Answered step by step

Verified Expert Solution

Question

1 Approved Answer

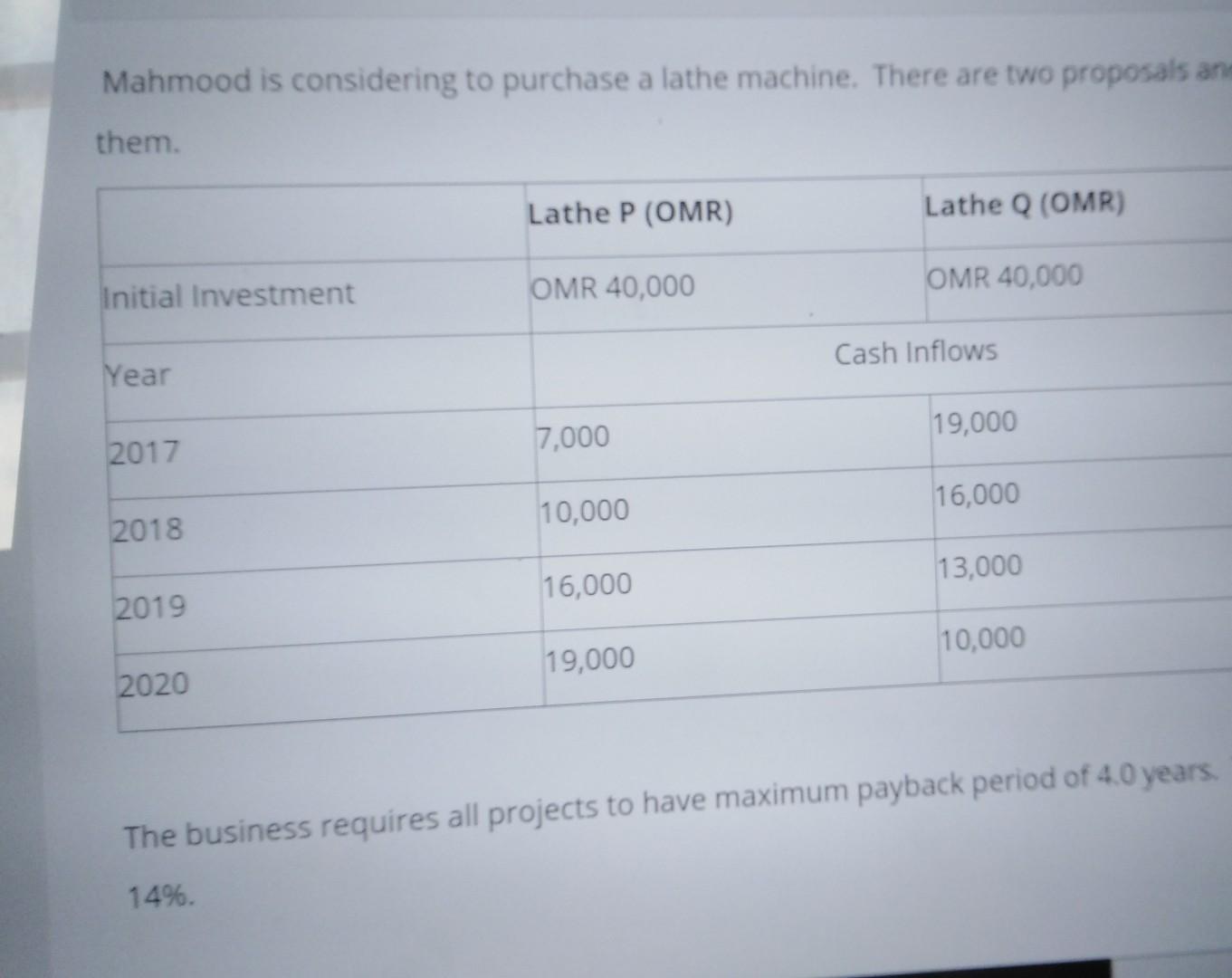

Mahmood is considering to purchase a lathe machine. There are two proposals an them. Lathe P (OMR) Lathe Q (OMR) Initial Investment OMR 40,000 OMR

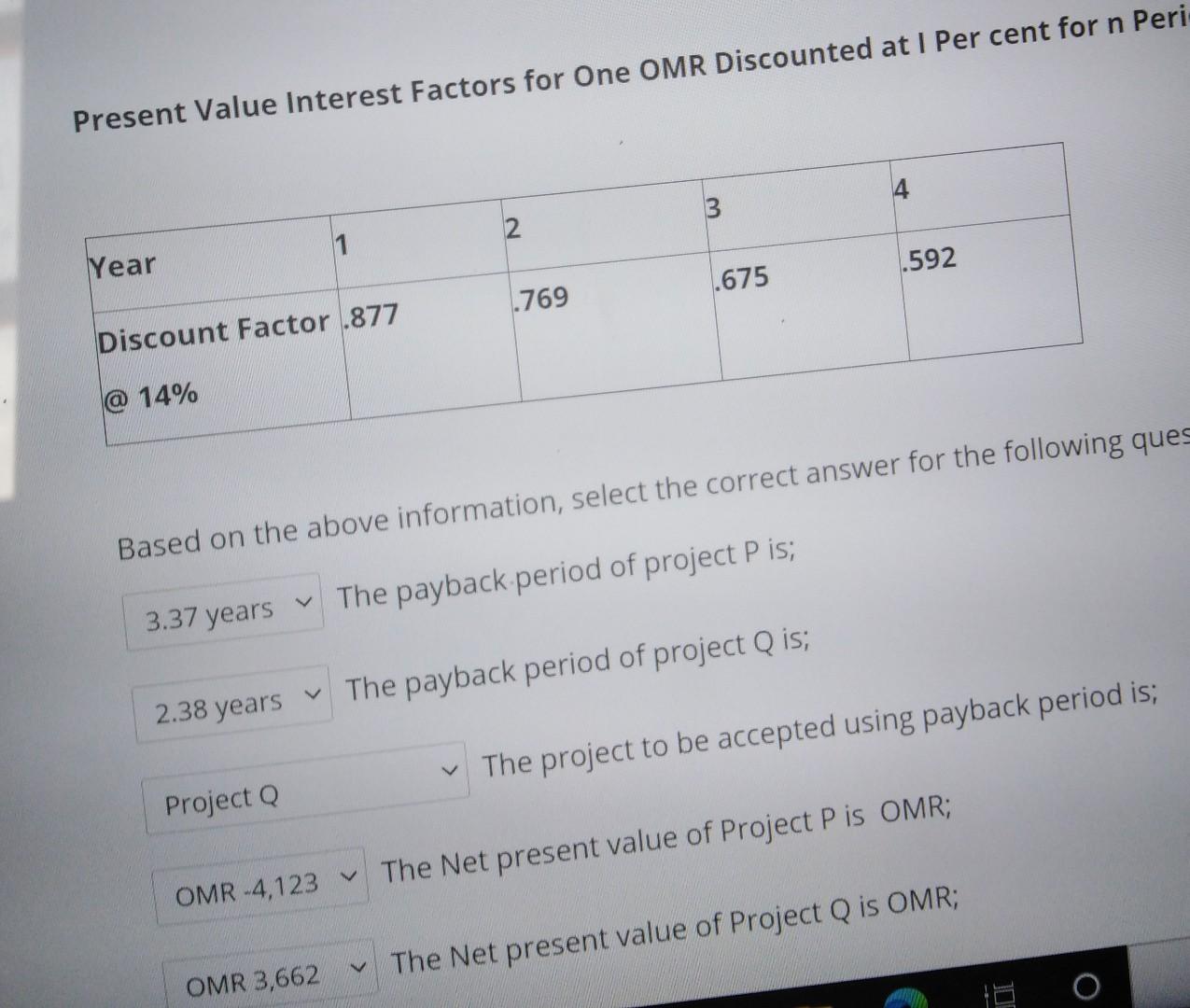

Mahmood is considering to purchase a lathe machine. There are two proposals an them. Lathe P (OMR) Lathe Q (OMR) Initial Investment OMR 40,000 OMR 40,000 Cash Inflows Year 2017 7,000 19,000 16,000 10,000 2018 13,000 16,000 2019 10,000 19,000 2020 The business requires all projects to have maximum payback period of 4.0 years. 14%. Present Value Interest Factors for One OMR Discounted at 1 Per cent for n Peri 4 2 1 Year .592 .675 .769 Discount Factor .877 @ 14% Based on the above information, select the correct answer for the following ques The payback period of project P is; 3.37 years The payback period of project Q is; 2.38 years The project to be accepted using payback period is; Project OMR-4,123 The Net present value of Project P is OMR; The Net present value of Project Q is OMR; OMR3,662

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started