 7.41%. Working capital would increase by $35,000 initially, but it would be recovered at the end of the project's 5 -pear life. Madison's marginat tax rate is 40%, and a 9% cost of capital is appropriate for the project. a. Calculate the project's NPV, IRR, MIRG, and payback. Do not round intermediate calculations. Round the monetary value to the nearest dollar and percentage values and payback to two decimal place Negative values, if any, should be indicated by a minus sign. APV: 5 IRR: MIRR: The peoject's payback: years b. Assume mandgement is unsure about the $110,000 cost savings - this figure could deviate by as much as plus or minus 20%, Do not round intermediate calculations, Round your answer to the neare dollar, Negative values, it any, should be indicated by a minus sign. Calculste the NPV if cost savings value deviate by plus 20%. Calculate the NPV if cost savings value deviate by minus 20%. C. Suppose the CFO wants you to do a scenario analysis with 6 fferent values for the cost savings, the machine's salvage value, and the working capital (WC) requirement. She asks you to use the following probobities and values in the scenario analysis: Calculate the project's expected NPV, its standard deviation, and its coefficient of variotion, Do not round intermediote caiculations. found the monetary values to the nearest dollar and a coefficient o variation to two decimal places. Negative values, if any, should be indicated by a minus sign. The project's expected NPV: 5 Standard deviation: \$ Coefficient of veriation