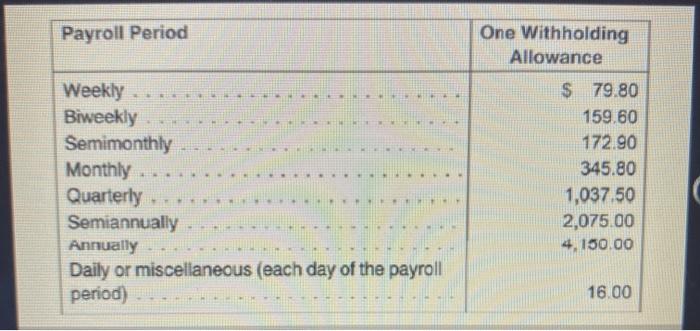

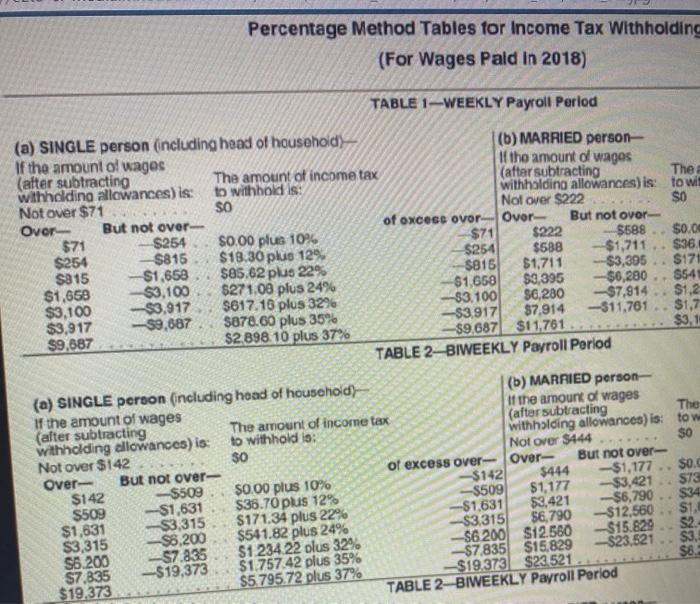

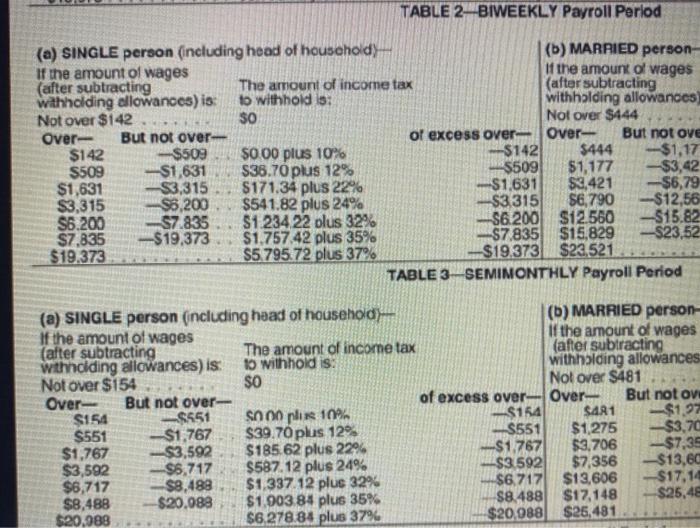

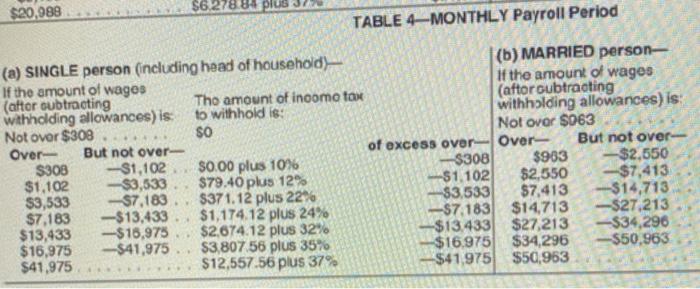

Maggie Vitteta, single, works 36 hours per week at $20.00 an hour. How much is taken out for federal income tax with one withholding exemption? (Use Table 91 and Table 92) (Round your answer to the nearest cent.) Amount Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 16.00 Percentage Method Tables for Income Tax Withholding (For Wages Pald in 2018) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The withholding allowances) is: to withhold is: withholding allowances) is: to win Not over $71 SO Not over $222 $0 Over- But not over of oxcess ovor-Over But not over- $71 $254 $0.00 plus 10% $71 $222 $588 ..SO. $254 $815 $18.30 plus 12% $254 $588 -$1,711 .. $36 S815 $1,658 $85.62 plus 22% 5815 $1,711 $3,395 $171 $1,658 $3,100 $271.00 plus 24% -$1,658 $3,395 - $6,280 .. 9541 -$7.914 $3,100 -$3.100 $1.2 $3,917 S6,280 5617.15 plus 32% -$3.917 39,687 $7,914 $1,7 $878.60 plus 35% -$11,761 $3,917 $3,1 $9,687 -$9.687 $11,761 $2898.10 plus 37% TABLE 2-BIWEEKLY Payroll Period The (a) SINGLE person (including head of household) (b) MARRIED person- if the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting withholding allowances) is: to withhold is: withholding allowances) is: to w Not over $142 $0 Not Over $444 $0 Over- But not over- of excess over-Over- But not over- $142 -$509 $0.00 plus 10% $142 $444 -$1,177 .. SOC $509 - $1,631 $36.70 plus 12% -$509 $1,177 -$3,421 S73 $1,631 -$3,315 $171.34 plus 22% -$1.631 $3,421 - $6,790 .. $34 $3,315 $6,200 $541.82 plus 24% -$3315 $6,790 -$12,560 $1. -57.835 S6.200 $1 234 22 olus 32% -S6200) $12.560 $15.829 S2 $7,835 -$19,373 $1.757.42 plus 35% -$7,835 $15.829 -$23,521 .. $3. $19.373 $5.795.72 plus 37% $19.373 $23.521 $6. TABLE 2- BIWEEKLY Payroll Period TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (ncluding head of household) (6) MARRIED person If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting wahholding allowances) is: to withhold is: withholding allowances) Not over $142 SO Not over $444 Over- But not over of excess over Over- But not ove $142 -$509 S000 plus 10% -S142 $444 -$1,17 $509 -$1,631 $36.70 plus 12% 5509 $1,177 -$3,42 $1,631 $3,315 $171.34 plus 22% $1.631 $3,421 -$6,79 $3,315 $6.200 $541.82 plus 24% $3,315 $6,790 $12,56 S6.200 $7.835 $1234 22 plus 32% $6.200 $12.560 -515.82 $7,835 -$19,373 $1.757.42 plus 35% $7.835 $15,829 -$23,52 $19.373 $5.795.72 plus 37% $19,373 $23.521 TABLE 3-SEMIMONTHLY Payroll Period $0 (a) SINGLE person (ncluding head of household (6) MARRIED person If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting wthnciding allowances) is: to withhold is: withholding allowances Not over $154 Nol over $481 Over- But not over- of excess over Over- But not ov. $154 $551 SO no plis 10% $154 S4R1 $1,97 $551 $1,767 $39.70 plus 12 S551 $1,275 -$3.70 $1,767 $3,592 $185.62 plus 22% $1,767 $3,706 $7,35 $3,592 $5,717 $587.12 plus 24% $3 592 $7,356 $13,60 $6,717 $8,488 $1,337 12 plus 32% $6.717 $12,606 $17,14 $8,488 $20.088 $1,903 84 plus 35% $8.488 $17,148 $25,48 $20,988 $6.278.84 plus 37% $20,088 $25,481 $6.2 $20,988 TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (attor subtracting The amount of inoomo tox (aftor Gubtracting wthholding allowances) is. to withhold is: withholding allowances) is: Not over $308 SO Not over $063 Over But not over of excess over-Over- But not over $308 -$1,102 50.00 plus 10% -$3081 $903 -$2,550 $1,102 -$3,530 $79.40 plus 12% -S1.102 $2,550 $7,413 $3,533 -S7,183 $371.12 plus 22% -$3.533 $7,413 -$14,713 $7,183 -$13,433 $1,174.12 plus 24% -$7.183 $14,713 -$27.213 $13,433 -$18,975 $2,674.12 plus 32% $13.433 $27,213 $34.296 $16.975 -$41,975 $3,80756 plus 35% $16.975 $34,296 $50,963 $41,975 $12,557.56 plus 37% $41,975 $50,963