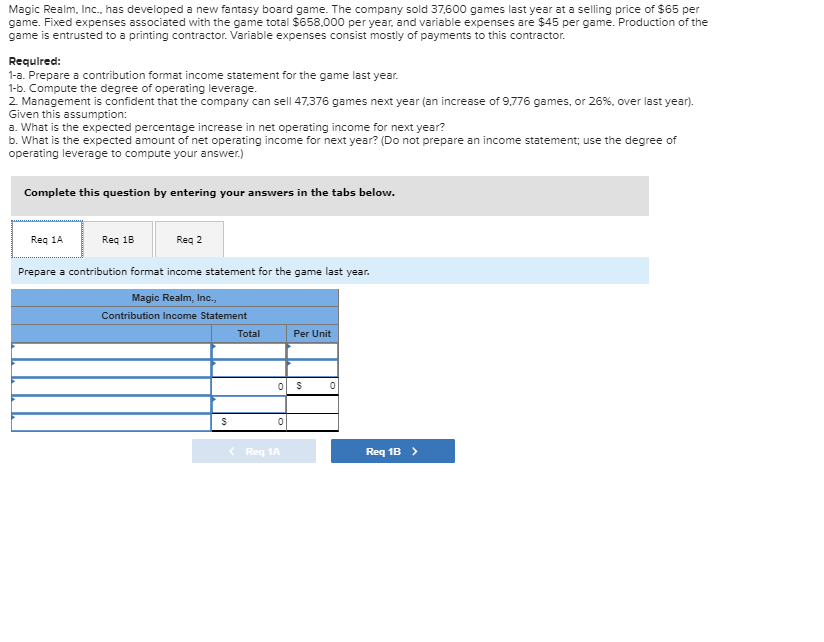

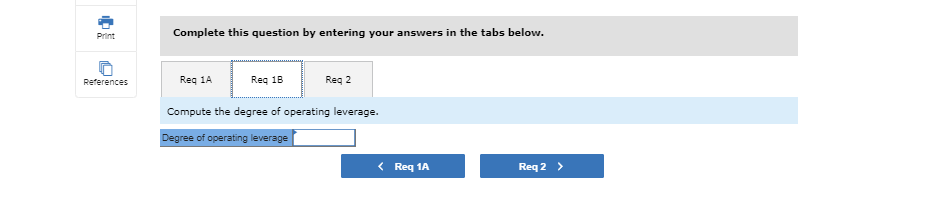

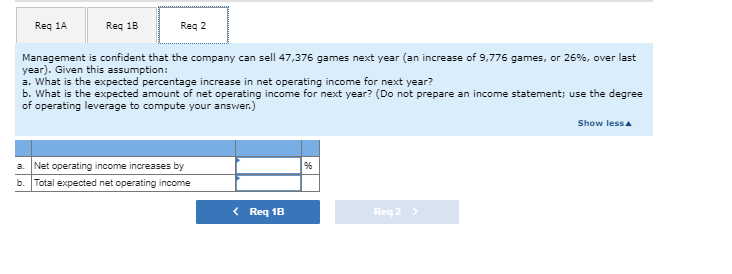

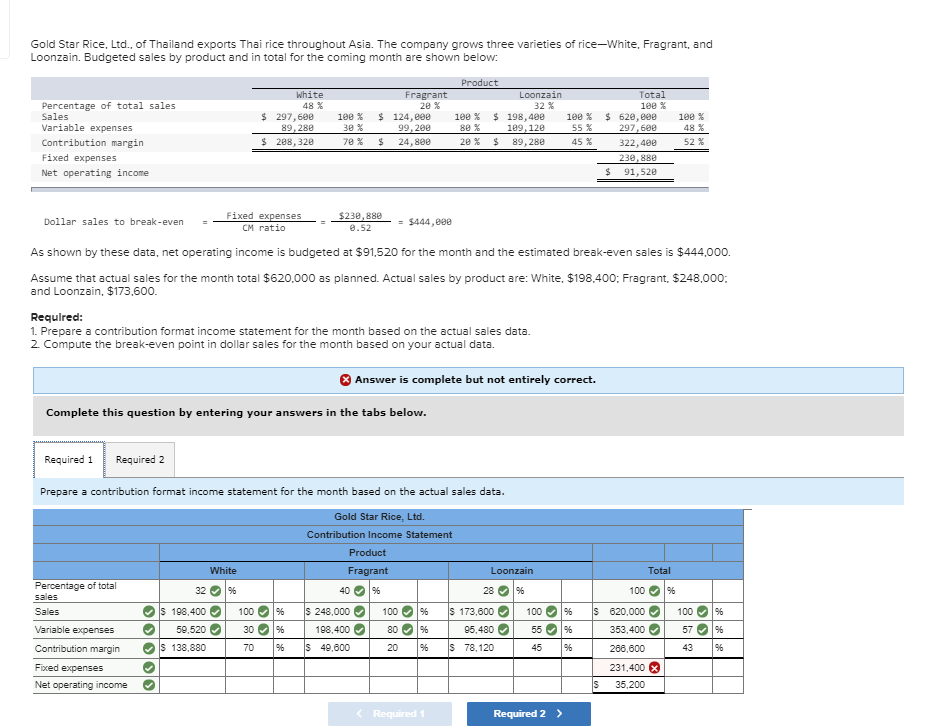

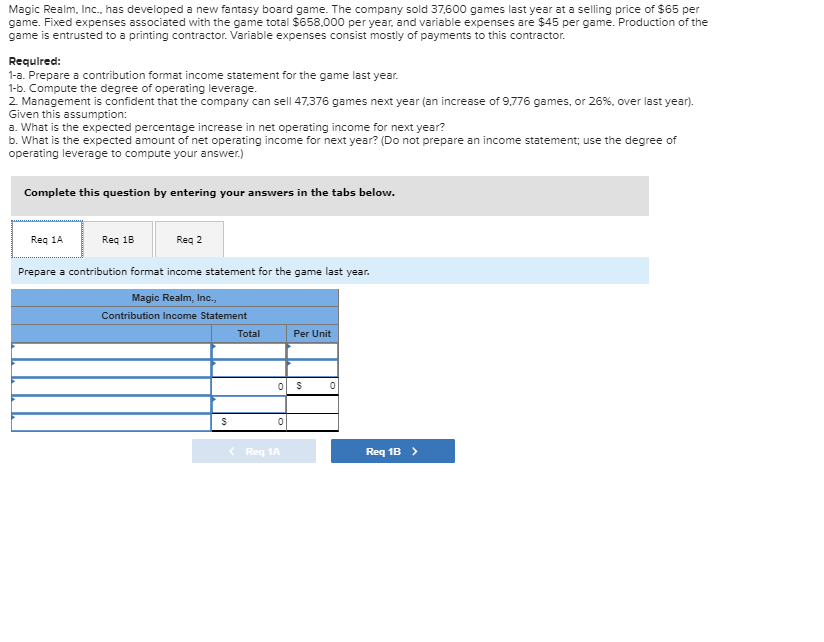

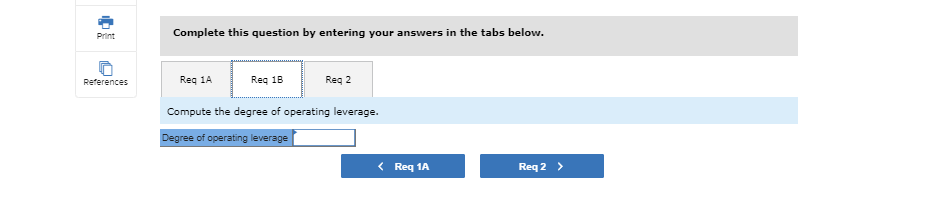

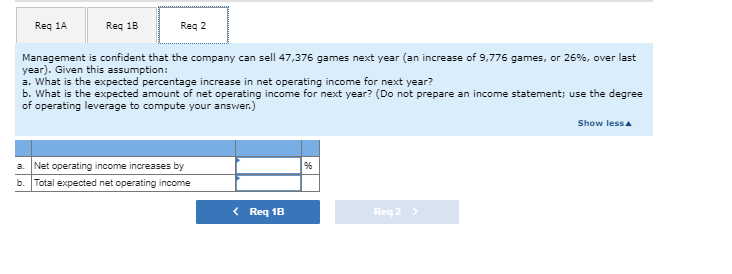

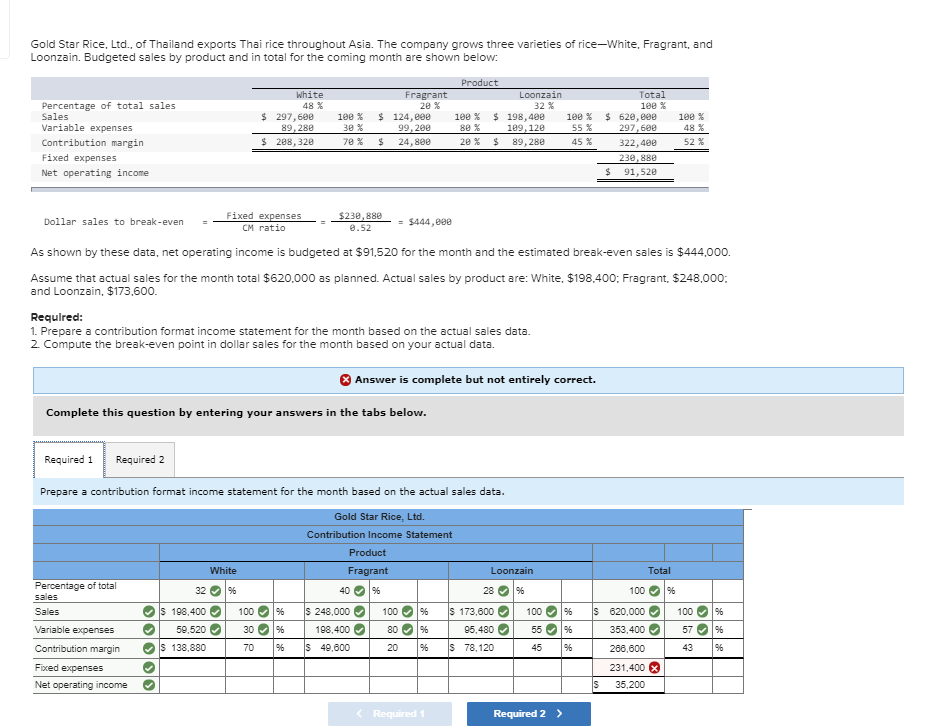

Magic Realm, Inc., has developed a new fantasy board game. The company sold 37,600 games last year at a selling price of $65 per game. Fixed expenses associated with the game total $658,000 per year, and variable expenses are $45 per game. Production of the game is entrusted to a printing contractor. Variable expenses consist mostly of payments to this contractor. Requlred: 1-a. Prepare a contribution format income statement for the game last year. 1-b. Compute the degree of operating leverage. 2. Management is confident that the company can sell 47,376 games next year (an increase of 9,776 games, or 26 %, over last year). Given this assumption: a. What is the expected percentage increase in net operating income for next year? b. What is the expected amount of net operating income for next year? (Do not prepare an income statement; use the degree of operating leverage to compute your answer.) Complete this question by entering your answers in the tabs below. Rea 1A Req 2 Req 1B Prepare a contribution format income statement for the game last year. Magic Realm, Inc., Contribution Income Statement Total Per Unit S C C Req 1A Req 1B Complete this question by entering your answers in the tabs below. print Req 1A Req 1B Req 2 References Compute the degree of operating leverage. Degree of operating leverage Req 2 Req 1A Req 1A Req 1B Req 2 Management is confident that the company can sell 47,376 games next year (an increase of 9,776 games, or 26 % , over last year). Given this assumption: a. What is the expected percentage increase in net operating income for next year? b. What is the expected amount of net operating income for next year? (Do not prepare a of operating leverage to compute your answer.) se the degree income statement; Show less A 9% Net operating income increases by Total expected net operating income Req 1B Req 2 Gold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Product Total White Fragrant 20% Loonzain Percentage of total sales Sales 48% 32% 100% $ 124,e0e 297,600 108 % 108% 198,408 100 % 620,e0e 297.600 108% Variable expenses 30% 80% 55% 48% 89.288 99.288 109,120 Contribution margin $ 288,320 7e% 20% 45% 52 24, 80e 89,280 322,400 Fixed expenses 230,888 Net operating income 91,520 Fixed expenses $230.880 Dollar sales to break-even $444,eee CM ratio .52 As shown by these data, net operating income is budgeted at $91,520 for the month and the estimated break-even sales is $444,000 Assume that actual sales for the month total $620,000 as planned. Actual sales by product are: White, $198,400; Fragrant, $248,000: and Loonzain, $173.600 Required: 1. Prepare a contribution format income statement for the month based on the actual sales data. 2. Compute the break-even point in dollar sales for the month based on your actual data. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 2 Required 1 Prepare a contribution format income statement for the month based on the actual sales data. Gold Star Rice, Ltd. Contribution Income Statement Product White Fragrant Loonzain Total Percentage of total sales 32 9% 40 % 28 % 100 % S 198,400 100 6 S 248,000 S 173,600 100 % S 620,000 Sales 100 96 100 96 Variable expenses 30 % 198,400 95,480 55 96 353.400 57 % 59,520 80 s 49.800 9% % S 78,120 S 138,880 Contribution margin 70 20 45 43 268,800 231,400 Fixed expenses Net operating income 35,200 Required 2 Required1 8 8