Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Magdolena Endowment Fund MEF, which supports the activities of the Magdolena Charitable Trust, is relatively new and small in terms of assets under management.

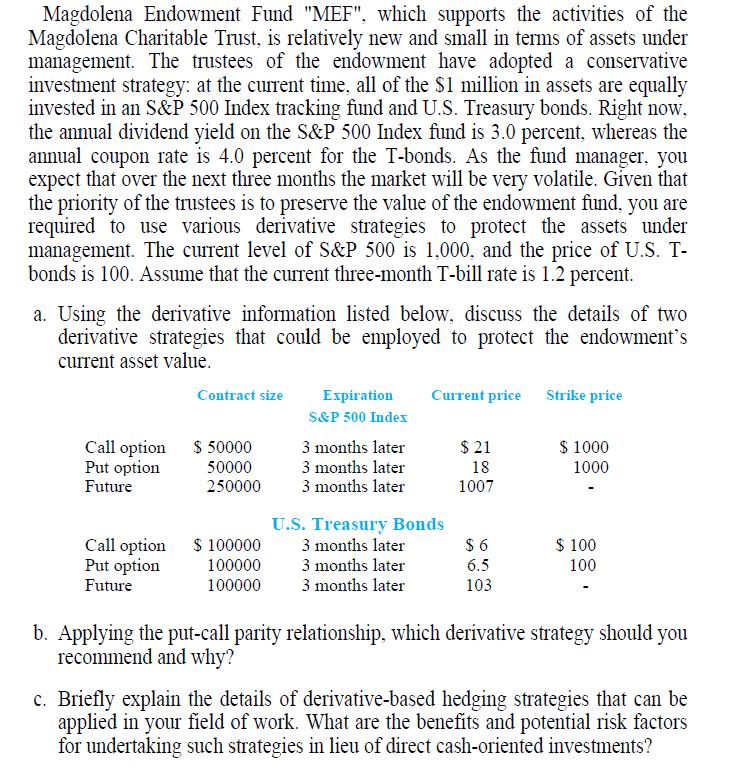

Magdolena Endowment Fund "MEF", which supports the activities of the Magdolena Charitable Trust, is relatively new and small in terms of assets under management. The trustees of the endowment have adopted a conservative investment strategy: at the current time, all of the $1 million in assets are equally invested in an S&P 500 Index tracking fund and U.S. Treasury bonds. Right now, the annual dividend yield on the S&P 500 Index fund is 3.0 percent, whereas the annual coupon rate is 4.0 percent for the T-bonds. As the fund manager, you expect that over the next three months the market will be very volatile. Given that the priority of the trustees is to preserve the value of the endowment fund, you are required to use various derivative strategies to protect the assets under management. The current level of S&P 500 is 1,000, and the price of U.S. T- bonds is 100. Assume that the current three-month T-bill rate is 1.2 percent. a. Using the derivative information listed below, discuss the details of two derivative strategies that could be employed to protect the endowment's current asset value. Contract size Current price Strike price Expiration S&P 500 Index $21 $ 1000 Call option Put option Future $ 50000 50000 250000 3 months later 3 months later 3 months later 18 1000 1007 U.S. Treasury Bonds $ 100000 3 months later $6 $ 100 Call option Put option Future 3 months later 6.5 100 100000 100000 3 months later 103 b. Applying the put-call parity relationship, which derivative strategy should you recommend and why? c. Briefly explain the details of derivative-based hedging strategies that can be applied in your field of work. What are the benefits and potential risk factors for undertaking such strategies in lieu of direct cash-oriented investments?

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Short Put Option Strategy The Endowment could sell put options with a strike price of 1000 on th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started