Answered step by step

Verified Expert Solution

Question

1 Approved Answer

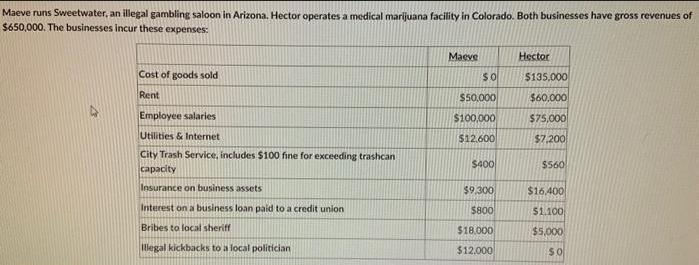

Maeve runs Sweetwater, an illegal gambling saloon in Arizona. Hector operates a medical marijuana facility in Colorado. Both businesses have gross revenues of $650,000.

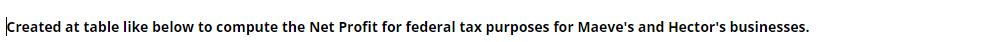

Maeve runs Sweetwater, an illegal gambling saloon in Arizona. Hector operates a medical marijuana facility in Colorado. Both businesses have gross revenues of $650,000. The businesses incur these expenses: Cost of goods sold Rent Employee salaries Utilities & Internet City Trash Service, includes $100 fine for exceeding trashcan capacity Insurance on business assets Interest on a business loan paid to a credit union Bribes to local sheriff Illegal kickbacks to a local politician Maeve $0 $50,000 $100,000 $12,600 $400 $9,300 $800 $18,000 $12.000 Hector $135,000 $60,000 $75,000 $7,200 $560 $16,400 $1.100 $5,000 $0 Created at table like below to compute the Net Profit for federal tax purposes for Maeve's and Hector's businesses. Gross Revenues Cost of Goods Sold Gross Income Rent Salaries Utilities & Internet City Trash Service Insurance Interest Bribes Kickbacks Net Profit MAEVE HECTOR

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Computation of Net profit for federal tax purposes for Maeves and Hector...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started